Central Bank Credibility’s Effect on Stock Exchange Returns’ Volatility: Evidence from OECD Countries

Abstract

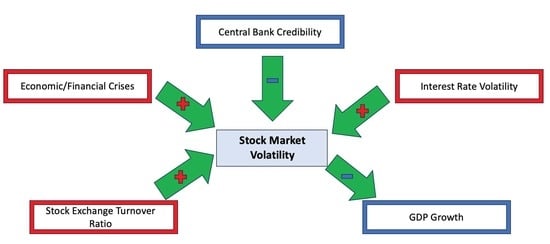

:1. Introduction

2. Literature Review on Central Bank Credibility

3. Data and Methodology

4. Empirical Results

4.1. Preliminary Analysis

4.2. Main Empirical Results

4.3. Causality Tests

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Faust and Svensson | Cecchetti and Krause | Papadamou et al. | |

|---|---|---|---|

| Panel-Specific AR(1) PCSE | Panel-Specific AR(1) PCSE | Panel-Specific AR(1) PCSE | |

| CBC | −0.0097275 ** (0.019) | −0.0882614 *** (0.000) | −0.033667 * (0.051) |

| IRV | 0.5424879 * (0.083) | 0.3378202 (0.258) | 0.5647712 * (0.067) |

| ERV | −8.484407 (0.354) | −9.765261 (0.261) | −8.353206 (0.362) |

| GDPgr% | −0.2395995 * (0.063) | −0.2062147 * (0.093) | −0.2321835 * (0.073) |

| TO% | 0.0168732 ** (0.001) | 0.0120307 ** (0.009) | 0.0157006 ** (0.002) |

| GEQY% | −0.0049047 (0.847) | −0.001656 (0.946) | −0.0010321 (0.968) |

| CRISIS | 2.0163 (0.240) | 2.52936 (0.140) | 2.166467 (0.214) |

| constant | 6.887517 *** (0.000) | 15.63308 *** (0.000) | 8.767636 *** (0.000) |

| R2 | 0.2442 | 0.3020 | 0.2343 |

| Faust and Svensson (2001) | Cecchetti and Krause (2002) | Papadamou et al. | ||||

|---|---|---|---|---|---|---|

| Fixed Effects | Random Effects | Fixed Effects | Random Effects | Fixed Effects | Random Effects | |

| CBC | −0.0042503 (0.514) | −0.0049009 (0.449) | −0.0980716 *** (0.000) | −0.1050752 *** (0.000) | −0.0789972 *** (0.000) | −0.0793453 *** (0.000) |

| IRV | 0.6018437 *** (0.000) | 0.6696149 *** (0.000) | 0.3049985 ** (0.043) | 0.3642293 ** (0.015) | 0.5788228 *** (0.000) | 0.6377589 *** (0.000) |

| ERV | 0.156938 (0.983) | 0.5396243 (0.941) | −8.415745 (0.237) | −9.268066 (0.191) | −1.874546 (0.795) | −1.194137 (0.868) |

| GDPgr% | −0.2565903 *** (0.000) | −0.218255 *** (0.000) | −0.2355467 *** (0.000) | −0.1949581 *** (0.000) | −0.2470508 *** (0.000) | −0.2143553 *** (0.000) |

| TO% | 0.0148665 ** (0.003) | 0.0140271 ** (0.001) | 0.012279 ** (0.010) | 0.0091824 ** (0.015) | 0.0150571 ** (0.002) | 0.0131448 ** (0.001) |

| GEQY% | 0.0021057 (0.933) | 0.0041359 (0.867) | 0.004249 (0.860) | 0.0089958 (0.704) | 0.0064009 (0.795) | 0.0103138 (0.672) |

| CRISIS | 2.909735 *** (0.000) | 2.961605 *** (0.000) | 3.1065951 *** (0.000) | 3.214925 *** (0.000) | 3.196455 *** (0.000) | 3.260025 *** (0.000) |

| constant | 6.560556 *** (0.000) | 6.439202 *** (0.000) | 16.27637 *** (0.000) | 16.97344 *** (0.000) | 10.77239 *** (0.000) | 10.74413 *** (0.000) |

| R2 | 0.1358 | 0.1349 | 0.2278 | 0.2168 | 0.1631 | 0.1623 |

| Hausman | 48.23 *** (0.0000) | 56.98 *** (0.0000) | 12.63 * (0.0815) | |||

| Frees | 7.270 *** | 6.672 *** | 6.643 *** | |||

| Pesaran | 40.930 *** (0.0000) | 51.333 *** (0.0000) | 52.353 *** (0.0000) | |||

| Wooldridge | 40.930 *** (0.0000) | 41.412 *** (0.0000) | 41.686 *** (0.0000) | |||

| m-Wald | 994.32 *** (0.0000) | 675.70 *** (0.0000) | 1271.11 *** (0.0000) | |||

| RE-test | 193.03 *** (0.0000) | 114.34 *** (0.0000) | 195.20 *** (0.0000) | |||

| Faust and Svensson | Cecchetti and Krause | Papadamou et al. | |

|---|---|---|---|

| Faust and Svensson | 1 | ||

| Cecchetti and Krause | −0.29151 | 1 | |

| Papadamou et al. | −0.02326 | 0.300715 | 1 |

| Test No. of Interest | Conclusion of Causality |

|---|---|

| 1 and 9, 2 and 10, 3 and 11 | Central bank credibility Granger-causes stock market volatility |

| 4 and 12 | Interest rate volatility Granger-causes stock market volatility |

| 5 and 13 | Exchange rate volatility Granger-causes stock market volatility |

| 6 and 14 | Stock market volatility Granger-causes GDP growth |

| 7 and 15 | Turnover ratio Granger-causes stock market volatility |

| 8 and 16 | Financial integration Granger-causes stock market volatility |

| 1 | Levieuge et al. (2018) have also created a new index of credibility, although their approach is univariate, as they focus only on inflation (i.e., inflation targets and expectations). |

| 2 | Regarding central bank transparency, greater communication with the markets can increase the smoothness of their response to policy decisions, although excessively high transparency can have opposite results, such as causing confusion (Mishkin 2004; Neuenkirch 2013). |

| 3 | Inflation-based credibility measures also exist in several studies; see, among others, de Mendonça and Souza (2009) and Neuenkirch and Tillmann (2014). |

References

- Barro, Robert J., and David B. Gordon. 1983. A Positive Theory of Monetary Policy in a Natural Rate Model. Journal of Political Economy 91: 589–610. [Google Scholar] [CrossRef]

- Berger, Wolfram, and Friedrich Kißmer. 2013. Central Bank Independence and Financial Stability: A Tale of Perfect Harmony? European Journal of Political Economy 31: 109–18. [Google Scholar] [CrossRef]

- Bernanke, Ben S., and Kenneth N. Kuttner. 2005. What Explains the Stock Market’s Reaction to Federal Reserve Policy? The Journal of Finance 60: 1221–57. [Google Scholar] [CrossRef]

- Bicchal, Motilal. 2022. Assessing the Credibility of Inflation-Targeting Central Banks. Studies in International Economics and Finance. Singapore: Springer, pp. 73–96. [Google Scholar]

- Blinder, Alan S. 2000. Central-Bank Credibility: Why Do We Care? How Do We Build It? American Economic Review 90: 1421–31. [Google Scholar] [CrossRef]

- Bomfim, Antulio N. 2003. Pre-Announcement Effects, News Effects, and Volatility: Monetary Policy and the Stock Market. Journal of Banking & Finance 27: 133–51. [Google Scholar]

- Bomfim, Antulio N., and Glenn D. Rudebusch. 2000. Opportunistic and Deliberate Disinflation under Imperfect Credibility. Journal of Money, Credit and Banking 32: 707–21. [Google Scholar] [CrossRef]

- Bordo, Michael D., and Pierre L. Siklos. 2014. Central Bank Credibility, Reputation and Inflation Targeting in Historical Perspective. Cambridge: National Bureau of Economic Research, p. w20693. [Google Scholar]

- Bordo, Michael D., and Pierre L. Siklos. 2015. Central Bank Credibility: An Historical and Quantitative Exploration. Cambridge: National Bureau of Economic Research, p. w20824. [Google Scholar]

- Bordo, Michael D., and Pierre L. Siklos. 2017. Central Bank Credibility before and after the Crisis. Open Economies Review 28: 19–45. [Google Scholar] [CrossRef]

- Bredin, Don, Stuart Hyde, Dirk Nitzsche, and Gerard O’Reilly. 2007. UK Stock Returns and the Impact of Domestic Monetary Policy Shocks. Journal of Business Finance & Accounting 34: 872–88. [Google Scholar]

- Breitung, Jörg. 2001. The Local Power of Some Unit Root Tests for Panel Data. In Nonstationary Panels, Panel Cointegration, and Dynamic Panels. Bingley: Emerald Group Publishing Limited, pp. 161–77. [Google Scholar]

- Breitung, Jörg, and Samarjit Das. 2005. Panel Unit Root Tests Under Cross-Sectional Dependence. Statistica Neerlandica 59: 414–33. [Google Scholar] [CrossRef]

- Cecchetti, Stephen G., and Stefan Krause. 2002. Central Bank Structure, Policy Efficiency, and Macroeconomic Performance: Exploring Empirical Relationships. Review-Federal Reserve Bank of Saint Louis 84: 47–60. [Google Scholar] [CrossRef]

- Choi, In. 2001. Unit Root Tests for Panel Data. Journal of International Money and Finance 20: 249–72. [Google Scholar] [CrossRef]

- Chuliá, Helena, Martin Martens, and Dick van Dijk. 2010. Asymmetric Effects of Federal Funds Target Rate Changes on S&P100 Stock Returns, Volatilities, and Correlations. Journal of Banking & Finance 34: 834–39. [Google Scholar]

- Čihák, Martin. 2007. Central Banks and Financial Stability: A Survey. SSRN 998335. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=998335 (accessed on 5 August 2023).

- Clarke, Chris, and Adrienne Roberts. 2016. Mark Carney and the Gendered Political Economy of British Central Banking. The British Journal of Politics and International Relations 18: 49–71. [Google Scholar] [CrossRef]

- Cukierman, Alex, and Allan H. Meltzer. 1986. A Theory of Ambiguity, Credibility, and Inflation under Discretion and Asymmetric Information. Econometrica: Journal of the Econometric Society 54: 1099–128. [Google Scholar] [CrossRef]

- Cukierman, Alex, Steven B. Web, and Bilin Neyapti. 1992. Measuring the Independence of Central Banks and Its Effect on Policy Outcomes. The World Bank Economic Review 6: 353–98. [Google Scholar] [CrossRef]

- De Haan, Jakob, Fabian Amtenbrink, and Sandra Waller. 2004. The Transparency and Credibility of the European Central Bank. JCMS: Journal of Common Market Studies 42: 775–94. [Google Scholar]

- de Mendonça, Helder Ferreira. 2018. Credibility and Inflation Expectations: What We Can Tell from Seven Emerging Economies? Journal of Policy Modeling 40: 1165–81. [Google Scholar] [CrossRef]

- de Mendonça, Helder Ferreira, and Gustavo José de Guimaraes e Souza. 2009. Inflation Targeting Credibility and Reputation: The Consequences for the Interest Rate. Economic Modelling 26: 1228–38. [Google Scholar] [CrossRef]

- Dumitrescu, Elena-Ivona, and Christophe Hurlin. 2012. Testing for Granger Non-Causality in Heterogeneous Panels. Economic Modelling 29: 1450–60. [Google Scholar] [CrossRef]

- Eggertsson, Gauti B. 2003. Zero Bound on Interest Rates and Optimal Monetary Policy. Brookings Papers on Economic Activity 2003: 139–233. [Google Scholar] [CrossRef]

- Ehrmann, Michael, and Marcel Fratzscher. 2004. Taking Stock: Monetary Policy Transmission to Equity Markets. Journal of Money, Credit and Banking 36: 719–37. [Google Scholar] [CrossRef]

- Eijffinger, Sylvester C., and Petra M. Geraats. 2006. How Transparent Are Central Banks? European Journal of Political Economy 22: 1–21. [Google Scholar] [CrossRef]

- Engle, Robert F., and José Gonzalo Rangel. 2008. The Spline-GARCH Model for Low-Frequency Volatility and Its Global Macroeconomic Causes. The Review of Financial Studies 21: 1187–222. [Google Scholar] [CrossRef]

- Esqueda, Omar A., Tibebe A. Assefa, and André V. Mollick. 2012. Financial Globalization and Stock Market Risk. Journal of International Financial Markets, Institutions and Money 22: 87–102. [Google Scholar] [CrossRef]

- Faust, Jon, and Lars E. Svensson. 2001. Transparency and Credibility: Monetary Policy with Unobservable Goals. International Economic Review 42: 369–97. [Google Scholar] [CrossRef]

- Förch, Thomas, and Uwe Sunde. 2012. Central Bank Independence and Stock Market Returns in Emerging Economies. Economics Letters 115: 77–80. [Google Scholar] [CrossRef]

- Frees, Edward W. 1995. Assessing Cross-Sectional Correlation in Panel Data. Journal of Econometrics 69: 393–414. [Google Scholar] [CrossRef]

- Greene, William H. 2008. The Econometric Approach to Efficiency Analysis. The Measurement of Productive Efficiency and Productivity Growth 1: 92–250. [Google Scholar]

- Harris, Richard D., and Elias Tzavalis. 1999. Inference for Unit Roots in Dynamic Panels Where the Time Dimension Is Fixed. Journal of Econometrics 91: 201–26. [Google Scholar] [CrossRef]

- Hausman, Jerry A. 1978. Specification Tests in Econometrics. Econometrica: Journal of the Econometric Society 46: 1251–71. [Google Scholar] [CrossRef]

- Herrero, Ana G., and Pablo Del Rio. 2004. Financial Stability and the Design of Monetary Policy. In Financial Markets in Central and Eastern Europe. London: Routledge, pp. 357–91. [Google Scholar]

- Horváth, Roman, and Dan Vaško. 2016. Central Bank Transparency and Financial Stability. Journal of Financial Stability 22: 45–56. [Google Scholar] [CrossRef]

- Im, Kyung So, M. Hashem Pesaran, and Yongcheol Shin. 2003. Testing for Unit Roots in Heterogeneous Panels. Journal of Econometrics 115: 53–74. [Google Scholar] [CrossRef]

- Klomp, Jeroen, and Jakob De Haan. 2009. Central Bank Independence and Financial Instability. Journal of Financial Stability 5: 321–38. [Google Scholar] [CrossRef]

- Konrad, Ernst. 2009. The Impact of Monetary Policy Surprises on Asset Return Volatility: The Case of Germany. Financial Markets and Portfolio Management 23: 111–35. [Google Scholar] [CrossRef]

- Kydland, Finn E., and Edward C. Prescott. 1977. Rules Rather Than Discretion: The Inconsistency of Optimal Plans. Journal of Political Economy 85: 473–91. [Google Scholar] [CrossRef]

- Lalonde, René. 2005. Endogenous Central Bank Credibility in a Small Forward-Looking Model of the US Economy. Bank of Canada 2005–16. Ottawa: Bank of Canada. [Google Scholar]

- Levieuge, Grégory, Yannick Lucotte, and Sébastien Ringuedé. 2018. Central Bank Credibility and the Expectations Channel: Evidence Based on a New Credibility Index. Review of World Economics 154: 493–535. [Google Scholar] [CrossRef]

- Levin, Andrew, Chien-Fu Lin, and Chia-Shang J. Chu. 2002. Unit Root Tests in Panel Data: Asymptotic and Finite-Sample Properties. Journal of Econometrics 108: 1–24. [Google Scholar] [CrossRef]

- Lunde, Asger, and Allan A. Zebedee. 2009. Intraday Volatility Responses to Monetary Policy Events. Financial Markets and Portfolio Management 23: 383–99. [Google Scholar] [CrossRef]

- Łyziak, Tomasz, Joanna Mackiewicz, and Ewa Stanisławska. 2007. Central Bank Transparency and Credibility: The Case of Poland, 1998–2004. European Journal of Political Economy 23: 67–87. [Google Scholar] [CrossRef]

- Mackiewicz-Łyziak, Joanna. 2016. Central Bank Credibility: Determinants and Measurement. A Cross-Country Study. Acta Oeconomica 66: 125–51. [Google Scholar] [CrossRef]

- Mishkin, Frederic. 2004. Can Central Bank Transparency Go Too Far? Cambridge: National Bureau of Economic Research, Inc. [Google Scholar]

- Mun, Kyung-Chun. 2007. Volatility and Correlation in International Stock Markets and the Role of Exchange Rate Fluctuations. Journal of International Financial Markets, Institutions and Money 17: 25–41. [Google Scholar] [CrossRef]

- Neuenkirch, Matthias. 2013. Central Bank Transparency and Financial Market Expectations: The Case of Emerging Markets. Economic Systems 37: 598–609. [Google Scholar] [CrossRef]

- Neuenkirch, Matthias, and Peter Tillmann. 2014. Inflation Targeting, Credibility, and Non-Linear Taylor Rules. Journal of International Money and Finance 41: 30–45. [Google Scholar] [CrossRef]

- Papadamou, Stephanos, Moïse Sidiropoulos, and Eleftherios Spyromitros. 2014a. Determinants of Central Bank Credibility and Macroeconomic Performance: Evidence from Eastern European and Latin American Countries. Eastern European Economics 52: 5–31. [Google Scholar]

- Papadamou, Stephanos, Moïse Sidiropoulos, and Eleftherios Spyromitros. 2014b. Does Central Bank Transparency Affect Stock Market Volatility? Journal of International Financial Markets, Institutions and Money 31: 362–77. [Google Scholar] [CrossRef]

- Papadamou, Stephanos, Moïse Sidiropoulos, and Eleftherios Spyromitros. 2017. Does Central Bank Independence Affect Stock Market Volatility? Research in International Business and Finance 42: 855–64. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem. 2004. General Diagnostic Tests for Cross Section Dependence in Panels. SSRN 572504. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=572504 (accessed on 5 August 2023).

- Pesaran, M. Hashem. 2007. A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics 22: 265–312. [Google Scholar] [CrossRef]

- Reeves, Rachel, and Michael Sawicki. 2007. Do Financial Markets React to Bank of England Communication? European Journal of Political Economy 23: 207–27. [Google Scholar] [CrossRef]

- Rogoff, Kenneth. 1985. The Optimal Degree of Commitment to a Monetary Target. Quarterly Journal of Economics 100: 90. [Google Scholar] [CrossRef]

- Schwert, G. William. 1989. Why Does Stock Market Volatility Change Over Time? The Journal of Finance 44: 1115–53. [Google Scholar] [CrossRef]

- Svensson, Lars E. 1993. The Simplest Test of Inflation Target Credibility. Cambridge: National Bureau of Economic Research, Inc., p. 4604. [Google Scholar]

- Svensson, Lars E. 1999. Inflation Targeting as a Monetary Policy Rule. Journal of Monetary Economics 43: 607–54. [Google Scholar] [CrossRef]

- Tabellini, Guido. 1985. Accommodative Monetary Policy and Central Bank Reputation. Giornale degli Economisti e Annali di Economia 1: 389–425. [Google Scholar]

- Tabellini, Guido. 1987. Central Bank Reputation and the Monetization of Deficits: The 1981 Italian Monetary Reform. Economic Inquiry 25: 185–200. [Google Scholar] [CrossRef]

- Umutlu, Mehmet, Levent Akdeniz, and Aslihan Altay-Salih. 2010. The Degree of Financial Liberalization and Aggregated Stock-Return Volatility in Emerging Markets. Journal of Banking & Finance 34: 509–21. [Google Scholar]

- Vithessonthi, Chaiporn, and Yaowaluk Techarongrojwong. 2012. The Impact of Monetary Policy Decisions on Stock Returns: Evidence from Thailand. Journal of International Financial Markets, Institutions and Money 22: 487–507. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2002. Econometric Analysis of Cross Section and Panel Data. Cambridge: MIT Press. [Google Scholar]

- Yoshino, Naoyuki, Rajemdra N. Paramanik, and Anoop S. Kumar. 2022. Studies in International Economics and Finance. Singapore: Springer. [Google Scholar]

| Symbol | Variable | Measurement | Expected Effect | Related Literature |

|---|---|---|---|---|

| V | Stock volatility (%) | N/A | N/A | |

| CBC_FS | Faust and Svensson credibility index | See Equation (1), Section 2 | Reduction (β < 0) | Faust and Svensson (2001) |

| CBC_CK | Cecchetti and Krause credibility index | See Equation (2), Section 2 | Reduction (β < 0) | Cecchetti and Krause (2002) |

| CBC_PSS | Papadamou et al. credibility index | See Equation (4), Section 2 | Reduction (β < 0) | Papadamou et al. (2014a) |

| IRV | Interest rate volatility | Increase (β > 0) | Engle and Rangel (2008); Umutlu et al. (2010); Esqueda et al. (2012); Papadamou et al. (2014b) | |

| ERV | Exchange rate volatility | Increase (β > 0) | Mun (2007); Engle and Rangel (2008); Papadamou et al. (2014b, 2017) | |

| GDPgr% | GDP growth (%) | Reduction (β < 0) | Esqueda et al. (2012); Papadamou et al. (2014b) | |

| TO% | Stock market turnover ratio (%) | Increase (β > 0) | Umutlu et al. (2010); Esqueda et al. (2012); Papadamou et al. (2014b) | |

| GEQY% | Country’s financial integration (%) | Decrease (β < 0) | Umutlu et al. (2010); Esqueda et al. (2012); Papadamou et al. (2014b) |

| Variable | Obs | Min | Max | Mean | St. Dev. | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|

| StockVolatility% | 1150 | 0.858594 | 44.32756 | 7.475769 | 4.708059 | 2.593413 | 11.23017 |

| CBC_FS | 1150 | 0 | 474.5144 | 1.768587 | 21.52727 | 20.25228 | 426.5401 |

| CBC_CK | 1150 | 0 | 100 | 95.09907 | 12.4111 | −7.05577 | 51.29661 |

| CBC_PSS | 1150 | 18.51405 | 76.01432 | 54.4163 | 9.424272 | −1.1013 | 1.386359 |

| IRV | 1150 | 0 | 10.2404 | 0.477765 | 1.099349 | 4.927183 | 28.33911 |

| ERV | 1150 | 1.87 × 10−05 | 1.17008 | 0.024886 | 0.040637 | 21.17785 | 562.1366 |

| GDPgr% | 1150 | −14.6291 | 14.23086 | 3.085623 | 3.178347 | −0.90316 | 3.630022 |

| TO% | 1150 | 0.04951 | 694.4285 | 66.72895 | 54.13451 | 3.611341 | 24.75761 |

| GEQY% | 1150 | −40.0863 | 106.5942 | 3.806401 | 6.220961 | 5.99037 | 86.06132 |

| Without Drift | ||||||

|---|---|---|---|---|---|---|

| Levin–Lin–Chu | Harris–Tzavalis | Breitung | Im–Pesaran–Shin | Fisher-Type ADF | CADF | |

| StockVolatility% | −10.9406 *** (0.0000) | −21.3220 *** (0.0000) | −8.1928 *** (0.0000) | −9.3738 *** (0.0000) | −12.0942 *** (0.0000) | −4.110 *** (0.000) |

| CBC_FS | −2.2785 ** (0.0113) | −46.4737 *** (0.0000) | −3.5183 *** (0.0002) | Ν/A | −15.3315 *** (0.0000) | −3.131 *** (0.000) |

| CBC_CK | −19.2048 *** (0.0000) | −20.4465 *** (0.0000) | −3.1576 *** (0.0008) | Ν/A | −9.6576 *** (0.0000) | −2.677 ** (0.015) |

| CBC_PSS | −7.2774 *** (0.0000) | −27.2715 *** (0.0000) | −2.3456 ** (0.0095) | −9.8057 *** (0.0000) | −13.6266 *** (0.0000) | −3.560 *** (0.000) |

| IRV | −8.9964 *** (0.0000) | −20.3711 *** (0.0000) | −2.1365 ** (0.0163) | −5.4575 *** (0.0000) | −8.2820 *** (0.0000) | −3.262 *** (0.000) |

| ERV | −1.9124 ** (0.0279) | −35.7532 *** (0.0000) | −5.8540 *** (0.0000) | −11.6235 *** (0.0000) | −18.0200 *** (0.0000) | −4.246 *** (0.000) |

| GDPgr% | −8.0634 *** (0.0000) | −36.2767 *** (0.0000) | −8.8554 *** (0.0000) | −13.0168 *** (0.0000) | −19.5908 *** (0.0000) | −3.757 *** (0.000) |

| TO% | −4.6458 *** (0.0000) | −14.2511 *** (0.0000) | −4.0463 *** (0.0000) | −6.7404 *** (0.0000) | −8.5856 *** (0.0000) | −3.024 *** (0.000) |

| GEQY% | −7.3464 *** (0.0000) | −28.4434 *** (0.0000) | −8.9934 *** (0.0000) | −8.1769 *** (0.0000) | −10.9902 *** (0.0000) | −3.450 *** (0.000) |

| With Drift | ||||||

| StockVolatility% | −9.9099 *** (0.0000) | −16.5302 *** (0.0000) | −11.5751 *** (0.0000) | −11.5890 *** (0.0000) | −16.1873 *** (0.0000) | −3.357 *** (0.000) |

| CBC_FS | −2.2785 ** (0.0113) | −46.4737 *** (0.0000) | 3.4220 (0.9997) | Ν/A | −17.4704 *** (0.0000) | −2.619 ** (0.034) |

| CBC_CK | −29.2353 *** (0.0000) | −13.2022 *** (0.0000) | 5.3978 (1.0000) | Ν/A | −14.0644 *** (0.0000) | −2.660 ** (0.050) |

| CBC_PSS | −5.7978 *** (0.0000) | −16.2002 *** (0.0000) | −1.8811 ** (0.0300) | −9.6812 *** (0.0000) | −16.9537 *** (0.0000) | −3.064 *** (0.000) |

| IRV | −6.9175 *** (0.0000) | −11.4299 *** (0.0000) | 11.3736 (1.0000) | −7.2514 *** (0.0000) | −13.2195 *** (0.0000) | −2.746 *** (0.005) |

| ERV | 0.3212 (0.6260) | −19.6869 *** (0.0000) | −1.7019 ** (0.0444) | −12.0747 *** (0.0000) | −19.5963 *** (0.0000) | −3.203 *** (0.000) |

| GDPgr% | −6.5931 *** (0.0000) | −21.3133 *** (0.0000) | −8.4394 *** (0.0000) | −13.7045 *** (0.0000) | −20.4738 *** (0.0000) | −2.795 *** (0.002) |

| TO% | −5.3015 *** (0.0000) | −10.2691 *** (0.0000) | −5.5466 *** (0.0000) | −8.3889 *** (0.0000) | −13.8389 *** (0.0000) | −2.881 *** (0.000) |

| GEQY% | −5.9420 *** (0.0000) | −15.9711 *** (0.0000) | −7.8645 *** (0.0000) | −9.5427 *** (0.0000) | −15.3088 *** (0.0000) | −2.674 *** (0.000) |

| Faust and Svensson | Cecchetti and Krause | Papadamou et al. | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Fixed Effects | Driscoll–Kraay SE | PCSE | Fixed Effects | Driscoll–Kraay SE | PCSE | Random Effects | Driscoll–Kraay SE | PCSE | |

| CBC | −0.0042503 (0.514) | −0.0059995 ** (0.005) | −0.0059995 * (0.093) | −0.0980716 *** (0.000) | −0.118987 ** (0.009) | −0.118987 *** (0.000) | −0.0793453 *** (0.000) | −0.0809598 * (0.074) | −0.0809598 *** (0.000) |

| IRV | 0.6018437 *** (0.000) | 0.8676288 (0.112) | 0.8676288 ** (0.006) | 0.3049985 ** (0.043) | 0.4713715 (0.279) | 0.4713715 (0.113) | 0.6377589 *** (0.000) | 0.8157348 * (0.088) | 0.8157348 ** (0.008) |

| ERV | 0.156938 (0.983) | 1.155226 (0.914) | 1.155226 (0.904) | −8.415745 (0.237) | −11.76966 (0.467) | −11.76966 (0.184) | −1.194137 (0.868) | 0.6682272 (0.953) | 0.6682272 (0.942) |

| GDPgr% | −0.2565903 *** (0.000) | −0.1066731 (0.546) | −0.1066731 (0.447) | −0.2355467 *** (0.000) | −0.114846 (0.491) | −0.114846 (0.376) | −0.2143553 *** (0.000) | −0.106662 (0.544) | −0.106662 (0.433) |

| TO% | 0.0148665 ** (0.003) | 0.0127952 ** (0.005) | 0.0127952 ** (0.001) | 0.012279 ** (0.010) | 0.00599 * (0.095) | 0.00599 * (0.082) | 0.0131448 ** (0.001) | 0.0105045 ** (0.004) | 0.0105045 ** (0.003) |

| GEQY% | 0.0021057 (0.933) | 0.0109246 (0.541) | 0.0109246 (0.669) | 0.004249 (0.860) | 0.0184488 (0.329) | 0.0184488 (0.492) | 0.0103138 (0.672) | 0.022974 (0.190) | 0.022974 (0.429) |

| CRISIS | 2.909735 *** (0.000) | 3.093889 * (0.052) | 3.093889 * (0.060) | 3.1065951 *** (0.000) | 3.378389 ** (0.027) | 3.378389 ** (0.031) | 3.260025 *** (0.000) | 3.403322 ** (0.028) | 3.403322 ** (0.035) |

| constant | 6.560556 *** (0.000) | 6.017702 *** (0.000) | 6.017702 *** (0.000) | 16.27637 *** (0.000) | 18.20141 ** (0.001) | 18.20141 *** (0.000) | 10.74413 *** (0.000) | 10.46806 ** (0.002) | 10.46806 *** (0.000) |

| R2 | 0.1358 | 0.1248 | 0.1248 | 0.2278 | 0.2224 | 0.2224 | 0.1623 | 0.1519 | 0.1519 |

| RMSE | 4.8465 | 4.5681 | 4.7709 | ||||||

| Test No. | Null Hypothesis | Dumitrescu and Hurlin (2012) Z-bar |

|---|---|---|

| 1 | CBC_FS does not Granger-cause StockVolatility | N/A |

| 2 | CBC_CK does not Granger-cause StockVolatility | N/A |

| 3 | CBC_PSS does not Granger-cause StockVolatility | 3.7828 *** (0.0002) |

| 4 | IRV does not Granger-cause StockVolatility | 14.1476 *** (0.0000) |

| 5 | ERV does not Granger-cause StockVolatility | 11.9415 *** (0.0000) |

| 6 | GDPgr% does not Granger-cause StockVolatility | −0.0458 (0.9635) |

| 7 | TO% does not Granger-cause StockVolatility | 24.1962 *** (0.0000) |

| 8 | GEQY% does not Granger-cause StockVolatility | 5.3252 *** (0.0000) |

| 9 | StockVolatility does not Granger-cause CBC_FS | N/A |

| 10 | StockVolatility does not Granger-cause CBC_CK | N/A |

| 11 | StockVolatility does not Granger-cause CBC_PSS | 1.3960 (0.1627) |

| 12 | StockVolatility does not Granger-cause IRV | 0.8215 (0.4114) |

| 13 | StockVolatility does not Granger-cause ERV | 1.5275 (0.1266) |

| 14 | StockVolatility does not Granger-cause GDPgr% | 2.3115 ** (0.0208) |

| 15 | StockVolatility does not Granger-cause TO% | 0.9137 (0.3609) |

| 16 | StockVolatility does not Granger-cause GEQY% | −0.3775 (0.7058) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dokas, I.; Oikonomou, G.; Papadamou, S.; Spyromitros, E. Central Bank Credibility’s Effect on Stock Exchange Returns’ Volatility: Evidence from OECD Countries. Economies 2023, 11, 257. https://doi.org/10.3390/economies11100257

Dokas I, Oikonomou G, Papadamou S, Spyromitros E. Central Bank Credibility’s Effect on Stock Exchange Returns’ Volatility: Evidence from OECD Countries. Economies. 2023; 11(10):257. https://doi.org/10.3390/economies11100257

Chicago/Turabian StyleDokas, Ioannis, Georgios Oikonomou, Stephanos Papadamou, and Eleftherios Spyromitros. 2023. "Central Bank Credibility’s Effect on Stock Exchange Returns’ Volatility: Evidence from OECD Countries" Economies 11, no. 10: 257. https://doi.org/10.3390/economies11100257