1. Introduction

Sustainable development determines the future of humankind while oil resources dependence and the ongoing greenhouse gases (GHG: nitrous oxide, carbon dioxide, gas flaring, methane, etc.) emissions have severe consequences for the environment and global warming [

1,

2,

3,

4,

5,

6,

7]. In a recent study, Gatto et al. [

8] report that oil-dependent developing and emerging countries share 15–20% of GHG emissions in the Earth’s atmosphere. As documented in the Climate Watch [

9], carbon dioxide (CO

2), with a share of 74% in GHG emissions in 2017, remains the main component of environmental degradation and climate change. For example, in 2016, the oil-based activities sourced 12.3 billion metric tons (or 30%) of the planet’s CO

2 releases [

10].

In this context, Africa is the lower-emissions region with a share of only 4% of carbon release from the world fossil fuel sector in 2017 [

11]. The region also accounts for over one-third of carbon pollution from energy use and manufacturing sector compared to 80% of such emissions worldwide, while this continent is the most vulnerable to global warming [

3,

12,

13,

14]. African economies have also experienced one of the world’s highest levels of gross domestic product (GDP) growth of 4.5% for almost two decades (1995–2013), which persisted even during the 2008/2009 financial crisis [

15,

16]. Oil resources abundance is the backbone of economies in countries such as Nigeria and the Congo Democratic Republic (COD), with around 5.8% and 5.9% average annual GDP growth over 2000–2019 [

17]. Additionally, according to World Bank [

17], the GDP figures for African region (expressed in constant 2010 US dollars (

$)) amounted to

$664.583 billion,

$812.256 billion, and

$1.834 trillion in 1990, 2000, and 2019, respectively. The corresponding average annual growth has been 2.2% (for the first decade 1990–2000) and even more vigorous with 4.6% (for the following two decades 2000–2019). United Nations Economic Commission for Africa (UNECA) [

18] and Talukdar and Meisner [

19] show concerns because these growth trends could have the adverse environmental impacts. Meanwhile, Africa with its infant industries, including oil companies, also became greater CO

2 emitter due to the overextraction of oil resources (to support the said growth); the oil processing requires extensive energy use, resulting in fugitive emissions, etc. [

4,

13,

18,

20,

21,

22]. According to the International Energy Agency (IEA) [

23], the economic growth and oil resources dependency has raised the energy demand up to 80% of the total energy required to stimulate the region’s economic activities. The 2020 report of British Petroleum (BP) [

24] revealed that fossil fuel energy consumption in Africa, including oil resources, amounted to over 40% of the total energy mix. Such an extensive use of primary energy had a detrimental effect on the environment [

25,

26]. Though Africa is the least carbon polluter of the planet, yet its carbon emissions are increasing over the years. In this regard, BP [

24] draws the attention that the CO

2 emissions in the region increased from 1070.2 million tons in 2009 to 1308.5 million tons in 2019, with an annual growth of 2.0% between 2008 and 2018. These African emissions trends could even dramatically rise to 30% by 2030 with the region’s GDP and population growth projection [

11].

The prior literature mainly suggests an inverted U-shaped relationship between income level and pollution, commonly known as the environmental Kuznets curve (EKC) [

27,

28,

29,

30,

31]. Particularly, the development level affects the environmental quality based on scale, composition, and technical (also called technique effect) effects of the economy [

32]. Scale effect postulates that holding the structure and the technology of the economy unchanged, the production increase leads to environmental deterioration. Thereby, economic development worsens environmental pollutions and related climate damages [

32,

33]. The pre-industrial era relates to the scale effect because economic prosperity improves the living standards of people who initially consume more energy-intensive goods increasing the pollution level. Thus, IEA [

34] documented the boom of fuel-based vehicles, which are the most polluting (carbon emitters). The industrialization era leads to the overexploitation of the oil resources to match the economy’s energy needs. Consequently, this operational process jeopardizes the environment by emitting CO

2 through fugitive emissions and flaring. Furthermore, the oil sector’s energy consumption, together with that of the rest of the economy, enhances the carbon emissions, ultimately damaging the environmental quality. In the second stage, additional economic growth shares a high-income level in moving from quantitative to qualitative growth. Particularly, as the economy develops, citizens may require a safe and healthy environment. This process characterizes the ongoing structural change in the economy from agricultural activities to the heavy and “dirty” industry, then to virtual activities (services): post-industrial era. The said economic transition contributes to low-pollution intensity after crossing the turning point (TP) via development of advanced and innovative technology in the economy. The aforementioned mechanism corresponds to the composition effect. Lastly, the technique effect gauges the production efficiency and the adaptability of energy-efficient and low-carbon technologies, which improves the environment [

3,

4,

32,

33,

35,

36,

37,

38,

39,

40].

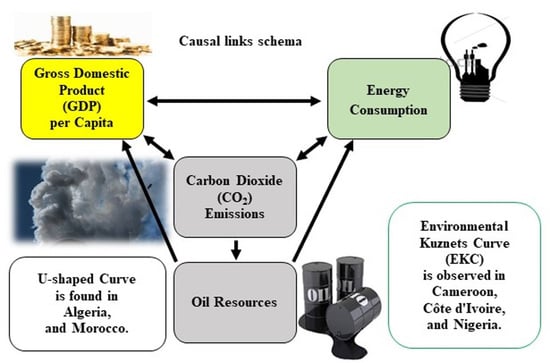

Figure 1 depicts the described process comprehensively.

The past studies provide inconclusive and controversial findings about the nexus between oil production and environmental pollutions. For instance, Johnston, Lim, and Roh [

5] found that oil resources exploitation degrades the air quality. Furthermore, the dependence of the economy on the fossil fuel exploitation is unfriendly to sustainable development because it boosts CO

2 and flaring emissions [

20]. Extending these views, Fuinhas, et al. [

41] found that oil rents increase carbon emissions in the case of 21 oil-rich economies. Similarly, Mahmood et al. [

42] applied the non-linear ARDL approach to analyze Saudi Arabia’s environmental conditions. Their empirical outcomes revealed that the economic growth and oil rents positively affect the carbon footprints.

Moreover, several studies have also tested EKC hypothesis in connection with the oil-resource abundance. For instance, Mahmood and Furqan [

37] investigated the connection between GDP, oil rents, urbanization, foreign direct investment, financial market development, energy consumption, and CO

2 emissions in the Gulf Cooperation Council (GCC) six economies. They confirmed the EKC hypothesis by utilizing the fixed effects (FE), and the spatial Durbin model (SDM). Additionally, energy consumption, GDP, and oil rents aggravate carbon pollution in GCC countries and even in border countries. In a similar vein, Sadik-Zada and Loewenstein [

44] tested the EKC hypothesis by examining the relationship between income and carbon emissions in 37 oil-rich counties cross-time 1989–2019. Their findings confirmed an inverted U-shaped relationship between economic growth and pollution, while oil rents significantly enhance environmental pollution in oil-producing countries.

Ike et al. [

45] also found an inverted U effect of economic growth on CO

2 emissions only in countries with median and higher level of carbon emissions. Moreover, from the first to sixth quantile, oil production significantly accelerates carbon emissions. However, the results are quite heterogeneous as this effect is weaker in the highest quantile and stronger in the lowest quantile. Sadik-Zada and Gatto [

46] examined the EKC phenomenon in 38 oil-producing countries from 1960 to 2018 and rejected an inverted U-shaped nexus between income per capita and CO

2 emissions. They found that the tertiary or service sector increases carbon emissions by a lower rate than the manufacturing sector does (which causes three times more emissions). Therefore, the structural shift to the tertiary sector triggered by oil rents could substantially improve the environmental quality in oil-rich countries. These findings indicate the level of oil resources abundance has an asymmetric effect on the environment, which requires further inquiry in other country settings with diverse economic, geographical, social, political, and technological factors.

Some papers have also successfully tested the EKC hypothesis in African region by including additional factors. For instance, in their regional analysis, Bibi and Jamil [

47] confirmed an inverted U-shaped relationship between economic growth and carbon emissions in North Africa, while their findings refuted the EKC hypothesis in Sub-Saharan Africa. Yusuf et al. [

48] found the similar results in case of African oil-producing countries. While taking several measures of environmental pollution, they proved the EKC theory for methane gas emissions only. Tiba and Frikha [

49] also observed a bell-shaped relationship by applying the dynamic panel models in case of 26 African countries. Mahmood et al. [

50] applied the spatial analysis, in their recent study on North African region, to probe the EKC phenomenon by taking the additional factors such as imports, exports and foreign direct investment. Their findings unveiled the existence of the EKC or bell-shaped nexus between economic growth and CO

2 emissions. However, Sarkodie [

51] reported mixed evidence about the EKC in Africa. Their findings revealed an inverted U-effect of economic growth on carbon emissions and a U-shaped influence of economic growth on ecological footprints.

The prior studies have mainly tested the effect of energy consumption on pollution in Africa. For example, Awodumi and Adewuyi [

25] demonstrated that energy consumption promotes growth while raising CO

2 emissions in African oil-producing countries. Using the augmented mean group (AMG) model for 19 African economies, Nathaniel and Iheonu [

26] affirmed that many African nations relied on energy consumption to power their economies even though the said energy source is carbon-intensive. Similarly, Muhammad [

52] documented the pollution-enhancing role of energy consumption in North Africa. The past literature has mainly overlooked the underlying nexus of carbon emissions with oil resources abundance, energy consumption, and growth in Africa. To fill this gap, the objective of the current research project is to explore the effects of oil resources abundance, energy consumption, and economic development on CO

2 emissions within the EKC framework. To our best knowledge, this is a pioneering study in bridging the identified gap in the African context. It is important to examine the identified gap for Africa because, with its history of oil exploitation, the region is also identified as home to at least 30% of the world’s newly discovered oil and gas resources [

23]; these African oil resources have always attracted multinational companies to invest and exploit these resources.

The study contributes to the existing literature as follows: First of all, this study is the fresh empirical evidence on the EKC hypothesis based on energy consumption and oil resources abundance in African economies. The prior studies have mainly examined the EKC hypothesis with other factors especially in Africa. Moreover, their empirical findings are highly controversial and inconclusive. Therefore, our study is the first to empirically test the linkage between oil-resource abundance and environmental quality in the context of the EKC theory. Secondly, following the study of Ulucak and Bilgili [

53], we investigate the EKC hypothesis by examining the role of development level in explaining the heterogeneous relationship between income level and pollution. Therefore, we divided our data into two panels, namely, lower-middle income and low-income (LMI and LI) and upper-middle income countries (UMI) based on income-group classification of the World Bank. Thirdly, we determine the TP of the EKC results to find out the threshold levels of specific African economies for policy formulation. Fourthly, the study applies the advanced panel ARDL model, AMG, to account for cross-sectional dependence (CD) and sample heterogeneity problems, which have been ignored in some past studies. Lastly, we apply the Dumitrescu and Hurlin (D–H) Granger non-causality approach as an additional robustness measure to determine the causal linkages among our considered variables. Based on this empirical analysis, the findings would extend the existing literature and provide a reliable roadmap to policymakers for sustainable development and ecological balance, not just the economy.

6. Conclusions and Policy Implications

This study empirically examined the dynamic effect of the oil resources–energy consumption–income–CO2 emissions nexus based on the EKC hypothesis. The analysis relies on the panel data of 11 African oil-producing countries from 1980 to 2014. The study applied the new and robust AMG model to address CD, country-specific heterogeneity issues, and estimate long-run coefficients. The results depict that oil resources have mixed impacts on environmental quality. Only Angola’s oil resources are carbon-intensive (with the associated threats for the environmental pollution) due to the scale effect and the sectoral industries’ inefficient technologies. However, in the case of the UMI panel and countries, such as, Algeria, Gabon, Morocco, and Nigeria, the oil industry decarbonizes the development process owing to technical effects. Regarding energy consumption for the panel of LMI and LI and some of its countries such as CIV, COD, Tunisia, and Morocco, energy consumption is detrimental to the environment. Similarly, in case of UMI panel, and its related country Gabon, we found that this energy consumption is also carbon intensive.

Moreover, the panel-level of LMI and LI validates the EKC hypothesis with the TP of $2415.11, and the countries such as Cameroon ($1403.60), CIV ($1668.72), and Nigeria ($2021.28). All these TPs are below the countries’ corresponding highest GDP figures such as Cameroon ($1829.14), CIV ($2059.26), and then Nigeria ($2563.94). These findings further confirm the EKC theory in these countries. Notably, Nigerian highest GDP coincides with its recent (or 2014) GDP figure ($2563.94). Therefore this country’s TP remains intact, whereas the TP was higher than current income level in Cameroon ($1400.39) and CIV ($1377.80). Therefore, these outcomes suggest Cameroonian and Ivorian authorities to keep improving their economy while mitigating pollution. Contrarily, only Morocco and Algeria reveal a U-shaped curve with the scale effect in the LMI and LI and UMI panels, respectively. Besides, oil resources Granger cause energy consumption. Thus, an investment of oil rents in the renewable energy sector would promote development of the green energy sector. Therefore, such actions could promote the EKC phenomenon in those African countries, which have not yet achieved this level of sustainable growth.

Our findings have useful policy implications for academicians, African governments, the corporate oil sector, and environmental agencies. The Angolan oil industry and the energy consumption process in CIV, COD, Gabon, Tunisia, and Morocco should shift from obsolete equipment to clean technology because these activities compromise the environmental quality and climate conditions. Moreover, Noor-Ouarzazate’s photovoltaic new central supports Morocco’s determination to clean-up its energy sector. In Angola, oil resources extraction should particularly use technologies to mitigate fugitive emissions and flaring gas dramatically. Thereby, the oil industry and the economy’s energy usage should rely on state-of-the-art technologies to anticipate pollution levels of both sectors based on the country’s specificity. Moreover, the selected African countries have to implement (or keep relying on) the “green” legislations to promote the new and environmental-friendly investments in both sectors. These governments should also grant (and support cooperation between) research and development projects towards innovative and cleaner technologies. All these economies should pursue economic diversification and be more services-oriented. Oil extraction and energy sectors can offer interesting opportunities to develop services activities (examples: subcontracting, transport, etc.) for more productive economic integration. The countries should also have well-performing hospital infrastructures. These actions would pave the way to achieve decarbonization and mitigate climate change for the welfare of present and future generations.

Our research has mainly focused on oil resources and their impact on carbon emissions in 11 African oil-producing countries due to data availability constraints. Future research can explore the role of other mineral resources in affecting the environmental quality by including more African or resource-rich countries in the sample. This research has mainly utilized an advanced and robust parametric panel ADL approach. However, we also recommend to apply other non-parametric approaches, which could help capture the non-linear or asymmetric effects of concerned variables.