The Impact of Industry on European Union Emissions Trading Market—From Network Perspective

Abstract

:1. Introduction

2. Data

- EGSAS: Electricity, gas, steam, and air conditioning supply.

- WTEM: Wholesale trade, excluding motor vehicles and motorcycles.

- MONM: Manufacture of other non-metallic mineral products.

- MBM: Manufacture of basic metals.

- MCRP: Manufacture of coke and refined petroleum products.

- MCC: Manufacture of chemicals and chemical products.

- OOOB: Office administrative, office support, and other business support activities.

- PADC: Public administration and defense; compulsory social security.

- MPP: Manufacture of paper and paper products.

- AHMC: Activities of head offices; management consultancy activities.

- MF: Manufacture of food products.

- ECP: Extraction of crude petroleum.

- OPST: Other professional, scientific, and technical activities.

- AETA: Architectural and engineering activities; technical testing and analysis

- MMTS: Manufacture of motor vehicles, trailers, and semi-trailers

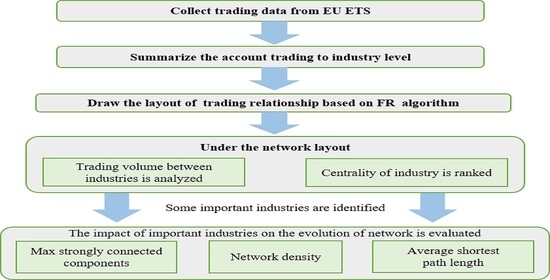

3. Methods

3.1. Network Construction

3.2. Network Indexes

3.3. Assessment of Industry Impact on the Network

4. Results and Discussion

4.1. The Structure of the Trading Network

4.2. Trading Volume Analysis

4.3. Evolution of the Trading Network

4.4. Centrality Analysis of Industries

4.5. Impact of Industry on the Network

5. Conclusions

6. Shortcomings and Future Work

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| Acronym | Meaning |

| EU ETS | European Union Emissions Trading System |

| CITL | Community Independent Transaction Log |

| FR | Fruchterman–Reingold |

| EGSAS | Electricity, gas, steam, and air conditioning supply. |

| WTEM | Wholesale trade, except of motor vehicles and motorcycles |

| MONM | Manufacture of other non-metallic mineral products |

| MBM | Manufacture of basic metals |

| MCRP | Manufacture of coke and refined petroleum products |

| MCC | Manufacture of chemicals and chemical products. |

| OOOB | Office administrative, office support, and other business support activities |

| PADC | Public administration and defense; compulsory social security |

| MPP | Manufacture of paper and paper products |

| AHMC | Activities of head offices; management consultancy activities |

| MF | Manufacture of food products |

| ECP | Extraction of crude petroleum |

| OPST | Other professional, scientific, and technical activities |

| AETA | Architectural and engineering activities; technical testing and analysis |

| MMTS | Manufacture of motor vehicles, trailers, and semi-trailers |

References

- Ellerman, A.D.; Barbara, K.B. Over-Allocation or Abatement? A Preliminary Analysis of the EU ETS Based on the 2005-06 Emissions Data. Environ. Resour. Econ. 2008, 41, 267–287. [Google Scholar] [CrossRef] [Green Version]

- Best, R.; Zhang, Q.Y. What explains carbon-pricing variation between countries? Energy Policy 2020, 143. [Google Scholar] [CrossRef]

- Anderson, B.; Di, M.C. Abatement and allocation in the pilot phase of the EU ETS. Environ. Resour. Econ. 2011, 48, 83–103. [Google Scholar] [CrossRef] [Green Version]

- Buchner, B.K.; Carraro, C.; Ellerman, A.D. The Allocation of European Union Allowances: Lessons, Unifying Themes and General Principles. Clim. Chang. Model. Policy Work. Pap. 2006. [Google Scholar] [CrossRef] [Green Version]

- Georgopoulou, E.; Sarafidis, Y.; Mirasgedis, S.; Lalas, D.P. Next allocation phase of the EU emissions trading scheme: How tough will the future be? Energy Policy 2006, 34, 4002–4023. [Google Scholar] [CrossRef]

- Verde, S.F.; Teixido, J.; Marcantonini, C.; Labandeira, X. Free allocation rules in the EU emissions trading system: What does the empirical literature show? Clim. Policy 2019, 19, 439–452. [Google Scholar] [CrossRef]

- Benz, E.; Trück, S. Modeling the price dynamics of CO2 emission allowances. Energy. Econ. 2009, 31, 4–15. [Google Scholar] [CrossRef]

- Christiansen, A.; Arvanitakis, A.; Tangen, K.; Hasselknippe, H. Price determinants in the EU emissions trading scheme. Clim. Policy 2005, 5, 15–30. [Google Scholar] [CrossRef]

- Delarue, E.; Lamberts, H.; D’haeseleer, W. Simulating greenhouse gas allowance cost and GHG emission reduction in Western Europe. Energy 2007, 32, 1299–1309. [Google Scholar] [CrossRef]

- Denny, E.; O’Malley, M. The impact of carbon prices on generation-cycling costs. Energy Policy 2009, 37, 1204–1212. [Google Scholar] [CrossRef]

- Albers, S.; Jan-André, B.; Peters, H. Will the EU-ETS instigate airline network reconfigurations? J. Air Transp. Manag. 2009, 15, 1–6. [Google Scholar] [CrossRef]

- Alberola, E.; Benoît, C.; Chevallier, J. The EU Emissions Trading Scheme: The effects of Industrial Production and CO2 Emissions on European Carbon Prices. Econ. Int. 2008, 116, 93–126. [Google Scholar] [CrossRef] [Green Version]

- Asselt, H.V.; Biermann, F. European emissions trading and the international competitiveness of energy-intensive industries: A legal and political evaluation of possible supporting measures. Energy Policy 2007, 35, 497–506. [Google Scholar] [CrossRef]

- Oberndorfer, U.; Rennings, K. Costs and competitiveness effects of the European Union emissions trading scheme. Eur. Environ. 2007, 17, 1–17. [Google Scholar] [CrossRef]

- Verde, S.F. The Impact of the Eu Emissions Trading System on Competitiveness and Carbon Leakage: The Econometric Evidence. J. Econ. Surv. 2020, 34, 320–343. [Google Scholar] [CrossRef]

- Joltreau, E.; Sommerfeld, K. Why does emissions trading under the EU Emissions Trading System (ETS) not affect firms€ competitiveness? Empirical findings from the literature. Clim. Policy 2019, 19, 453–471. [Google Scholar] [CrossRef] [Green Version]

- Chevallier, J.; Ielpo, F.; Mercier, L. Risk aversion and institutional information disclosure on the European carbon market: A case-study of the 2006 compliance event. Energy Policy 2009, 37, 15–28. [Google Scholar] [CrossRef]

- Betz, R.A.; Schmidt, T.S. Transfer patterns in phase I of the EU emissions trading system: A first reality check based on cluster analysis. Clim. Policy 2016, 16, 474–495. [Google Scholar] [CrossRef]

- Liu, Y.P.; Guo, J.F.; Fan, Y. A big data study on emitting companies’ performance in the first two phases of the European Union Emission Trading Scheme. J. Clean. Prod. 2017, 142, 1028–1043. [Google Scholar] [CrossRef]

- Guo, J.F.; Gu, F.; Liu, Y.; Liang, X.; Mo, J.; Fan, Y. Assessing the impact of ETS trading profit on emission abatements based on firm-level transactions. Nat. Commun. 2020, 11, 2078. [Google Scholar] [CrossRef]

- Fan, Y.; Liu, Y.P.; Guo, J.F. How to explain carbon price using market micro-behavior? Appl. Econ. 2016, 48, 1–16. [Google Scholar] [CrossRef]

- Wang, J.; Gu, F.; Liu, Y.; Fan, Y.; Guo, J. Bidirectional interactions between trading behaviors and carbon prices in European Union emission trading scheme. J. Clean. Prod. 2019, 224, 435–443. [Google Scholar] [CrossRef]

- Jaraite, J.; Jong, T.; Kazukauskas, A.; Zaklan, A.; Zeitlberger, A. Ownership Links and Enhanced EUTL dataset. Eur. Univ. Inst. 2013. Available online: https://cadmus.eui.eu/handle/1814/64596 (accessed on 20 October 2020).

- Jaraite, J.; Jong, T.; Kazukauskas, A.; Zaklan, A.; Zeitlberger, A. Matching EU ETS Accounts to Historical Parent Companies A Technical Note. Eur. Univ. Inst. 2013, 18, 2014. [Google Scholar]

- Cludius, J.; Betz, R. The Role of Banks in EU Emissions Trading. Energy J. 2020, 41, 275–299. [Google Scholar] [CrossRef]

- Karpf, A.; Mandel, A.; Battiston, S. Price and network dynamics in the European carbon market. J. Econ. Behav. Organ. 2018, 153, 103–122. [Google Scholar] [CrossRef] [Green Version]

- Borghesi, S.; Flori, A. EU ETS facets in the net: Structure and evolution of the EU ETS network. Energy Econ. 2018, 75, 602–635. [Google Scholar] [CrossRef] [Green Version]

- Borghesi, S.; Flori, A. With or without U(K): A pre-Brexit network analysis of the EU ETS. PLoS ONE 2019, 14, e0221587. [Google Scholar] [CrossRef]

- Fruchterman, T.M.J.; Reingold, E.M. Graph drawing by force-directed placement. Softw. Pract. Exp. 2010, 21, 1129–1164. [Google Scholar] [CrossRef]

- Eades, P.A. Heuristic for graph drawing. In Congressus Numerantium; Utilitas Mathematica Pub. Incorporated: Winnipeg, MB, Canada, 1984; Volume 42, pp. 149–160. [Google Scholar]

- Acemoglu, D.; Ozdaglar, A.; Tahbaz- Salehi, A. Systemic Risk and Stability in Financial Networks. Am. Econ. Rev. 2015, 105, 564–608. [Google Scholar] [CrossRef]

- Dai, P.F.; Xiong, X.; Zhou, W.X. A global economic policy uncertainty index from principal component analysis. Financ. Res. Lett. 2020, 101686. [Google Scholar] [CrossRef]

- Dai, P.F.; Xiong, X.; Zhou, W.X. Visibility graph analysis of economy policy uncertainty indices. Phys. A Stat. Mech. Appl. 2019, 531, 121748. [Google Scholar] [CrossRef]

| IND | SELL | IND | BUY | IND | TOTLT | IND | NET |

|---|---|---|---|---|---|---|---|

| bank | 3.33 × 108 | EGSAS | 4.32 × 108 | EGSAS | 6.99 × 108 | EGSAS | 1.65 × 108 |

| EGSAS | 2.67 × 108 | bank | 3.59 × 108 | bank | 6.92 × 108 | MBM | −7.6 × 108 |

| exchange | 2.54 × 108 | exchange | 2.53 × 108 | exchange | 5.08 × 108 | bank | 2.57 × 107 |

| broker | 1.02 × 108 | broker | 1.14 × 108 | broker | 2.16 × 108 | MCRP | −2.4 × 107 |

| MBM | 1.01 × 108 | MCRP | 5.65 × 107 | MCRP | 1.37 × 108 | MPP | −1.6 × 107 |

| MCRP | 8.06 × 107 | MONM | 3.73 × 107 | MBM | 1.27 × 108 | MCC | −1.6 × 107 |

| MONM | 5.08 × 107 | MBM | 2.57 × 107 | MONM | 8.82 × 107 | MONM | −1.3 × 107 |

| AHMC | 3.20 × 107 | AHMC | 2.37 × 107 | AHMC | 5.57 × 107 | broker | 1.22 × 107 |

| MCC | 3.20 × 107 | OOOB | 2.36 × 107 | MCC | 4.84 × 107 | MF | −1.1 × 107 |

| MF | 2.08 × 107 | MCC | 1.64 × 107 | OOOB | 4.41 × 107 | AHMC | −8.3 × 106 |

| IND | SELL | IND | BUY | IND | TOTAL | IND | NET |

|---|---|---|---|---|---|---|---|

| bank | 3.66 × 109 | bank | 3.67 × 109 | bank | 7.33 × 109 | EGSAS | 4.38 × 108 |

| exchange | 2.62 × 109 | broker | 2.84 × 109 | broker | 5.32 × 109 | broker | 3.72 × 108 |

| BROKE | 2.47 × 109 | exchange | 2.57 × 109 | exchange | 5.19 × 109 | MBM | −2.8 × 108 |

| EGSAS | 1.48 × 109 | EGSAS | 1.92 × 109 | EGSAS | 3.4 × 109 | MONM | −2.5 × 108 |

| WTEM | 5.08 × 108 | WTEM | 4.20 × 108 | WTEM | 9.27 × 108 | OOOB | 1.27 × 108 |

| MONM | 4.57 × 108 | OOOB | 3.22 × 108 | MONM | 6.6 × 108 | WTEM | −8.8 × 107 |

| MBM | 4.06 × 108 | MCRP | 2.79 × 108 | MCRP | 6.06 × 108 | PADC | −4.9 × 107 |

| MCRP | 3.27 × 108 | MCC | 2.25 × 108 | MBM | 5.3 × 108 | MCRP | −4.8 × 107 |

| MCC | 2.53 × 108 | MONM | 2.04 × 108 | OOOB | 5.17 × 108 | MPP | −4.7 × 107 |

| OOOB | 1.95 × 108 | MBM | 1.26 × 108 | MCC | 4.78 × 108 | ECP | 4.3 × 107 |

| PageRank | Eigenvector Centrality | Degree Centrality | Closeness Centrality | Betweenness Centrality |

|---|---|---|---|---|

| Results in Phase I | ||||

| EGSAS | EGSAS | EGSAS | EGSAS | EGSAS |

| broker | broker | broker | broker | broker |

| bank | bank | bank | bank | bank |

| exchange | exchange | exchange | exchange | exchange |

| MCRP | MCRP | MONM | MCRP | MONM |

| MONM | MONM | MCRP | MONM | MCRP |

| MCC | MCC | MCC | MCC | MMTS |

| MF | MF | MPP | MF | MCC |

| MBM | AHMC | MF | MBM | MBM |

| AHMC | MBM | MBM | AHMC | MF |

| Results in Phase II | ||||

| broker | broker | broker | broker | broker |

| EGSAS | EGSAS | EGSAS | EGSAS | EGSAS |

| WTEM | WTEM | WTEM | WTEM | bank |

| bank | bank | bank | bank | WTEM |

| exchange | AHMC | OOOB | exchange | exchange |

| MONM | OOOB | OPST | OOOB | AHMC |

| AHMC | exchange | exchange | AHMC | MONM |

| OOOB | MONM | MONM | MONM | OOOB |

| MCC | MCC | AHMC | MCC | AETA |

| OPST | OPST | MCC | OPST | OPST |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, J.; Liu, Y.; Fan, Y.; Guo, J. The Impact of Industry on European Union Emissions Trading Market—From Network Perspective. Energies 2020, 13, 5642. https://doi.org/10.3390/en13215642

Wang J, Liu Y, Fan Y, Guo J. The Impact of Industry on European Union Emissions Trading Market—From Network Perspective. Energies. 2020; 13(21):5642. https://doi.org/10.3390/en13215642

Chicago/Turabian StyleWang, Jiqiang, Yinpeng Liu, Ying Fan, and Jianfeng Guo. 2020. "The Impact of Industry on European Union Emissions Trading Market—From Network Perspective" Energies 13, no. 21: 5642. https://doi.org/10.3390/en13215642