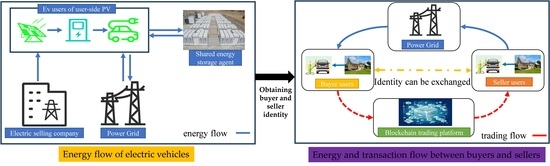

7.1. Analysis of “Multi-Seller–Multi-Buyer” Energy Purchase Strategy

The practical example described in this study is a regional EV user group with three different charging habits. The daily trading situation is also discussed. Each EV user is equipped with a corresponding PV device and a bi-directional charging pile, which is used to realize the power supply and transmission of electric energy for EVs. Typical winter data were selected for the user-side PV system, and the daily PV output curve is shown in

Figure 4. Simultaneously, there is shared energy storage with a certain capacity in the area, which is used to provide rental services to sellers, realize temporary storage of electric energy, and alleviate the utilization of electric energy.

We assume that the three types of EV users after equivalence aggregation are night shift (Class A), early in the morning and late in the evening (Class B), and normal work and rest (Class C). To further verify the model’s effectiveness, three scenarios represent three different types of EV users. Scenario I is dominated by Class A EV users. Scenario II is dominated by Class C EV users. Scenario III is dominated by Class B EV users. The parameters N = [80, 50, 40] EVs are set for Scenario I, N = [30, 50, 80] EVs for Scenario II, and N = [40, 40, 80] EVs for Scenario III.

Table 1 lists the EV parameters after equivalence aggregation, where 0 indicates no charging and 1 indicates charging.

According to

Table 1, the charging periods for Class A users are 5:00–8:00, 14:00, and 17:00–24:00. The charging periods for Class B users are 1:00–5:00, 12:00–13:00, 15:00, 18:00, and 21:00–24:00. The charging periods for Class C users are 7:00–13:00,16:00–17:00, and 19:00–23:00. The optimal power purchase strategy for Class A users is illustrated in

Figure 5.

In Scenario I, Class A users are dominant, as shown in

Figure 5a, and the energy purchase period is divided into two phases: 5:00–8:00 and 22:00–24:00. This is contrary to the charging period, and the reason is that the PV power generation of Class A users is rising at 14:00, so energy is accumulated at a certain degree. Therefore, there is no need to purchase electricity. From 17:00 to 21:00, the PV output gradually decreases. However, it can still meet the electricity demand of users. In the first stage, owing to the charging demand, Class A users are subjected to the time characteristics of PV output. Therefore, they choose to purchase electricity from the state grid or the electricity sales company. From 1:00 to 5:00, the price of the electricity sales company is lower. Therefore, Class A users choose the electricity sales company to purchase electricity at 5:00, and at 6:00–8:00, they choose the state grid with the lower price to purchase electricity. According to

Table 1, during the charging periods of 14:00 and 17:00–22:00, power purchasing is not finished, the reason is that PV power generation can meet their needs. As time goes on, the PV output decreases and surplus power reduces. Therefore, a state grid with a low price is selected to purchase electricity from 22:00 to 24:00. In Scenarios II and III, as shown in

Figure 5b,c, Class C and B users dominate, respectively. The number of Class A users is reduced compared to Scenario I, which results in a lower power purchase than that in Scenario I. The energy purchase period is consistent with Scenario I, and the low-price operation subject is selected for purchase. The electricity prices for each operating subject are shown in

Figure 6.

According to

Table 1, from 1:00 to 5:00, Class B users must be charged, Class C users do not need to be charged, and Class A users only need electricity at 5:00. Both A and C users can provide some of their own resting power supply from 1:00 to 5:00. However, plenty of electricity is purchased by the electricity-selling company at a low price. PVs are in the period of power generation at 12:00–13:00, 15:00, and 18:00, which meets charging needs for Class B users. Therefore, no power purchase occurs.

The optimal power purchase strategy for Class B users is illustrated in

Figure 7. In Scenario I, as presented in

Figure 7a, Class B users purchase power from Class A users at 21:00, which is consistent with the power purchase strategy diagram of Class A users shown in

Figure 5, where Class B users have no power purchase demand at this time. From 22:00 to 24:00, Class A and C users have no remaining electricity. Therefore, they purchase state grid electricity at a low price. In Scenario II, Class B users purchase electricity from Class A users and electricity from an electricity-selling company at 21:00. Compared to Scenario I, the number of Class A users has decreased, and insufficient electricity can be purchased from the electricity-selling company at a lower price. In Scenario III, compared to Scenario II, the number of Class A users has slightly increased, but compared to Scenario I, the electricity level is still insufficient at this time. The remaining electricity is also purchased from the electricity-selling company.

The energy purchase strategy for Class C users is illustrated in

Figure 8.

Table 1 indicates that during the period from 1:00 to 6:00, Class C users have no charging demand. Therefore, they do not purchase electricity. From 7:00 to 13:00, Class C users have a certain charging demand. As time goes by, power generation increase gradually, resulting in the power purchased by Class C users gradually declining, which is embodied in the period from 12:00 to 18:00 in

Figure 8a, and Class C users no longer purchase from other channels during this period. During the period from 19:00 to 23:00, with the gradual reduction in PV output and the Class C users having a certain demand for energy purchase, the purchased electricity gradually increases. In Scenario I presented in

Figure 8a, electricity is purchased from the state grid at a low price from 7:00 to 8:00. At 9:00, parts of electricity demands are provided by Class B users, and the remaining electricity demands are provided by the electricity-selling company at a low price. At 10:00, with the accumulation of PV output, only the power of Class B users can meet the electricity demands of Class C users. At 11:00, Class A users also have a certain amount of residual power, and together with Class B users, they provide power for Class C users. At 9:00–11:00, the electricity demands tend to decrease. At 19:00, the electricity demands for Class C users are provided by B users and the state grid. At 20:00, the electricity demands for Class C users are provided only by B users. From 21:00 to 23:00, no users could provide electricity, so Class C users choose to purchase from the state grid and the electricity-selling company at a low price. In Scenarios II and III, presented

Figure 8b,c, the change trend of the energy purchase strategy of Class C users is consistent with that of Scenario I, but owing to the change in the number of users, the power purchased from other users, the grid, and the electricity sales company at 9:00–11:00 and 19:00–20:00 changed to a certain extent. At 11:00, Class C users in Scenarios II and III do not purchase electricity from Class A users. At 19:00, Class C users in Scenarios II and III only purchased electricity from the state grid and not from Class B users, which is different from what is presented in

Figure 8a. This indicates that Class B users have no electricity to sell in these two scenarios at this time.

The user and seller revenues for the three scenarios are presented in

Table 2,

Table 3 and

Table 4. In Scenario I, the revenue of Class A users is primarily at 21:00. Class B user revenue is primarily at 9:00–11:00 and 19:00–20:00. Class C user benefits are primarily at 1:00, 9:00–11:00, and 19:00–21:00. In Scenario II, the revenues of Class A users are primarily at 21:00. The revenues of Class B users are primarily at 9:00–11:00 and 20:00, and the revenues of Class C users are primarily between 1:00 and 2:00. In Scenario III, the benefits of Class A users are primarily at 1:00 and 21:00. Class B users’ income is primarily at 9:00–11:00 and 20:00. Class C users’ benefits are primarily from 1:00 to 2:00.

As depicted in

Figure 9, the diagrams illustrate the cost state of the three scenarios. Overall, the cost of procuring energy from an electricity sales company and the power grid surpasses that of acquiring from the “multi-seller–multi-buyer” in all three scenarios, proving that the method can attract EV users to purchase energy.

When the use of electricity is at its peak, two situations will emerge: the seller possesses surplus energy or the seller lacks surplus energy. From 4:00 to 6:00, all three sellers in the three scenarios will adapt based on the buyer’s demand. When the “multi-seller–multi-buyer” system lacks surplus energy, the buyer can purchase from the power grid and the electricity sales company. From 6:00 to 10:00, the costs of the power grid and power-selling company magnify, while the costs of the “multi-seller–multi-buyer” model gradually decline. This is attributed to the seller’s surplus energy being diminished, and the electricity prices are lower in the “multi-seller–multi-buyer” model than the power grid and power-selling companies. From 10:00 to 18:00, the output of the PV system is at its peak and the number of buyers decreases, resulting in energy procurement requirements being diminished. From 18:00 to 24:00, the PV system gradually ceases electricity generation, and parts of sellers continue supplying energy, but primarily relying on the power grid and the power-selling company.

7.2. Trading Model Analysis of Multi-Operation Agents Considering “Multi-Seller–Multi-Buyer”

Figure 10 displays the revenue of the multi-operation agents. In Scenario I, as shown in

Figure 10a, because the electricity-selling company has the lowest price on the market from 1:00 to 5:00, the buyer prioritized purchasing electricity during this period. From 1:00 to 4:00, Class B users buy it, and the revenue increases owing to the addition of Class A users at 5:00. From 6:00 to 8:00, the electricity price of the state grid is lower than that of the electricity-selling company, and the revenues of the state grid increase. The PV output is higher from 8:00 to 18:00, as shown in

Figure 4. However, owing to early energy accumulation, the sharing energy storage provider still has profits from 19:00 to 21:00. From 11:00 to 12:00, the energy storage revenue decreases to zero, and the dominant Class C users must purchase electricity during this period. In contrast, Class A and B users do not purchase electricity or purchase less electricity to provide electricity for Class C users, which leads to the electricity flown to the energy storage being reduced and revenues being decreased. Energy storage has benefits from 13:00 to 21:00. However, the overall benefits are reduced compared to Scenario I, which is related to the reduction in power in energy storage.

In Scenario II presented in

Figure 10b, the period from 1:00 to 8:00 is roughly consistent with the change trend in Scenario I, as electricity demand is mainly provided by electricity-selling companies from 9:00 to 10:00. However, the benefits of shared energy storage slightly increase. As the PV output increases, the benefits of multiple operators gradually decrease.

In Scenario III, presented in

Figure 10c, the revenue trend of each operating entity is similar to Scenario II. In addition to the providers of energy storage, the revenue peak of each operating entity occurs in the morning and evening. Because the providers of energy storage earn the charging and discharging rental fees of the users’ surplus power, their revenue peak occurs in the noon–afternoon period. The energy storage can realize peak filling of the power operation.

The “multi-seller–multi-buyer” model of EV energy purchases and sales is compared with the conventional energy purchase channels of ordinary EV users who do not join blockchain technology, and the results are presented in

Table 5.

The model data without blockchain technology come from the sales platform of the state grid, and third-party charging stations. The average electricity cost of the new mode is calculated by a comprehensive calculation of the energy purchase and sales data after the user adopts the new trading mode. After joining the blockchain ledger, the cost of purchasing and selling electricity for users is significantly reduced, and the utilization time of energy storage devices is significantly improved, so the electricity cost is reduced for users. Simultaneously, the model in this study focuses on the utilization rate of distributed renewable energy and forms an effective interaction with the distributed electricity consumption scenario. The revenue of the trading platform and shared energy storage operators depends on the transaction frequency of the buyers and sellers. The trading platform and shared energy storage operators can deduct a fee from a single order, and they can maintain the stability and normal operation of the entire system. Power grid and electricity sales companies earn certain profits by supplementing the users’ insufficient power.

Particle Swarm Optimization (PSO) is an intelligent optimization algorithm that simulates groups such as birds searching for food. It is derived from the research on the foraging behavior of birds, as birds can find the optimal target through collective information sharing. In this paper, an improved PSO algorithm is proposed, and the details are as follows: first, we build an inertia weight model to enhance the global search optimal capability; second, a simulated annealing strategy is integrated into the iterative process of the algorithm to periodically enhance its local search optimal ability. Through the above improvements, the improved PSO algorithm has faster convergence compared to the traditional algorithm.

For the EV power trading model proposed in this study, an improved NGO algorithm is employed for resolution. Additionally, a comparative analysis is conducted among traditional PSO algorithms, commonly improved PSO algorithms, and the improved NGO algorithm, as illustrated in

Figure 11. The results indicate that the improved NGO algorithm has several advantages, including reduced iterations and higher fitness function values compared to the other optimization methods.

As shown in

Table 6, with under 500 iterations, the result of adopting the improved NGO algorithm has a shorter iteration time, and the user’s revenue is the highest, while the result of adopting the PSO algorithm has the longest running time and lower revenue. Although the improved PSO algorithm is not as efficient and profitable as the improved NGO, it performs better than PSO [

28].

Figure 12 shows the capacity curve of the shared energy storage operator. The revenue of a shared energy storage operator depends on the redundant power of the user. Energy storage began to increase at 10:00 and peaked at 16:00. At this stage, the PV power generation of the users increased, and electricity gradually accumulated. Subsequently, the PV power generation weakened, and electricity gradually slowed down accordingly. The trend of energy storage capacity changes in the three scenarios is roughly the same.