The Crude Oil International Trade Competition Networks: Evolution Trends and Estimating Potential Competition Links

Abstract

:1. Introduction

2. Materials and Methods

2.1. Model of Crude Oil Trade Competition Network

2.2. Link Prediction

2.2.1. Calculate the Stability of a Complex Network of Crude Oil Competition Networks

2.2.2. Main Algorithm of the Link Prediction Model

- (1)

- CN algorithm

- (2)

- AA algorithm

- (3)

- RA algorithm

- (4)

- PA algorithm

2.2.3. Division of Test Set and Training Set

2.2.4. Evaluating the Merits of the Model

2.3. Data

3. Evolution of Crude Oil Trade Status and Competition Pattern

3.1. Status of Crude Oil Trade

3.2. The Present Situation and Evolution of Competition Network Pattern

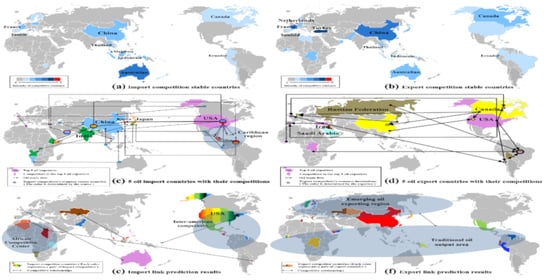

3.2.1. Import Competition Network

3.2.2. Export Competition Network

4. Link Prediction of Crude Oil Trade Competition Relationship

4.1. Test of Link Prediction

4.1.1. Premise Test and Algorithm Selection

4.1.2. Feasibility Test and Effectiveness Test

4.2. Analysis of New Competitive Relationships in International Crude Oil from 2000 to 2019

4.2.1. Asia–Pacific Has Become the Core of Crude Oil Competition, with a More Pronounced Intermediary Role for Europe

4.2.2. Cross-Continental Import Competition Has Emerged among Major Importers; Non-OPEC Countries Are More Likely to Generate New Competitions

4.3. Future Evolution Trend Analysis of Global Crude Oil Trade Competition Network

4.3.1. Potential Import Competition Is Concentrated in Latin America and Africa

4.3.2. Traditional Crude Oil Exporters Will Be Challenged by Emerging Crude Oil Exporters

4.3.3. Geopolitical, Economic, and Social Emergencies Have a Significant Impact on Crude Oil Security

5. Conclusions and Recommendations

- (1)

- The crude oil import competition evolution is mainly influenced by economic development. The rise of developing countries’ economies has shifted the core of crude oil import competition from Europe and the USA to the Asia–Pacific region. The import competition will mainly be concentrated in Latin America and Africa. The core of competition for crude oil imports has shifted along with the general world development pattern of “developed regions—sub-developed regions—developing regions”.

- (2)

- The crude oil export competition evolution is heavily influenced by geopolitics. It is particularly sensitive to the crude oil trading activities of the USA. The export competition will take shape between traditional and emerging exporters. The main route of the shift in the core of crude oil export competition is “traditional crude oil exporters—traditional crude oil exporters and emerging crude oil exporters”, which seems to be in line with the general development pattern. The current and future shift in the core of export competition should be more rationally described as “crude oil endowment areas—crude oil endowment areas and crude oil deficit areas”. With the US exporting large volumes of crude oil as the starting point for the shift, more exporters may be subject to similar export shocks in the future. The international crude oil export competition should receive more attention.

- (3)

- In future crude oil trade competition, the USA is likely to show the opposite of its past actions. The USA has seen a reduction in the intensity of import competition and an increase in export competition over the past 20 years, with many new export competitive relationships. However, projections of potential competitive relationships indicate that the USA will have import competition with neighboring countries and that no new export competition will arise.

- (4)

- The Russia–Ukraine war may lead to the withdrawal of the Russian Federation from some crude oil export markets in favor of new crude oil export markets, generating new export competition, which could lead to a series of problems, such as the security of the energy supply for some countries and the difficult economic situation of developed capitalist economies after the crisis.

- (1)

- For crude oil importers, it is vital to ensure the security of the national energy supply. Firstly, it is necessary to improve crude oil utilization rates, promote the diversification of import sources, and reduce the risk of being constrained by other countries; secondly, it is necessary to invest heavily in and research and develop clean energy, promote a cleaner and more diversified energy consumption structure, and foster energy self-sufficiency. Third, we must vigorously pursue policies to liberalize the energy market, lift price controls on some energy sources, and work to create a policy environment that is fully competitive and encourages private investment and technological progress.

- (2)

- For crude oil exporters, it is vital to safeguard national economic and social security. First, they should vigorously develop the midstream and downstream industrial chains of crude oil, increase the added value of crude oil exports, and optimize and upgrade their industrial structure, especially for countries whose fiscal revenue and economic structure are highly dependent on crude oil exports, which will definitely cause domestic economic crisis once they are subject to energy sanctions; second, they should establish good diplomatic relations and promote the continuous expansion and deepening of energy cooperation with crude oil importing countries.

- (3)

- For each crude oil trading country, it is important to advocate for a fair and free multilateral trading system, resist oil hegemony and energy sanctions, and build a benign and healthy international crude oil trading environment. From the Middle East, which has monopolized the oil market in the last century, to the United States, which has become increasingly energy-independent in the 21st century, to the current energy sanctions and crude oil supply crisis triggered by the Russia–Ukraine war, they have all had a huge impact on the global crude oil market. The threat of oil hegemony seems to have been hanging over the crude oil market, seriously hindering the energy autonomy of countries and international energy cooperation, while energy sanctions are not a scientific and reasonable solution means. Countries should resolve international trade disputes in a peaceful and developmental manner, based on the principle of mutual benefit.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- An, H.; Zhong, W.; Chen, Y.; Li, H.; Gao, X. Features and evolution of international crude oil trade relationships: A trading-based network analysis. Energy 2020, 74, 254–259. [Google Scholar] [CrossRef]

- BP Statistical Review of World Energy. 2017. Available online: https://www.bp.com/ (accessed on 4 March 2021).

- Wu, G.; Liu, L.; Wei, Y. Comparison of China’s oil import risk: Results based on portfolio theory and a diversification index approach. Energy Pol. 2009, 37, 3557–3565. [Google Scholar] [CrossRef]

- Du, R.; Wang, Y.; Dong, G.; Tian, L.; Liu, Y.; Wang, M.; Fang, G. A complex network perspective on interrelations and evolution features of international oil trade, 2002–2013. Appl. Energy 2017, 196, 142–151. [Google Scholar] [CrossRef]

- Zhang, Z.; Lan, H.; Xing, W. Global trade pattern of crude oil and petroleum products: Analysis based on complex network. In IOP Conference Series Earth and Environmental Science; IOP Publishing: Bristol, UK, 2018; Volume 153, p. 022033. [Google Scholar]

- Zhang, H.; Ji, Q.; Fan, Y. Competition, transmission and pattern evolution: A network analysis of global oil trade. Energy Pol. 2014, 73, 312–322. [Google Scholar] [CrossRef]

- Mon, Y.; Lim, S.; Kakinaka, M. Multiplex relations between states: Coevolution of trade agreements and political alliances. Sustainability 2019, 11, 3911. [Google Scholar] [CrossRef] [Green Version]

- Kitamura, T.; Managi, S. Driving force and resistance: Network feature in oil trade. Appl. Energy 2017, 208, 361–375. [Google Scholar] [CrossRef]

- Yang, Y.; Poon, J.P.; Liu, Y.; Bagchi-Sen, S. Small and flat worlds: A complex network analysis of international trade in crude oil. Energy 2015, 93, 534–543. [Google Scholar] [CrossRef]

- An, Q.; Wang, L.; Qu, D.; Zhang, H. Dependency network of international oil trade before and after oil price drop. Energy 2018, 165, 1021–1033. [Google Scholar] [CrossRef]

- Shao, Y.; Qiao, H.; Wang, S. What determines China’s crude oil importing trade patterns? Empirical evidences from 55 countries between 1992 and 2015. Energy Pol. 2017, 109, 854–862. [Google Scholar] [CrossRef]

- Zhang, H.; Ji, Q.; Fan, Y. What drives the formation of global oil trade patterns? Energy Econ. 2015, 49, 639–648. [Google Scholar] [CrossRef]

- Li, Y.; Ran, D. Network Structure and Influence Factors of Oil Industry Chain Trade about the Countries along “the Belt and Road”. Econ. Probl. 2021, 9, 11–118. (In Chinese) [Google Scholar]

- Zhang, C.; Fu, J.; Pu, Z. A study of the petroleum trade network of countries along “The Belt and Road Initiative”. J. Clean. Prod. 2019, 222, 593–605. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, H.; Fan, Y. Identification of global oil trade patterns: An empirical research based on complex network theory. Energy Convers. Manag. 2014, 85, 856–865. [Google Scholar] [CrossRef]

- Vivoda, V. Diversification of oil import sources and energy security: A key strategy or an elusive objective? Energy Pol. 2009, 37, 4615–4623. [Google Scholar] [CrossRef]

- Dong, G.; Qing, T.; Du, R.; Wang, C.; Li, R.; Wang, M.; Stanley, H.E. Complex network approach for the structural optimization of global crude oil trade system. J. Clean. Prod. 2020, 251, 119366. [Google Scholar] [CrossRef]

- Hao, X.; An, H.; Qi, H.; Gao, X. Evolution of the exergy flow network embodied in the global fossil energy trade: Based on complex network. Appl. Energy 2016, 162, 1515–1522. [Google Scholar] [CrossRef]

- He, Z.; Yang, Y.; Liu, Y.; Jin, F. Characteristics of evolution of global energy trading network and relationships between major countries. Prog. Geogr. 2019, 38, 1621–1632. (In Chinese) [Google Scholar] [CrossRef]

- Wang, M.; Tian, L.; Du, R. Research on the interaction patterns among the global crude oil import dependency countries: A complex network approach. Appl. Energy 2016, 180, 779–791. [Google Scholar] [CrossRef]

- Jedrzej, G.F.; Manue, P. A New Scramble for African Oil? Historical, Political, and Business Perspectives. Afr. Aff. 2007, 106, 229–251. [Google Scholar]

- Xia, S.; Hao, L.; Tang, W.; Cui, P.; Wu, F. The evolution of competition and cooperation in world crude oil flows from the perspective of complex networks and its enlightenment to China’s oil cooperation. J. Nat. Resour. 2020, 35, 2655–2673. (In Chinese) [Google Scholar] [CrossRef]

- Duenas, M.; Fagiolo, G. Modeling the international-trade network: A gravity approach. J. Econ. Interact. Coord. 2013, 8, 155–178. [Google Scholar] [CrossRef]

- Ravishankar, G.; Stack, M.M. The gravity model and trade efficiency: A stochastic frontier analysis of eastern European countries’ potential trade. World Econ. 2014, 37, 690–704. [Google Scholar] [CrossRef] [Green Version]

- Eita, J.H. Estimating export potential for a small open economy using a gravity model approach: Evidence from Namibia. J. Dev. Areas 2016, 50, 273–288. [Google Scholar] [CrossRef]

- Gómez, H.E. Comparing alternative methods to estimate gravity models of bilateral trade. Empir. Econ. 2013, 44, 1087–1111. [Google Scholar] [CrossRef] [Green Version]

- Vidmer, A.; Zeng, A.; Medo, M.; Zhang, Y. Prediction in complex systems: The case of the international trade network. Phys. A 2015, 436, 188–199. [Google Scholar] [CrossRef] [Green Version]

- Cannistraci, C.V.; Alanis, L.G.; Ravasi, T. Erratum: From link-prediction in brain connectomes and protein interactomes to the local-community-paradigm in complex networks. Sci. Rep. 2013, 3, 1613. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lada, A.A.; Eytan, A. Friends and neighbors on the Web. Soc. Netw. 2003, 25, 211–230. [Google Scholar]

- Guan, Q.; An, H.; Gao, X.; Huang, S.; Li, H. Estimating potential trade links in the international crude oil trade: A link prediction approach. Energy 2016, 102, 406–415. [Google Scholar] [CrossRef]

- Feng, S.; Li, H.; Qi, Y.; Guan, Q.; Wen, S. Who will build new trade relations? Finding potential relations in international liquefied natural gas trade. Energy 2017, 141, 1226–1238. [Google Scholar] [CrossRef]

- Liu, S.; Dong, Z. Who will trade bauxite with whom? Finding potential links through link prediction. Resour. Pol. 2019, 63, 101417. [Google Scholar] [CrossRef]

- Liu, S.; Dong, Z.; Ding, C.; Wang, T.; Zhang, Y. Do you need cobalt ore? Estimating potential trade relations through link prediction. Resour. Pol. 2020, 66, 101632. [Google Scholar] [CrossRef]

- Glick, R.; Rose, A.K. Contagion and trade: Why are currency crises regional? Int. Money Financ. 1999, 18, 603–617. [Google Scholar] [CrossRef]

- Wang, X.; Li, H.; Yao, H.; Chen, Z.; Guan, Q. Network feature and influence factors of global nature graphite trade competition. Resour. Pol. 2019, 60, 153–161. [Google Scholar] [CrossRef]

- Palla, G.; Barabási, A.L.; Vicsek, T. Quantifying social group evolution. Nature 2007, 446, 664–666. [Google Scholar] [CrossRef] [Green Version]

- Lü, L.; Zhou, T. Link prediction in complex networks: A survey. Phys. A 2011, 390, 1150–1170. [Google Scholar] [CrossRef] [Green Version]

- Zhou, T.; Lu, L.; Zhang, Y. Predicting missing links via local information. Eur. Phys. J. B 2009, 71, 623–630. [Google Scholar] [CrossRef] [Green Version]

- Libel, D.; Kleinberg, J. The link-prediction problem for social networks. J. Am. Soc. Inf. Sci. 2003, 58, 1019–1031. [Google Scholar]

- Holme, P.; Kim, B.J.; Yoon, C.N.; Han, S.K. Attack vulnerability of complex networks. Phys. Rev. E 2002, 65, 056109. [Google Scholar] [CrossRef] [Green Version]

- BP Statistical Review of World Energy. 2020. Available online: https://www.bp.com/ (accessed on 5 March 2022).

- Un Comtrade. Available online: https://comtrade.un.org/ (accessed on 24 April 2021).

- Paul, R. The End of Oil: On the Edge of a Perilous New World; Houghton Mifflin Harcourt: Boston, MA, USA, 2005. [Google Scholar]

- Zhang, J.; The, U.S. Hegemony and International Oil Politics. J. SJTU Philos. Soc. Sci. 2006, 14, 26–31. (In Chinese) [Google Scholar]

- Hao, H.; Xing, W.; Song, N.; Li, Z. A preliminary study for the impact of India’s future oil demand to China: Based on the cooperation between China and India. China Min. Mag. 2017, 26, 7–12. (In Chinese) [Google Scholar]

- Zhong, W.; An, H.; Shen, L.; Dai, T.; Fang, W.; Gao, X. Global pattern of the international fossil fuel trade: The evolution of communities. Energy 2017, 123, 260–270. [Google Scholar] [CrossRef]

- Rachel, B. The United States in the Middle East: Bound by Growing Energy Demand. Middle East Pol. 2014, 21, 34–39. [Google Scholar]

- Novikau, A. What does energy security mean for energy-exporting countries? A closer look at the Russian energy security strategy. J. Energy Nat. Resour. Law 2021, 39, 105–123. [Google Scholar] [CrossRef]

- Albuquerque, F.P.S.; Pacheco, C.C.; Leite, A.C.C.; Fuccille, A. The instrumentalization of the energy sector under Putin-Medvedev (2000–2018) and the Russian return to the international geopolitical scenario. Rev. Relac. Int. Estrateg. Segur. 2021, 16, 125–152. [Google Scholar] [CrossRef]

- Christy, S. Increasing Russia crude oil exports changing worldwide trade patterns. Oil Gas J. 2004, 102, 54–66. [Google Scholar]

- Lü, L.; Pan, L.; Zhou, T.; Zhang, Y.; Stanley, H. Toward link predictability of complex networks. Proc. Natl. Acad. Sci. USA 2015, 112, 2325–2330. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- George, M. Understanding crude oil import demand behaviour in Africa: The Ghana case. J. Afr. Trade 2017, 4, 75–87. [Google Scholar]

- Kapustina, L.M.; Kornilova, K.V.; Vozmilov, I.D. Consequences of introducing and removing economic sanctions against Iran for global economy. Int. Relat. Curr. Issues World Econ. Politics 2015, 12, 394–403. [Google Scholar]

- Tuzova, Y.; Qayum, F. Global oil glut and sanctions: The impact on Putin’s Russia. Energy Pol. 2016, 90, 140–151. [Google Scholar] [CrossRef]

- Gurvich, E.; Prilepskiy, I. The impact of financial sanctions on the Russian economy. Russ. J. Econ. 2015, 1, 359–385. [Google Scholar] [CrossRef]

| Market Share | Competition Intensity | Trade Performance | Major Exporter |

|---|---|---|---|

|  | Enter markets with large crude flows | USA, Iraq, Canada, Russian Federation |

|  | Exit most of the markets with high flow Remaining markets with small flows | Venezuela |

|  | Exit part of the crude oil market Remaining markets with high flows | Saudi Arabia |

|  | Enter markets with low crude flows | None |

| Indicators | Import (%) | Export (%) | |

|---|---|---|---|

| Immediacy | excellent | 87.50 | 91.63 |

| general | 10.80 | 8.37 | |

| poor | 1.70 | 0 | |

| Persistence | excellent | 30.00 | 40.25 |

| general | 29.62 | 35.68 | |

| poor | 40.38 | 24.07 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, X.; Zhang, H.; Zheng, S.; Xing, W.; Zhao, P.; Li, H. The Crude Oil International Trade Competition Networks: Evolution Trends and Estimating Potential Competition Links. Energies 2022, 15, 2395. https://doi.org/10.3390/en15072395

Zhou X, Zhang H, Zheng S, Xing W, Zhao P, Li H. The Crude Oil International Trade Competition Networks: Evolution Trends and Estimating Potential Competition Links. Energies. 2022; 15(7):2395. https://doi.org/10.3390/en15072395

Chicago/Turabian StyleZhou, Xuanru, Hua Zhang, Shuxian Zheng, Wanli Xing, Pei Zhao, and Haiying Li. 2022. "The Crude Oil International Trade Competition Networks: Evolution Trends and Estimating Potential Competition Links" Energies 15, no. 7: 2395. https://doi.org/10.3390/en15072395