Adaptive Market Hypothesis: Evidence from the Vietnamese Stock Market

Abstract

:1. Introduction

1.1. Papers Discussing Adaptive Market Hypothesis (AMH)

- The market efficiency should be varying through time;

- The market efficiency should be dependent on market conditions (i.e., financial crises, market crashes, stock bubbles, …).

1.2. Papers Discussing Vietnamese Stock Market Efficiency

2. Methods and Data Sources

2.1. Methods

2.1.1. Autocorrelation Testing Approach

- Automatic Variance Ratio (“AVR”) test;

- Automatic Portmanteau (“AP”) test; and

- Generalized Spectral (“GS”) test

- The AVR test, which is modified from the traditional variance ratio test, is the most popular test in the AMH examination. This is the primary testing method of this paper.

- The AP test is an asymptotic test, which relies on the squared correlation coefficients. This method eliminates the possibility that the positive correlations and the negative correlations offset one another (Kim et al. 2011).

- The GS test is an autocorrelation test that can determine the non-linear relationship in the data series. The non-linear relationship in stock data can be recognized (Lim and Brooks 2011), yet cannot be detected by popular linear tests such as the AVR test and the AP test.

- The Automatic Variance Ratio (AVR) test

- The Automatic Portmanteau (AP) test

- The Generalized Spectral (GS) test

2.1.2. The Time-Varying Autoregressive (TV-AR) Approach

2.2. Data

- rt is the weekly stock returns at week t

- Pt is the value of VN-INDEX/HNX-INDEX at the last trading day of week t

- Pt−1 is the value of VN-INDEX/HNX-INDEX at the last trading day of week (t − 1)

3. Empirical Results and Discussion

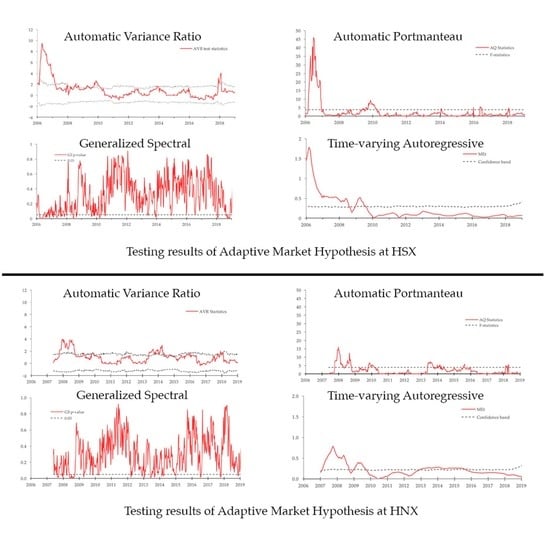

3.1. AVR Test Results

3.2. AP Test Results

3.3. The GS Test Statistics

3.4. The TV-AR Approach

4. Limitations and Suggestions

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

References

- Choi, In. 1999. Testing the Random Walk Hypothesis for Real Exchange Rates. Journal of Applied Econometrics 14: 293–308. [Google Scholar] [CrossRef]

- Cuong, Phan Khoa, and Zhou Jian. 2014. Factors influencing individual investors’ behavior: An empirical study of the Vietnamese stock market. American Journal of Business and Management 3: 77–94. [Google Scholar] [CrossRef]

- Dong Loc, Truong, Ger Lanjouw, and Robert Lensink. 2010. Stock-market efficiency in thin-trading markets: The case of the Vietnamese stock market. Applied Economics 42: 3519–32. [Google Scholar] [CrossRef]

- Escanciano, J. Carlos, and Carlos Velasco. 2006. Generalized Spectral Tests for the Martingale Difference Hypothesis. Journal of Econometrics 134: 151–85. [Google Scholar] [CrossRef]

- Escanciano, J. Carlos, and Ignacio N. Lobato. 2009. Testing the Martingale Hypothesis. Palgrave Handbook of Econometrics, 972–1003. [Google Scholar]

- Fama, Eugene F. 1970. Efficient Capital Markets: A Review of Theory and Empirical Work. The Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- Hiremath, Gourishankar S., and Jyoti Kumari. 2014. Stock Returns Predictability and the Adaptive Market Hypothesis in Emerging Markets: Evidence from India. SpringerPlus 3: 428. [Google Scholar] [CrossRef]

- Hoque, Hafiz A.A.B., Jae H. Kim, and Chong Soo Pyun. 2007. A Comparison of Variance Ratio Tests of Random Walk: A Case of Asian Emerging Stock Markets. International Review of Economics & Finance 16: 488–502. [Google Scholar]

- Ito, Mikio, Akihiko Noda, and Tatsuma Wada. 2014. International Stock Market Efficiency: A Non-Bayesian Time-Varying Model Approach. Applied Economics 46: 2744–54. [Google Scholar] [CrossRef]

- Ito, Mikio, and Shunsuke Sugiyama. 2009. Measuring the Degree of Time Varying Market Inefficiency. Economics Letters 103: 62–64. [Google Scholar] [CrossRef]

- Ito, Mikio, Akihiko Noda, and Tatsuma Wada. 2016. The evolution of stock market efficiency in the US: A non-Bayesian time-varying model approach. Applied Economics 48: 621–35. [Google Scholar] [CrossRef]

- Kim, Jae H. 2006. Wild Bootstrapping Variance Ratio Tests. Economics Letters 92: 38–43. [Google Scholar] [CrossRef]

- Kim, Jae H., Abul Shamsuddin, and Kian-Ping Lim. 2011. Stock Return Predictability and the Adaptive Markets Hypothesis: Evidence from Century-Long U.S. Data. Journal of Empirical Finance 18: 868–79. [Google Scholar] [CrossRef]

- Lim, Kian-Ping, and Robert Brooks. 2011. The evolution of stock market efficiency over time: A survey of the empirical literature. Journal of Economic Surveys 25: 69–108. [Google Scholar] [CrossRef]

- Lim, Kian-Ping, Robert Darren Brooks, and Melvin Hinich. 2006. Testing the Assertion That Emerging Asian Stock Markets Are Becoming More Efficient. SSRN Journal. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=906515 (accessed on 29 March 2019). [CrossRef]

- Lim, Kian-Ping, Weiwei Luo, and Jae H. Kim. 2013. Are US Stock Index Returns Predictable? Evidence from Automatic Autocorrelation-Based Tests. Applied Economics 45: 953–62. [Google Scholar] [CrossRef]

- Lo, Andrew W. 2004. The Adaptive Markets Hypothesis: Market Efficiency from an Evolutionary Perspective. Journal of Portfolio Management 30: 15–29. [Google Scholar] [CrossRef]

- Lo, Andrew W. 2005. Reconciling Efficient Markets with Behavioral Finance: The Adaptive Markets Hypothesis. Journal of Investment Consulting 7: 21–44. [Google Scholar]

- Lo, Andrew, and A. Craig MacKinlay. 1988. Stock Market Prices Do Not Follow Random Walks: Evidence From a Simple Specification Test. Review of Financial Studies 1: 41–66. [Google Scholar] [CrossRef]

- Lobato, Ignacio, John C. Nankervis, and N. E. Savin. 2001. Testing for Autocorrelation Using a Modified Box-Pierce Q Test. International Economic Review 42: 187–205. [Google Scholar] [CrossRef]

- Neely, Christopher J., Paul A. Weller, and Joshua M. Ulrich. 2009. The adaptive markets hypothesis: evidence from the foreign exchange market. Journal of Financial and Quantitative Analysis 44: 467–88. [Google Scholar] [CrossRef]

- Noda, Akihiko. 2016. A Test of the Adaptive Market Hypothesis Using a Time-Varying AR Model in Japan. Finance Research Letters 17: 66–71. [Google Scholar] [CrossRef]

- Phan, Khoa Cuong, and Jian Zhou. 2014. Market efficiency in emerging stock markets: A case study of the Vietnamese stock market. IOSR Journal of Business and Management 16: 61–73. [Google Scholar] [CrossRef]

- Smith, Graham. 2012. The Changing and Relative Efficiency of European Emerging Stock Markets. The European Journal of Finance 18: 689–708. [Google Scholar] [CrossRef]

- Urquhart, Andrew, and Frank McGroarty. 2014. Calendar effects, market conditions and the Adaptive Market Hypothesis: Evidence from long-run US data. International Review of Financial Analysis 35: 154–66. [Google Scholar] [CrossRef]

- Vo, Xuan Vinh. 2015. Foreign ownership and stock return volatility–Evidence from Vietnam. Journal of Multinational Financial Management 30: 101–9. [Google Scholar] [CrossRef]

- Vu, Thi Hanh, Nguyen Van Duy, Ho Manh Tung, and Vuong Quan Hoang. 2019. Determinants of Vietnamese Listed firms performance: Competition, Wage, CEO, Firm Size, Age, and International Trade. Journal of Risk and Financial Management 12: 62. [Google Scholar] [CrossRef]

- Vuong, Quan Hoang, and Viet Phuong La. 2019. BayesVL Package for Bayesian Statistical Analyses in R. Github: BayesVL version 0.6.5. Available online: https://github.com/sshpa/bayesvl (accessed on 7 May 2019). [CrossRef]

- Vuong, Quan Hoang. 2018. The Financial Economy of Viet Nam in an Age of Reform, 1986–2016. Routledge Handbook of Banking and Finance in Asia Routledge. Available online: http://www.routledgehandbooks.com/doi/10.4324/9781315543222-12 (accessed on 7 May 2019).

- Vuong, Quan-Hoang. 2019. Computational entrepreneurship: From Economic Complexities to Interdisciplinary. Problems and Perspective in Management 17: 117–29. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Phan Tran Trung, D.; Pham Quang, H. Adaptive Market Hypothesis: Evidence from the Vietnamese Stock Market. J. Risk Financial Manag. 2019, 12, 81. https://doi.org/10.3390/jrfm12020081

Phan Tran Trung D, Pham Quang H. Adaptive Market Hypothesis: Evidence from the Vietnamese Stock Market. Journal of Risk and Financial Management. 2019; 12(2):81. https://doi.org/10.3390/jrfm12020081

Chicago/Turabian StylePhan Tran Trung, Dzung, and Hung Pham Quang. 2019. "Adaptive Market Hypothesis: Evidence from the Vietnamese Stock Market" Journal of Risk and Financial Management 12, no. 2: 81. https://doi.org/10.3390/jrfm12020081