Innovation under Restrictions, Hybrid SMEs and the 5th Wave Theory

A special issue of Journal of Open Innovation: Technology, Market, and Complexity (ISSN 2199-8531).

Deadline for manuscript submissions: closed (31 December 2020) | Viewed by 18168

Special Issue Editor

Interests: energy management; modeling; blue-green economy; industry 4.0; Internet of Things; Internet of Energy; digitalization; sustainability; international management; vocational training, education, business; CSR; SME management; cultural dimensions; 5th wave theory/tomorrow age; future studies

Special Issue Information

Dear Colleagues,

In this Special Issue, the effect of restrictions and limitations on the 5th wave theory and their impacts on innovation are investigated. It is important to make these innovative technologies, markets, and business simple and user-friendly to motivate HR and the public sector to face tomorrow’s shocks by showing them the potential benefits. Throughout human history, innovations have been generated through restrictions and challenges:

- Wars;

- Sanctions;

- Low sustainability;

- Risks; and

- Growing urbanizations.

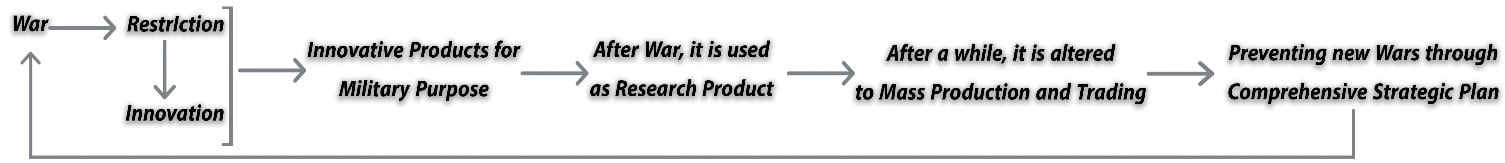

Restriction influences sustainability. Thus, restrictions are necessary for humans to be able to develop and improve quality of liveability and life and make the world a better place; in short, humans need to struggle with these restrictions in order to find ways to meet their needs, as restrictions lead to attempts to find solutions, and these solutions usually are innovative. Even wars can play an important role in creating innovative solutions: As per the model in Figure 1, many innovative products were created through necessity due to wartime restrictions and were first used as war products before becoming the focus of research and then popularized in society.

Figure 1. I-DWar Model (Prof. Dr. Hamid Doost Mohammadian, 2019).

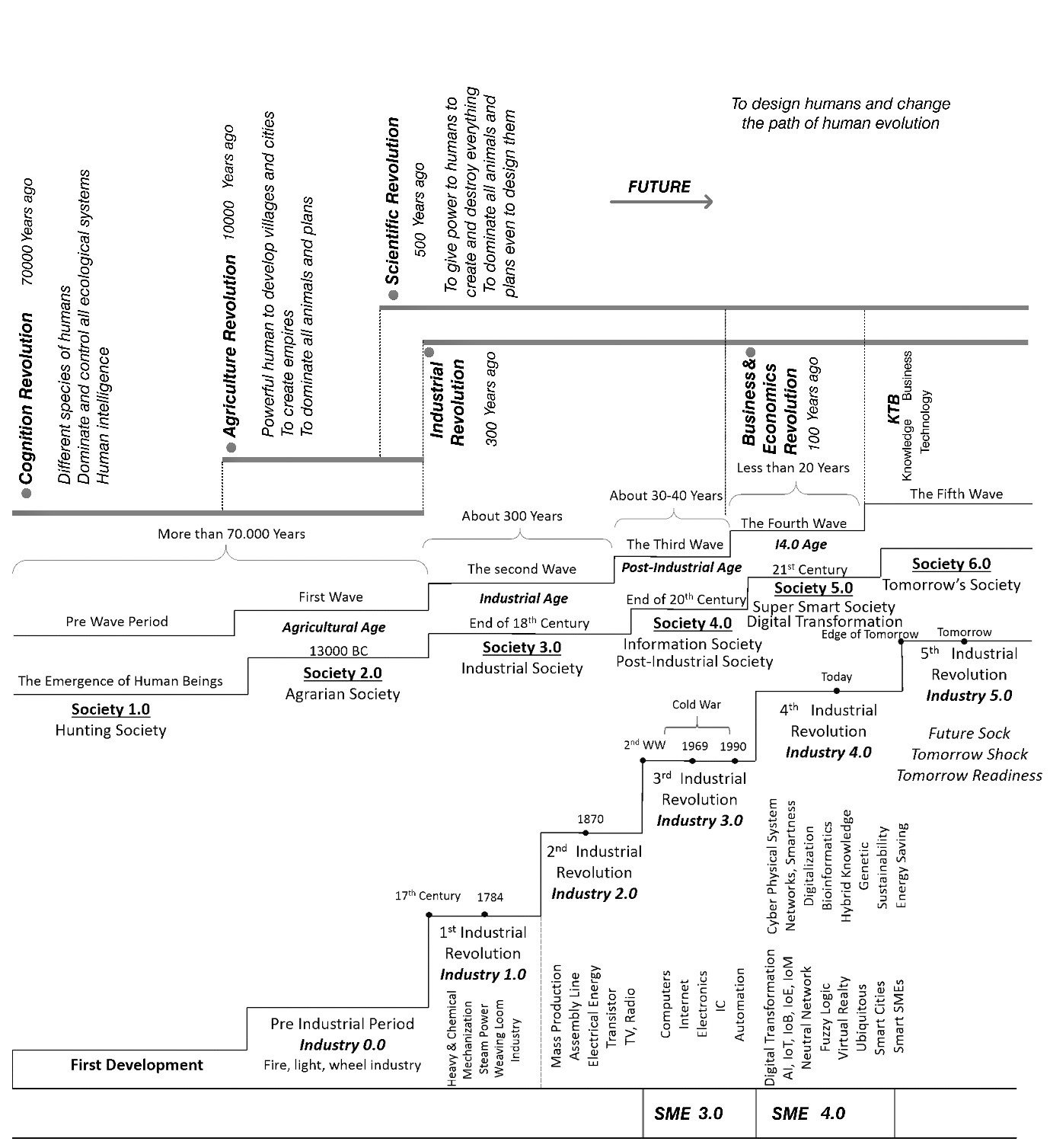

The 5th wave/tomorrow age theory, which regards edge of tomorrow, was introduced by Prof. Dr. Hamid Doost Mohammadian in 2010 and evaluated and improved until 2017. Based on this theory, hybrid SMEs that are concerned with business and marketing, social responsibility such as CSR strategies, and being environmentally friendly, could improve clean economy and human life.

Figure 2. The 5th wave Theory, Ages and Business and Economics Revolution (Invented by Prof. Dr. Hamid Doost Mohammadian, 2017–2019).

Germany post-World War II is a good example of this innovation under restrictons. In 2020, Germany is one of the most innovative economies in the world. Today, SMEs form more than 95% of businesses all around the World, and they play an indispensable role in developing a clean, innovative economy as well as sustainability in a country that aims at creating business and entrepreneurship. SMEs are introduced as the economic backbone of each country through improving inclusive and sustainable economic growth, providing employment and work for all, enhancing sustainable industrialization, and even as tool to achieve sustainable development. In this regard, SMEs could be used as techniques to achieve Sustainable Development Goals.

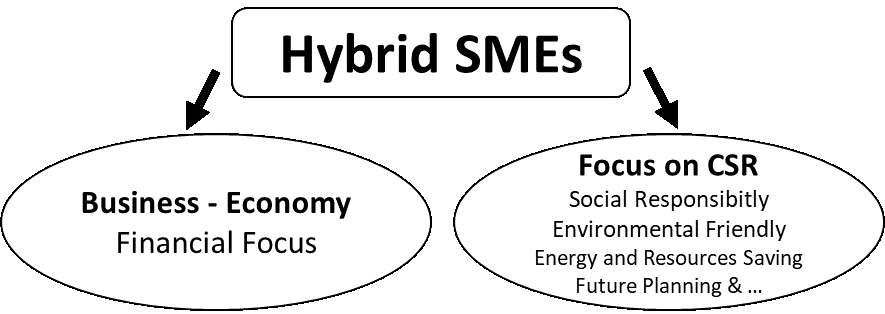

Hybrid SMEs are a new method which can enable SMEs to better manage resources and have the required flexibility to respond to and be ready for business conditions linked to the theory of the age of tomorrow. Hybrid SMEs founded on technology, HR competencies, sustainable strategies such as CSR or smartness could develop sustainability and create livable urban areas with a high quality of life by balancing between CSR and business economy.

Figure 3. Hybrid SMEs (Prof. Dr. Hamid Doost Mohammadian, 2019).

Prof. Dr. Hamid Doost MohammadianGuest Editor

Manuscript Submission Information

Manuscripts should be submitted online at www.mdpi.com by registering and logging in to this website. Once you are registered, click here to go to the submission form. Manuscripts can be submitted until the deadline. All submissions that pass pre-check are peer-reviewed. Accepted papers will be published continuously in the journal (as soon as accepted) and will be listed together on the special issue website. Research articles, review articles as well as short communications are invited. For planned papers, a title and short abstract (about 100 words) can be sent to the Editorial Office for announcement on this website.

Submitted manuscripts should not have been published previously, nor be under consideration for publication elsewhere (except conference proceedings papers). All manuscripts are thoroughly refereed through a single-blind peer-review process. A guide for authors and other relevant information for submission of manuscripts is available on the Instructions for Authors page. Journal of Open Innovation: Technology, Market, and Complexity is an international peer-reviewed open access quarterly journal published by MDPI.

Please visit the Instructions for Authors page before submitting a manuscript. The Article Processing Charge (APC) for publication in this open access journal is 800 CHF (Swiss Francs). Submitted papers should be well formatted and use good English. Authors may use MDPI's English editing service prior to publication or during author revisions.

Keywords

- innovation

- risk management

- hybrid SMEs

- sustainability

- sustainable development

- restrictions

- limitation

- passive defense

- warden theory

- high technologies

- livability

- quality of life

- sustainable, livable urban settings

- human resources

- CSR

- the 5th wave theory

- tomorrow shocks readiness

- ages/waves

- environment

- war

- sanction

- air pulotion

- resources

- 7PS model