Modeling Prices for Sawtimber Stumpage in the South-Central United States

Abstract

:1. Introduction

2. Empirical Model and Estimation Methods

i = LA, TX, MS, AR; t = 1981q1, 1981q2, … , 2014q4

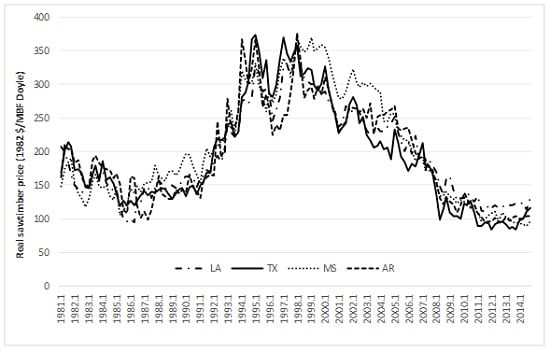

3. Data

4. Empirical Results

5. Discussion and Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Yearbook (Various Issues); Random Lengths Publication: Eugene, OR, USA, 1993–2014.

- Timber Mart-South Market News Quarterly. Available online: http://www.timbermart-south.com/ (accessed on 14 July 2016).

- Jefferies, H.M. United States forest inventory and harvest trends on privately-owned timberlands. Available online: http://nafoalliance.org/images/issues/carbon/resources/F2M-inventory-harvest-trends-20160620.pdf (accessed on 14 July 2016).

- Oswalt, S.N.; Smith, W.B.; Miles, P.D.; Pugh, S.A. Forest Resources of the United States, 2012: A Technical Document Supporting the Forest Service 2015 Update of the RPA Assessment; US Department of Agriculture, Forest Service, Washington Office: Washington, DC, USA, 2014; p. 218.

- Dipesh, K.C.; Will, R.E.; Lynch, T.B.; Heinemann, R.; Holeman, R. Comparison of loblolly, shortleaf, and pitch X loblolly pine plantations growing in Oklahoma. For. Sci. 2015, 61, 540–547. [Google Scholar] [CrossRef]

- Dipesh, K.C.; Will, R.E.; Hennessey, T.C.; Lynch, T.B.; Heinemann, R.; Holeman, R.T.; Wilson, D.E. Effects of simulated ice storm damage on midrotation loblolly pine stands. For. Sci. 2015, 61, 774–779. [Google Scholar] [CrossRef]

- Bentley, J.W.; Cooper, J.A.; Howell, M. 2011‐Timber Product Output and Use‐Forest Inventory and Analysis Factsheet; Louisiana’s Timber Industry: Asheville, NC, USA, 2014; p. 4. [Google Scholar]

- Texas A&M Forest Service. Directory of Forest Products Industries. Available online: http://tfsfrd.tamu.edu/ForestProductsDirectory/DirectoryofForestProductsIndustries.html (accessed on 14 July 2016).

- Bentley, J.W.; Cooper, J.A.; Howell, M. Mississippi’s Timber Industry, 2011—Timber Product Output and Use—Forest Inventory and Analysis Factsheet; US Department of Agriculture Forest Service, Southern Research Station: Asheville, NC, USA, 2014; p. 4.

- Bentley, J.W.; Cooper, J.A.; Howell, M. Arkansas’ Timber Industry, 2011—Timber Product Output and Use—Forest Inventory and Analysis Factsheet; USDA-Forest Service, Southern Research Station: Asheville, NC, USA, 2014; p. 4.

- Saud, P.; Wang, J.; Sharma, B.D.; Liu, W. Carbon impacts of hardwood lumber processing in the northeastern United States. Can. J. For. Res. 2015, 45, 1699–1710. [Google Scholar] [CrossRef]

- Parajuli, R.; Chang, S.J. The softwood sawtimber stumpage market in Louisiana: Market dynamics, structural break and vector error-correction model. For. Sci. 2015, 61, 904–913. [Google Scholar] [CrossRef]

- McKillop, W.L.M. Supply and demand for forest products—An econometric study. Hilgardia 1967, 38, 1–132. [Google Scholar] [CrossRef]

- Adams, D.; Blackwell, J. An econometric model of the United States forest products industry. For. Sci. 1973, 19, 82–96. [Google Scholar]

- Robinson, V.L. An econometric model of softwood lumber and stumpage markets, 1947–1967. For. Sci. 1974, 20, 171–179. [Google Scholar]

- Adams, D.M.; Haynes, R.W. The 1980 timber assessment market model: Structure, projections, and policy simulations. For. Sci. 1980, 26, 1–64. [Google Scholar]

- Newman, D.H. An econometric analysis of the southern softwood stumpage market: 1950–1980. For. Sci. 1987, 33, 932–945. [Google Scholar]

- Liao, X.; Zhang, Y. An econometric analysis of softwood production in the US South: A comparison of industrial and nonindustrial forest ownerships. For. Prod. J. 2008, 58, 69–73. [Google Scholar]

- Leuschner, W.A. An econometric analysis of the Wisconsin aspen pulpwood market. For. Sci. 1973, 19, 41–46. [Google Scholar]

- Daniels, B.J.; Hyde, W.F. Estimation of supply and demand for North Carolina’s timber. For. Ecol. Manag. 1986, 14, 59–67. [Google Scholar] [CrossRef]

- Carter, D.R. Effects of supply and demand determinants on pulpwood stumpage quantity and price in Texas. For. Sci. 1992, 38, 652–660. [Google Scholar]

- Parajuli, R.; Zhang, D.; Chang, S.J. Modeling stumpage markets using vector error correction vs. simultaneous equation estimation approach: A case of the Louisiana sawtimber market. For. Pol. Econ. 2016, 70, 16–19. [Google Scholar] [CrossRef]

- Nagubadi, V.; Munn, I.A.; Tahai, A. Integration of hardwood stumpage markets in the southcentral United States. J. For. Econ. 2001, 7, 69–98. [Google Scholar]

- Yin, R.; Newman, D.H.; Siry, J. Testing for market integration among southern pine regions. J. For. Econ. 2002, 8, 151–166. [Google Scholar] [CrossRef]

- Anderson, N.; Germain, R. Variation and trends in sawmill wood procurement in the Northeastern United States. For. Prod. J. 2007, 57, 36–44. [Google Scholar]

- Zhang, D. Welfare impacts of the 1996 United States-Canada Softwood Lumber (trade) Agreement. Can. J. For. Res. 2001, 31, 1958–1967. [Google Scholar] [CrossRef]

- Zellner, A. An efficient method of estimating seemingly unrelated regression equations and tests of aggregation bias. J. Am. Stat. Assoc. 1962, 57, 500–509. [Google Scholar] [CrossRef]

- Greene, W. Econometric Analysis, 7th ed.; Pearson Education Limited: New York, NY, USA, 2011; p. 292. [Google Scholar]

- Alig, R.J. Econometric analysis of forest acreage trends in the southeast. For. Sci. 1986, 32, 119–134. [Google Scholar]

- Nagubadi, R.; Zhang, D.; Prestemon, J.; Wear, D. Softwood lumber products in the United States: Substitutes, complements, or unrelated? For. Sci. 2004, 50, 416–426. [Google Scholar]

- Henderson, J.E.; Willson, T.M.; Dunn, M.A.; Kazmierczak, R.F. The impact of forestry-related ordinances on timber harvesting in ST. Tammany parish, Louisiana. Contemp. Econ. Policy 2008, 27, 67–75. [Google Scholar] [CrossRef]

- Niquidet, K. Revitalized? An event study of forest policy reform in British Columbia. J. For. Econ. 2008, 14, 227–241. [Google Scholar] [CrossRef]

- Majumdar, S.; Zhang, D.; Zhang, Y. Estimating regional softwood lumber supply in the United States using seemingly unrelated regression. For. Prod. J. 2010, 60, 709–714. [Google Scholar] [CrossRef]

- Granger, C.J. Investigating causal relationships by econometrics models and cross spectral methods. Econometrica 1969, 37, 425–435. [Google Scholar] [CrossRef]

- Testing for Granger Causality. Available online: http://davegiles.blogspot.com/2011/04/testing-for-granger-causality.html (accessed on 14 July 2016).

- Department of Agriculture & Forestry. Available online: http://www.ldaf.state.la.us/forestry/reports/ (accessed on 31 August 2015).

- Texas A&M Forest Service. Available online: http://texasforestservice.tamu.edu/TimberPriceTrends/ (accessed on 31 August 2015).

- Mississippi State University Extension Service. Available online: http://msucares.com/forestry/prices/ (accessed on 31 August 2015).

- Cooperative Extension Service, University of Arkansas System. Available online: http://www.uaex.edu/environment-nature/forestry/timber-price-report.aspx (accessed on 31 August 2015).

- Walkingstick, T.; Division of Agriculture, University of Arkansas Systems, Little Rock, AR, USA; Cunningham, K.; Division of Agriculture, University of Arkansas Systems, Little Rock, AR, USA. Personal communication, 2015.

- Ning, Z.; Sun, C. Vertical price transmission in timber and lumber markets. J. For. Econ. 2014, 20, 17–32. [Google Scholar] [CrossRef]

- Yearbook, Forest Product Market Prices and Statistics (Various Issues); Random Lengths Publications: Eugene, OR, USA, 1986–2014.

- US BLS. Producer Price Indexes. US Department of Labor, Bureau of Labor Statistics. Available online: http://www.bls.gov/ppi/ (accessed on 14 July 2016).

- Edgar, C.; Joshi, O.; Zehnder, R.; Carraway, B.; Taylor, E. Harvest Trend 2014; Texas A&M Forest Service Publication: College Station, TX, USA, 2015; p. 22. [Google Scholar]

- Joshi, O.; Edgar, C.; Zehnder, R.; Carraway, B. Economic Impact of the Texas Forest Sector, 2012; Texas A&M Forest Service Publication: College Station, TX, USA, 2014; p. 12. [Google Scholar]

- Hodges, D.G.; Hartsell, A.J.; Brandeis, C.; Brandeis, T.J.; Bentley, J.W. Recession effects on the forests and forest products industries of the South. For. Prod. J. 2011, 61, 614–624. [Google Scholar] [CrossRef]

| Variable a | Description | Unit |

|---|---|---|

| pstit | Price of softwood sawtimber stumpage | $/MBF (Doyle) |

| ppwit | Price of softwood pulpwood stumpage | $/cord |

| pcnsit | Price of chip-n-saw | $/cord |

| plumit | #2, 2 × 4 KD southern yellow pine (westside) | $/MBF |

| sowl | PNW federal timber harvest reductions | 1 if date ≥ 1993q1, 0 otherwise |

| recs08 | Great financial crisis 2008 | 1 if 2008q1 ≤ date ≤ 2009q2, 0 otherwise |

| post_recs | Post-financial crisis period | 1 if date > 2009q2, 0 otherwise |

| Variable | Mean a | Std. Dev. | Min | Max |

|---|---|---|---|---|

| pst in LA | 194.71 | 66.51 | 95.16 | 367.57 |

| ppw in LA | 15.66 | 3.47 | 10.20 | 24.74 |

| pcns in LA | 46.27 | 20.25 | 16.78 | 93.11 |

| pst in TX | 192.59 | 78.44 | 84.08 | 374.10 |

| ppw in TX | 15.58 | 5.59 | 7.06 | 32.47 |

| pcns in TX | 30.28 | 13.11 | 7.17 | 65.56 |

| pst in MS | 205.71 | 82.60 | 88.83 | 368.95 |

| ppw in MS | 13.97 | 3.97 | 8.35 | 30.59 |

| pcns in MS | 39.45 | 14.96 | 17.54 | 75.85 |

| pst in AR | 194.60 | 72.73 | 94.11 | 375.90 |

| ppw in AR | 12.62 | 2.92 | 8.23 | 23.25 |

| pcns in AR | 35.32 | 12.39 | 17.78 | 77.88 |

| plum | 235.18 | 62.31 | 128.70 | 407.63 |

| sowl | 0.65 | 0.48 | 0 | 1 |

| recs08 | 0.04 | 0.21 | 0 | 1 |

| post_recs | 0.18 | 0.38 | 0 | 1 |

| Variable | SUR Coefficient Estimates | |||

|---|---|---|---|---|

| Louisiana | Texas | Mississippi | Arkansas | |

| ppwit | 0.052 (0.04) | 0.059 a (0.02) | −0.010 (0.04) | 0.094 a (0.04) |

| pcnsit | 0.01 (0.02) | 0.046 b (0.02) | 0.068 b (0.04) | 0.111 a (0.04) |

| plumit | 0.157 a (0.03) | 0.149 a (0.04) | 0.133 a (0.04) | 0.132 a (0.05) |

| pstit-1 | 0.745 a (0.04) | 0.715 a (0.05) | 0.777 a (0.04) | 0.630 a (0.05) |

| sowl | 0.088 a (0.03) | 0.095 a (0.03) | 0.064 a (0.02) | 0.128 a (0.03) |

| recs08 | −0.054 (0.04) | −0.152 a (0.05) | −0.061 (0.04) | −0.164 a (0.06) |

| post-recs | −0.088 a (0.03) | −0.125 a (0.04) | −0.104 a (0.04) | −0.173 a (0.05) |

| quarter 2 | −0.060 a (0.02) | −0.025 (0.02) | −0.045 a (0.02) | −0.024 (0.02) |

| quarter 3 | −0.041 a (0.02) | −0.013 (0.02) | −0.026 (0.02) | −0.061 a (0.02) |

| quarter 4 | −0.022 (0.02) | −0.001 (0.02) | −0.001 (0.02) | −0.015 (0.02) |

| constant | 0.284 (0.22) | 0.320 (0.26) | 0.218 (0.25) | 0.563 (0.31) |

| Q-test for white noise at 4 lags | 3.78 [0.44] | 2.59 [0.36] | 4.25 [0.37] | 6.47 [0.17] |

| R2 | 0.961 | 0.958 | 0.968 | 0.939 |

| Breusch-Pagan test of independence—χ2(6): 108.63, p-value = 0.0000 | ||||

| Variable | Granger Causality Wald Test—χ2 value, p-values in brackets | |||

|---|---|---|---|---|

| Louisiana (Lags = 1) | Texas (Lags = 1) | Mississippi (Lags = 3) | Arkansas (Lags = 3) | |

| pst to ppw | 0.61 [0.43] | 1.05 [0.31] | 1.69 [0.19] | 0.08 [0.77] |

| ppw to pst | 4.79 [0.03] | 0.01 [0.99] | 8.28 [0.00] | 0.01 [0.95] |

| pst to pcns | 0.19 [0.66] | 0.01 [0.92] | 1.18 [0.28] | 0.02 [0.87] |

| pcns to pst | 13.05 [0.00] | 21.12 [0.00] | 9.26 [0.00] | 2.83 [0.09] |

| pst to plum | 15.15 [0.00] | 19.35 [0.00] | 11.09 [0.00] | 11.20 [0.00] |

| plum to pst | 0.72 [0.39] | 0.74 [0.39] | 0.09 [0.76] | 1.95 [0.16] |

| ppw to pcns | 1.80 [0.18] | 1.00 [0.32] | 0.79 [0.37] | 2.38 [0.12] |

| pcns to ppw | 0.46 [0.49] | 2.58 [0.10] | 2.08 [0.15] | 0.13 [0.72] |

| ppw to plum | 0.42 [0.52] | 0.06 [0.81] | 0.44 [0.51] | 1.80 [0.18] |

| plum to ppw | 3.22 [0.07] | 1.42 [0.23] | 0.01 [0.98] | 0.01 [0.92] |

| pcns to plum | 0.01 [0.91] | 0.88 [0.35] | 10.98 [0.00] | 2.16 [0.14] |

| plum to pcns | 0.88 [0.35] | 0.01 [0.92] | 1.69 [0.19] | 4.19 [0.04] |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Parajuli, R.; Tanger, S.; Joshi, O.; Henderson, J. Modeling Prices for Sawtimber Stumpage in the South-Central United States. Forests 2016, 7, 148. https://doi.org/10.3390/f7070148

Parajuli R, Tanger S, Joshi O, Henderson J. Modeling Prices for Sawtimber Stumpage in the South-Central United States. Forests. 2016; 7(7):148. https://doi.org/10.3390/f7070148

Chicago/Turabian StyleParajuli, Rajan, Shaun Tanger, Omkar Joshi, and James Henderson. 2016. "Modeling Prices for Sawtimber Stumpage in the South-Central United States" Forests 7, no. 7: 148. https://doi.org/10.3390/f7070148