Virtual Net-Metering Option for Bangladesh: An Opportunity for Another Solar Boom like Solar Home System Program

Abstract

:1. Introduction

Research Background

2. Virtual Net-Metering (VNM)

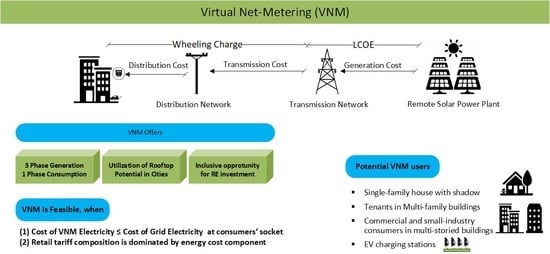

- Single-entity VNM follows a straightforward business model where a single investor develops a larger solar power plant at any site to meet energy demands for other sites. The generator site uses electricity at the rate of LCOE, and other sites pay wheeling costs. This model is also known as multi-site meter aggregation. Examples of such VNM can be found in [20,24].

- Third-party VNM follows the typical producer–retailer business model. An entity develops and operates a power plant to produce energy and sells the energy to one or multiple consumers. In Germany, this model is known as tenant electricity, where the tenants can purchase cheaper power from the landlord [25,26]. In the case of solar farms, the model is comparable with the synthetic or virtual power purchase agreement (vPPA) between a producer and consumers. The price of energy is agreed between two parties for a certain period of time. In addition to power price, consumers pay network charges for transferring the power.

- Community VNM allows a group of consumers to form a community to invest in a shared power plant to meet their energy demand, as shown in Figure 2 [24,27]. The business model for the community VNM can be complicated, as different types of consumers can form a community to produce and consume. Since electricity tariffs differ for different consumer categories, a community power plant will not generate the same benefits for everyone. SOM Energia in Spain and the Clean Energy Collective in the USA are examples of shared generation for roofless consumers [24].

- The retail aggregation VNM model uses the concept of a common platform business concept, such as the Uber and Airbnb model. In the case of energy, the aggregator virtually collects excess power from various generators and sells it to consumers [28]. Consumers receive a reduced energy price compared to the grid electricity tariff. Solshare Ltd., a private company, has implemented this concept by inter-connecting and aggregating solar home systems in Bangladesh [29]. However, unlike other European companies, such as Sonnen in Germany, Solshare builds its own distribution networks.

3. Rationale for VNM and This Research in Bangladesh

3.1. Opportunities for Implementing VNM

3.2. Challenges to Overcome through Implementing VNM

- VNM could provide an inclusive opportunity to invest in PV systems for those who do not have roof space. At the same time, as energy can be generated in three phases and consumed with a single-phase connection through VNM, it can also address the 3-phase policy barrier for installing PV systems. As a result, residents in multi-family buildings and commercial and small industries in multi-storied establishments can install or own PV systems despite space and single-phase connection limitations.

- VNM could promote transportation electrification in Bangladesh. The country hosts more than a million electric 3-wheelers, which consume a significant amount of energy from the grid [38]. According to the distribution operators, there are more than 10,000 registered 3-wheeler charging stations around the country [39,40,41]. These charging stations are primarily located in urban or semi-urban areas where space availability is insufficient for developing solar systems to meet the electric vehicle charging energy demands. VNM could enable the charging station owners to invest in PV systems to offer green electricity for electric three-wheelers. At the same time, it can promote the adoption of electric vehicles among VNM users.

4. Materials and Methods

4.1. Socket Parity Model

4.2. VNM Model

4.3. Scenario and Sensitivity

- Scenarios: Two scenarios for energy wheeling were considered for each RSPP type, as shown in Table 5.

- Sensitivity: Investment cost and wheeling charge were varied to analyze the sensitivity on user benefit, as shown in Table 6.

4.4. Data Collection

5. Results

5.1. Cost of VNM Energy and Socket Parity

5.2. Economic Benefit of Using VNM

5.3. Sensitivity Analysis

6. Discussion

6.1. Potential of VNM for Other Developing Countries

6.2. Promotion of Electric Vehicles through VNM

6.3. Dealing with Land Availability Issues for Solar PV Systems

6.4. VNM for Implementing Renewable Portfolio Standards (RPS) and Mandates

6.5. VNM to Increase Citizen Investment in RE

6.6. Recommended VNM Implementation Pathway

6.7. Limitations and Outlook

7. Conclusions

- − The crucial challenges for renewable energy development in highly populated developing countries are land/space scarcity and lack of investment.

- − There are several under-explored opportunities, such as energy cost-dominant electricity tariffs, availability of smart energy meters, and rising demand sectors (e.g., electric 3-wheelers), in developing countries for adopting emerging system concepts such as VNM.

- − There are a significant number of consumer categories for whom adopting VNM is suitable in Bangladesh and the region.

- − VNM is an economically feasible alternative to grid electricity for consumers such as commercial, industry, and high-energy-consuming households.

- − VNM is a potential pathway for involving consumers in renewable energy investment to address the lack of investment challenges.

- − VNM could foster the implementation of rooftop PV systems and address the land/space availability challenges.

- − VNM could help tackle growing energy demands for EVs, and it could be a catalyst for promoting EVs in developing countries.

- − The existing housing models could be used for implementing VNM and developing RSPPs.

- − The research customized the socket parity method for identifying suitable consumers for VNM and prosumer aggregation concepts.

- − The net present cost method was applied for analyzing comparable cost-saving benefits between grid and VNM electricity.

- − A combined model with socket parity and NPC was developed for determining the country-level economic feasibility of VNM prosumer aggregation concepts.

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Chen, G. Energy Transition in South Asia Is Critical to Reaching Global Net-Zero. Available online: https://blogs.worldbank.org/endpovertyinsouthasia/energy-transition-south-asia-critical-reaching-global-net-zero (accessed on 2 June 2022).

- Chowdhury, S.A. National Solar Energy Roadmap, 2021–2041, Sustainable and Renewable Energy Authortiy SREDA, Dhaka. 2020. Available online: http://www.sreda.gov.bd/sites/default/files/files/sreda.portal.gov.bd/notices/fba98896_568a_4efd_a48b_8d92bfc04049/2020-10-22-17-12-7b0e5a0c0dabd4c17492bcf3bd7488b4.pdf (accessed on 15 January 2021).

- Barua, S.; Aziz, S. (Eds.) Chapter 15—Making green finance work for the sustainable energy transition in emerging economies. In Energy-Growth Nexus in an Era of Globalization; Elsevier: Berkeley, CA, USA, 2022. [Google Scholar]

- Qaiser, I. A comparison of renewable and sustainable energy sector of the South Asian countries: An application of SWOT methodology. Renew. Energy 2021, 181, 417–425. [Google Scholar] [CrossRef]

- IEA. Data and Statistics—Bangladesh. Available online: https://www.iea.org/data-and-statistics/data-tables?country=BANGLADESH (accessed on 26 May 2022).

- Shetol, M.H.; Rahman, M.M.; Sarder, R.; Hossain, M.I.; Riday, F.K. Present status of Bangladesh gas fields and future development: A review. J. Nat. Gas Geosci. 2019, 4, 347–354. [Google Scholar] [CrossRef]

- SREDA. RE Generation Mix|National Database of Renewable Energy. Available online: http://www.renewableenergy.gov.bd/ (accessed on 21 September 2020).

- Hossain, M. Green Finance in Bangladesh: Policies, Institutions, and Challenges; Tokyo ADBI Working Paper No. 892; Asian Development Bank Institute (ADBI): Tokyo, Japan, 2018. [Google Scholar]

- Power Division. Power Division Annual Report FY 2020–2021; Bangladesh Power Division: Dhaka, Bangladesh, 2022. [Google Scholar]

- Islam, S. Christmas Day Could Usher in Bangladesh’s Biggest Solar Field. Available online: https://www.pv-magazine.com/2021/12/23/christmas-day-could-usher-in-bangladeshs-biggest-solar-field/ (accessed on 26 May 2022).

- Islam, S. Bangladesh Set to Approve 70MW Solar Plant. Available online: https://www.pv-magazine.com/2022/01/04/bangladesh-set-to-approve-70mw-solar-plant/ (accessed on 26 May 2022).

- BPDB. Annual Report 2019–2020; Bangladesh Power Development Board (BPDB): Dhaka, Bangladesh, 2022. [Google Scholar]

- Islam, S. Bangladeshi Fabrics Maker Invests in 100 MW Solar Plant. Available online: https://www.pv-magazine.com/2022/04/15/bangladeshi-fabrics-maker-invests-in-100-mw-solar-plant/ (accessed on 15 April 2022).

- Bangladesh Net-Metering Guideline 2018; SREDA: Dhaka, Bangladesh, 2018.

- Jager-Waldau, A.; Bucher, C.; Frederiksen, K.H.B.; Guerro-Lemus, R.; Mason, G.; Mather, B.; Mayr, C.; Moneta, D.; Nikoletatos, J.; Roberts, M.B. Self-consumption of electricity produced from PV systems in apartment buildings—Comparison of the situation in Australia, Austria, Denmark, Germany, Greece, Italy, Spain, Switzerland and the USA. In Proceedings of the 2018 IEEE 7th World Conference on Photovoltaic Energy Conversion (WCPEC) (A Joint Conference of 45th IEEE PVSC, 28th PVSEC & 34th EU PVSEC), Waikoloa, HI, USA, 10–15 June 2018; pp. 1424–1430. [Google Scholar]

- Augustine, P.; McGavisk, E. The next big thing in renewable energy: Shared solar. Electr. J. 2016, 29, 36–42. [Google Scholar] [CrossRef]

- Toby, D. Couture, Clean Energy Solutions Center|The Future of Solar Policy. Available online: https://cleanenergysolutions.org/training/isa/future-solar-policy (accessed on 31 January 2022).

- USAID; MNRE. Case Study on Virtual Net Metering: Partnership to Advance Clean Energy Deploy-Ment (Pace-D); USAID: Washington, DC, USA; Ministry of New and Renewable Energy: Delhi, India, 2018. Available online: https://solarrooftop.gov.in/knowledge/file-14.pdf (accessed on 6 April 2022).

- Roux, A.; Anjali, S. Net Metering and PV Self-Consumption in Emerging Countries; Photovoltaic Power Systems Programme EA-PVPS T9-18:2018; International Energy Agency (IEA): Paris, France, 2018; Available online: https://iea-pvps.org/wp-content/uploads/2020/01/T9_NetMeteringAndPVDevelopmentInEmergingCountries_EN_Report.pdf (accessed on 26 March 2022).

- Langham, E.; Cooper, C.; Ison, N. Virtual Net Metering in Australia: Opportunities and Barriers; Institute for Sustainable Futures, UTS: Sydney, Australia, 2013; Available online: https://opus.lib.uts.edu.au/bitstream/10453/31943/1/2012004596OK.pdf (accessed on 3 November 2021).

- Office of Utilities Regulation. Electricity Wheeling Methodologies; Consultation Document ELE2012004_CON001; Office of Utilities Regulation: Kingston, Jamaica, 2012; Available online: https://our.org.jm/wp-content/uploads/2021/01/electricity_wheeling_methodologies_-_consultation_document.pdf (accessed on 9 March 2022).

- Hamada, H.; Yokoyama, R. Wheeling Charge Reflecting the Transmission Conditions based on the Embedded Cost Method. J. Int. Counc. Electr. Eng. 2011, 1, 74–78. [Google Scholar] [CrossRef]

- USAID. Developing the Fee for Wheeling Electricity in Pakistan: Sustainable Energy for Paki-Stan (SEP) Project; USAID: Arlington, TX, USA, 2020. Available online: https://pdf.usaid.gov/pdf_docs/PA00XJVQ.pdf (accessed on 23 February 2022).

- Moura, R.; Brito, M.C. Prosumer aggregation policies, country experience and business models. Energy Policy 2019, 132, 820–830. [Google Scholar] [CrossRef]

- Moser, R.; Xia-Bauer, C.; Thema, J.; Vondung, F. Solar Prosumers in the German Energy Transition: A Multi-Level Perspective Analysis of the German ‘Mieterstrom’ Model. Energies 2021, 14, 1188. [Google Scholar] [CrossRef]

- BMWi. Gesetz zur Förderung von Mieterstrom und zur Änderung Weiterer Vorschriften des Erneuerbare-Energien-Gesetzes. Available online: https://www.bmwi.de/Redaktion/DE/Artikel/Service/mieterstrom.html (accessed on 8 March 2022).

- Feldman, D.; Brockway, A.M.; Ulrich, E.; Margolis, R. Shared Solar: Current Landscape, Market Potential, and the Impact of Federal Securities Regulation; NREL: Lakewood, CO, USA, 2015. Available online: https://www.nrel.gov/docs/fy15osti/63892.pdf (accessed on 7 January 2022).

- Iria, J.; Scott, P.; Attarha, A.; Gordon, D.; Franklin, E. MV-LV network-secure bidding optimisation of an aggregator of prosumers in real-time energy and reserve markets. Energy 2021, 242, 122962. [Google Scholar] [CrossRef]

- Agnihotri, A.; Bhattacharya, S. SOLshare: Revolutionary Peer-to-Peer Solar Energy Trading in a Developing Market; SAGE Publications, SAGE Business Cases Originals: London, UK, 2022. [Google Scholar]

- Thakur, J.; Chakraborty, B. Impact of compensation mechanisms for PV generation on residential consumers and shared net metering model for developing nations: A case study of India. J. Clean. Prod. 2019, 218, 696–707. [Google Scholar] [CrossRef]

- Shaw-Williams, D.; Susilawati, C. A techno-economic evaluation of Virtual Net Metering for the Australian community housing sector. Appl. Energy 2019, 261, 114271. [Google Scholar] [CrossRef]

- Christoforidis, G.C.; Panapakidis, I.P.; Papadopoulos, T.A.; Papagiannis, G.K.; Koumparou, I.; Hadjipanayi, M.; Georghiou, G.E. A Model for the Assessment of Different Net-Metering Policies. Energies 2016, 9, 262. [Google Scholar] [CrossRef]

- HOMER-Energy, Net Present Cost. Available online: https://www.homerenergy.com/products/pro/docs/latest/net_present_cost.html (accessed on 9 March 2022).

- The Financial Express. 8.8m more prepaid meters to be set up by 2022. The Financial Express. 28 February 2021. Available online: https://thefinancialexpress.com.bd/national/88m-more-prepaid-meters-to-be-set-up-by-2022-1614513449 (accessed on 15 June 2021).

- Zhou, S.; Brown, M.A. Smart meter deployment in Europe: A comparative case study on the impacts of national policy schemes. J. Clean. Prod. 2017, 144, 22–32. [Google Scholar] [CrossRef]

- BERC. Bangladesh Tariff Ornance 2020. Available online: https://berc.portal.gov.bd/site/page/a7258783-743a-4145-95a1-9156e4984b7e/ (accessed on 31 January 2022).

- BDEW. BDEW-Strompreisanalyse April 2022. Available online: https://www.bdew.de/service/daten-und-grafiken/bdew-strompreisanalyse/ (accessed on 10 May 2022).

- Hasan, A.M. Electric Rickshaw Charging Stations as Distributed Energy Storages for Integrating Intermittent Renewable Energy Sources: A Case of Bangladesh. Energies 2020, 13, 6119. [Google Scholar] [CrossRef]

- DESCO. Monthly Operational Data. Available online: https://www.desco.org.bd/newsysadmin/mod_b.php (accessed on 4 February 2022).

- BREB. Annual Report 2020–2021. Available online: http://www.reb.gov.bd/site/page/b1c41e26-5e60-45b8-a9c0-a53295dd52e5/%E0%A6%AC%E0%A6%BE%E0%A6%B0%E0%A7%8D%E0%A6%B7%E0%A6%BF%E0%A6%95-%E0%A6%AA%E0%A7%8D%E0%A6%B0%E0%A6%A4%E0%A6%BF%E0%A6%AC%E0%A7%87%E0%A6%A6%E0%A6%A8 (accessed on 9 March 2022).

- DPDC. Annual Report 2021; Dhaka Power Distribution Company Ltd.: Dhaka, Bangladesh, 2022; Available online: https://dpdc.org.bd/page/view/32 (accessed on 21 March 2022).

- Smets, A.; Jäger, K.; Isabella, O.; van Swaaij, R.; Zeman, M. Solar Energy: The Physics and Engineering of Photovoltaic Conversion, Technologies and Systems; UIT Cambridge: Cambridge, UK, 2016. [Google Scholar]

- Ramasamy, V.; David, F.; Jal, D.; Robert, M.U.S. Solar Photovoltaic System and Energy Storage Cost Benchmarks: Q1 2021; NREL: Golden, CO, USA, 2021. Available online: https://www.nrel.gov/docs/fy22osti/80694.pdf (accessed on 29 February 2022).

- World Bank. Bangladesh Scaling-Up Renewable Energy Project; The World Bank Report No: PAD2413; World Bank: Washington, DC, USA, 2019; Available online: https://documents1.worldbank.org/curated/en/218251551754892999/pdf/Bangladesh-Scaling-Up-Renewable-Energy-Project.pdf (accessed on 5 January 2022).

- Solargis, Global Solar Atlas. Available online: https://globalsolaratlas.info/support/methodology (accessed on 23 February 2022).

- Klaus, K.; Boris, F.; Björn, M.; Reinartz, K.; Igor, R.; Christian, K. Degradation in PV Power Plants: Theory and Practice. In Proceedings of the 6th European PV Solar Energy Conference and Exhibition, Brussels, Belgium, 24–28 September 2018; Available online: https://www.ise.fraunhofer.de/content/dam/ise/de/documents/publications/conference-paper/36-eupvsec-2019/Kiefer_5BO75.pdf (accessed on 23 March 2022).

- DPDC. Tariff Rate. Available online: https://dpdc.org.bd/page/view/18 (accessed on 13 June 2022).

- Islam, S. Bangladesh’s Highest-Opex Rooftop PV Plant Goes Online: Bangladesh Has Inaugurated Its Largest Rooftop Solar Array under the Opex Model, at a Location South of Dhaka. Available online: https://www.pv-magazine.com/2022/04/12/bangladeshs-highest-opex-rooftop-pv-plant-goes-online/ (accessed on 21 April 2022).

- Siyambalapitiya, T. Tariff Appraisal Study: Balancing Sustainability and Efficiency with Inclusive Access; Asian Development Bank (ADB): Manila, Philippines, 2018. [Google Scholar] [CrossRef]

- IRENA. Renewable Power Generation Costs in 2020; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2021. [Google Scholar]

- GlobalPetrolPrices.com, Electricity Prices around the World|GlobalPetrolPrices.com. Available online: https://www.globalpetrolprices.com/electricity_prices/ (accessed on 24 May 2022).

- Holmberg, K.; Erdemir, A. The impact of tribology on energy use and CO2 emission globally and in combustion engine and electric cars. Tribol. Int. 2019, 135, 389–396. [Google Scholar] [CrossRef]

- IEA. Tracking Fuel Consumption of Cars and Vans 2020—Analysis—IEA. Available online: https://www.iea.org/reports/tracking-fuel-consumption-of-cars-and-vans-2020-2 (accessed on 28 April 2022).

- United News of Bangladesh. Solar Power Investors Face Land Crisis; New Age: Dhaka, Bangladesh, 2022; Available online: https://www.newagebd.net/article/162612/solar-power-investors-face-land-crisis (accessed on 15 May 2022).

- Islam, S. Minister highlights Bangladesh’s lack of land for solar. PV Magazine. 25 May 2021. Available online: https://www.pv-magazine.com/2021/05/25/minister-highlights-bangladeshs-lack-of-land-for-solar/ (accessed on 15 March 2022).

- Bangladesh Planning Commission. Bangladesh Delta Plan 2100: Land Use and Infrastructure Development; General Economics Division (GED), Bangladesh Planning Commission, Ministry of Planning, Government of Bangladesh: Dhaka, Bangladesh, 2018. Available online: http://www.plancomm.gov.bd/site/files/0adcee77-2db8-41bf-b36b-657b5ee1efb9/Bangladesh-Delta-Plan-2100 (accessed on 3 April 2022).

- NEO. Global Report Assessment of Technical Rooftop Solar Energy Potential in Select Cities; Netherlands Geomatics & Earth Observation B.V.: Amersfoort, The Netherlands, 2021. [Google Scholar]

- SREDA. National Database of Renewable Energy. Available online: http://www.renewableenergy.gov.bd/index.php (accessed on 25 May 2022).

- IRENA. Renewable Energy Policies in a Time of Transition; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2018; Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2018/Apr/IRENA_IEA_REN21_Policies_2018.pdf (accessed on 16 April 2022).

- Export Finance. Bangladesh—Country Profiles—Country Risk. Available online: https://www.exportfinance.gov.au/resources/country-profiles/bangladesh-test/country-risk/ (accessed on 25 May 2022).

- UNB. Public hearing on proposed hike in bulk power tariff Wednesday; Dhaka Tribune, 17 May 2022. Available online: https://www.dhakatribune.com/bangladesh/2022/05/17/public-hearing-on-proposed-hike-in-bulk-power-tariff-wednesday (accessed on 25 May 2022).

- RAJUK. Uttara Apartment Project. Available online: http://www.rajuk.gov.bd/site/project/511989bf-117b-4382-9b94-c62b1f898d92/উত্তরা-এপার্টমেন্ট-প্রকল্প (accessed on 29 April 2022).

- Gjorgievski, V.Z.; Cundeva, S.; Markovska, N.; Georghiou, G.E. Virtual net-billing: A fair energy sharing method for collective self-consumption. Energy 2022, 254, 124246. [Google Scholar] [CrossRef]

| Type of VNM | Description | Potential User |

|---|---|---|

| Single entity (one-to-one) | An entity offsets the electricity of site B from the excess production from site A | Organizations with multiple meters |

| Third-party (One-to-many) | An entity sells exported electricity generation to separate entity(s) | Any generator (solar farm or landlord) or consumer |

| Community group VNM (One-to-many) | People of a community invest in a power plant and transfer the power to the investors/owners via the grid. | People of a community, residents of multi-family housing, commercial community |

| Retail aggregation (Many-to-many) | Multiple entities sell exported generation to a retailer for resale to multiple consumers. | Local generators with exportable electricity Retailers, including community retailers |

| Parameter | Value | Unit | Comment/Source | |

|---|---|---|---|---|

| RSPP Type | Rooftop PV | Ground-mounted PV | ||

| Investment cost, I | 50,000 | 65,000 | BDT/kWp | Values were collected from local project developers via email |

| In USD | ~588 | ~765 | USD/kWp | 1 USD (2022) = 85 BDT |

| Follow-up investment, FI | 25% | Of investment | SREDA | |

| O&M Cost, M | 1% | Of Investment | Values were collected from project developers via email | |

| Energy Yield, EY | 1373 | 1418 | kWh/kWp | [45] |

| RSPP Capacity | 1000 | kWp | ||

| Discount rate, R | 6.4% | Per year | [44] | |

| Project Life | 25 | Year | ||

| Plant degradation (PDR) | 0.7% | Per year | [46] | |

| Depreciation | Linear, 4% | Per year | ||

| O&M Cost Escalation (OCER) | 2.5% | Per year | Values were collected from local project developers via email | |

| Utility | Net Distribution Cost (NtDc) | System Loss | Total Distributable Energy (ET) | Wheeling Cost (WC-Grid) | Puchase Cost per unit | Cost of Lost Energy (C) |

|---|---|---|---|---|---|---|

| MBDT | % | MkWh | MBDT | BDT/kWh | MBDT | |

| BPDB | 11,495 | 7.08% | 12,515 | 3742 | 6.17 | 5887 |

| BREB | 51,210 | 10.65% | 35,819 | 11,057 | 4.60 | 19,644 |

| DPDC | 8448 | 7.15% | 9669 | 3014 | 6.69 | 4982 |

| DESCO | 4728 | 6.94% | 5749 | 1871 | 6.75 | 2897 |

| WZPDC | 3707 | 8.59% | 3618 | 1147 | 5.67 | 1926 |

| NESCO | 4085 | 10.26% | 3980 | 1272 | 5.34 | 2430 |

| Bangladesh Total | 83,673 | 8.45% | 71,350 | 22,103 | 5.41 | 38,922 |

| Notation | Wheeling Scenario | Definition |

|---|---|---|

| DWc | Wheeling through a distribution network. | When the point of generation (RSPP) and consumption are under the same distribution network |

| TDWc | Wheeling through both a transmission and a distribution networks | When the RSPP feeds to the transmission grid and energy is consumed through a distribution grid |

| Scenario | Definition |

|---|---|

| RPVRSPP + DWc | Large Rooftop and Ground-mounted PV systems located within the distribution network of consumers |

| GPVRSPP + DWc | |

| RPVRSPP + TDWc | Large Rooftop and Ground-mounted PV systems are located outside the distribution network of consumers, and they require the transmission network for energy wheeling |

| GPVRSPP + TDWc |

| Parameter | Application | Base Value [Unit] | Sensitivity | Output Parameter |

|---|---|---|---|---|

| Investment cost | RPVRSPP | 50,000 [BDT/kWp] | ± 20% | VNM user benefit [%] |

| GPVRSPP | 65,000 [BDT/kWp] | |||

| Wheeling cost | DWc | 1.55 [BDT/kWh] | Minimum and maximum wheeling charges by utilities | |

| TDWc | 1.86 [BDT/kWh] |

| Data | Application of Data | Source |

|---|---|---|

| Transmission and distribution operators’ costs. | Wheeling costs | [36] |

| Bangladesh electricity tariff | Socket parity and grid electricity cost | [36] |

| Tariff-wise Energy consumption Tariff-wise no. of Consumers | Required capacity share of RSPP and user benefit calculation | [12,39,40,41] |

| Utility | Net Dc without System Loss | Net Dc, Including System Loss | Net Dc and Tc without System Losses | Net Dc and Tc, Including System Losses |

|---|---|---|---|---|

| BPDB | 0.92 | 1.39 | 1.22 | 1.69 |

| BREB | 1.43 | 1.98 | 1.74 | 2.29 |

| DPDC | 0.87 | 1.39 | 1.19 | 1.70 |

| DESCO | 0.82 | 1.33 | 1.15 | 1.65 |

| WZPDC | 1.02 | 1.56 | 1.34 | 1.87 |

| NESCO | 1.03 | 1.64 | 1.35 | 1.96 |

| Mean | 1.02 | 1.55 | 1.33 | 1.86 |

| Parameters | Residential (600 kWh/mo) | Residential (800 kWh/mo) | Residential (1000 kWh/mo) | Commercial | Small Industry | Battery Charging Station |

|---|---|---|---|---|---|---|

| Scenario: RPV-DWc | ||||||

| Savings, BDT | 271,525 | 514,384 | 746,854 | 609,880 | 1948,642 | 1710,575 |

| Saving, % of Grid | 34% | 42% | 45% | 52% | 44% | 38% |

| Discounted Payback, yr | 10 | 8 | 7 | 6 | 7 | 9 |

| Scenario: RPV-TDWc | ||||||

| Savings, BDT | 240,858 | 473,493 | 695,741 | 578,910 | 1806,377 | 1550,450 |

| Saving, % of Grid | 30% | 38% | 42% | 49% | 40% | 34% |

| Discounted Payback, yr | 11 | 8 | 7 | 6 | 8 | 9 |

| Scenario: GPV-DWc | ||||||

| Savings, BDT | 190,630 | 406,523 | 612,028 | 528,187 | 1573,375 | 1288,198 |

| Saving, % of Grid | 24% | 33% | 37% | 45% | 35% | 29% |

| Discounted Payback, yr | 14 | 11 | 9 | 7 | 10 | 12 |

| Scenario: GPV-TDWc | ||||||

| Savings, BDT | 159,962 | 365,632 | 560,915 | 497,217 | 1431,111 | 1128,073 |

| Saving, % of Grid | 20% | 30% | 34% | 42% | 32% | 25% |

| Discounted Payback, yr | 15 | 11 | 10 | 8 | 10 | 13 |

| Consumer Information | RPV | GPV | ||||||

|---|---|---|---|---|---|---|---|---|

| Consumer Category | Annual Consumption, kWh | Tariff BDT/kWh | Required RSPP Capacity Share, kWp | One Time Capital Share, BDT | Annual O&M Share, BDT | Required RSPP Capacity Share, kWp | One Time Capital Share, BDT | Annual O&M Share, BDT |

| LT_Residential (600 kWh/mo) | 7200 | 7.1 | 5.24 | 262,200 | 2622 | 5.08 | 330,042 | 3300 |

| LT_Residential (800 kWh/mo) | 9600 | 8.2 | 6.99 | 349,599 | 3496 | 6.77 | 440,056 | 4401 |

| LT_Residential (1000 kWh/mo) | 12,000 | 8.8 | 8.74 | 436,999 | 4370 | 8.46 | 550,071 | 5501 |

| LT_Commercial | 7271 | 10.3 | 5.30 | 264,785 | 2648 | 5.13 | 333,297 | 3333 |

| LT_Small Industry | 33,400 | 8.53 | 24.33 | 1,216,315 | 12,163 | 23.55 | 1,531,030 | 15,310 |

| LT_Battery Charging Station | 37,593 | 7.64 | 27.38 | 1,369,009 | 13,690 | 26.51 | 1,723,233 | 17,232 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hasan, A.S.M.M. Virtual Net-Metering Option for Bangladesh: An Opportunity for Another Solar Boom like Solar Home System Program. Energies 2022, 15, 4616. https://doi.org/10.3390/en15134616

Hasan ASMM. Virtual Net-Metering Option for Bangladesh: An Opportunity for Another Solar Boom like Solar Home System Program. Energies. 2022; 15(13):4616. https://doi.org/10.3390/en15134616

Chicago/Turabian StyleHasan, A. S. M. Mominul. 2022. "Virtual Net-Metering Option for Bangladesh: An Opportunity for Another Solar Boom like Solar Home System Program" Energies 15, no. 13: 4616. https://doi.org/10.3390/en15134616