Regional Energy Transition: An Analytical Approach Applied to the Slovakian Coal Region †

Abstract

:1. Introduction

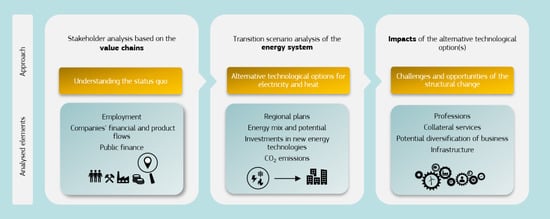

2. Materials and Methods

2.1. Value Chain Analysis

2.2. Energy System Analysis

2.3. Integrated Approach

2.4. Case Study Description

3. Results

3.1. Coal Value Chain

3.2. Transition Scenario of the Energy Sector

3.3. Impacts on Business Activities

3.4. Impacts on Employment

3.5. Impacts on Public Revenues

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Company | Type of Activity | Value Chain Segment |

|---|---|---|

| Contitech vibration control Slovakia s.r.o. | Manufacture of other rubber products | Input |

| Fortischem a.s. | Manufacture of plastics in primary forms | Input |

| Saargummi slovakia s.r.o. | Manufacture of other rubber products | Input |

| Slovaktual s.r.o. | Manufacture of builders’ ware of plastic | Input |

| Vegum a.s. | Manufacture of other rubber products | Input |

| Bana Cary a.s. | Coal mining | Mining |

| Bana Dolina a.s. | Coal mining | Mining |

| BIC Prievidza s.r.o. | Other education | Mining |

| HBP security s.r.o. | Private security activities | Mining |

| Hornonitrianske Bane Prievidza a.s | Coal mining | Mining |

| Ekosystemy s.r.o. | Machining | Transport |

| Evots s.r.o. * | Freight transport, excavations, demolitions and waste management | Transport |

| Hornonitrianske bane zamestnanecka a.s. ** | Manufacture of machinery for mining quarrying and construction | Transport |

| Hornonitrianske bane a.s. *** | Manufacture of machinery for mining quarrying and construction | Transport |

| Agro GTV s.r.o. | Greenhouse agriculture | End Market |

| Agro rybia farma s.r.o. | Freshwater aquaculture | End Market |

| Handlovska energetika s.r.o. | Steam and air conditioning supply | End Market |

| Paliva a stavebniny a.s. | Other retail sale in non-specialised stores | End Market |

| Priamos a.s. Prievidza | Agents involved in the sale of a variety of goods | End Market |

| Prievidzske tepelne hospodarstvo a.s. | Steam and air conditioning supply | End Market |

References

- European Commission. COM (2016) 860 Final. 2016. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM:2016:0860:FIN (accessed on 14 December 2020).

- United Nations Framework Convention on Climate Change. Conference of the Parties: Report of the Conference of the Parties on Its Twenty-First Session, Held in Paris from 30 November to 13 December 2015; Addendum Part two: Action taken by the Conference of the Parties at Its Twenty-First Session. FCCC/CP/2015/10/Add.1: Paris Agreement. Paris, France. 29 January 2016. Available online: https://unfccc.int/resource/docs/2015/cop21/eng/10.pdf (accessed on 14 December 2020).

- European Commission. No Region Left Behind: Launch of the Platform for Coal Regions in Transition. 11 December 2017. Available online: https://ec.europa.eu/commission/presscorner/detail/en/IP_17_5165 (accessed on 10 April 2020).

- European Commission. COM (2020) 22 Final. 2019. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52020PC0022 (accessed on 14 December 2020).

- European Commission. COM (2019) 640 Final. 2019. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM:2019:640:FIN (accessed on 14 December 2020).

- Kona, A.; Bertoldi, P.; Kılkış, Ş. Covenant of Mayors: Local Energy Generation, Methodology, Policies and Good Practice Examples. Energies 2019, 12, 985. [Google Scholar] [CrossRef] [Green Version]

- Stognief, N.; Walk, P.; Schöttker, O.; Oei, P.-Y. Economic Resilience of German Lignite Regions in Transition. Sustainability 2019, 11, 5991. [Google Scholar] [CrossRef] [Green Version]

- Li, F.G.; Pye, S.; Strachan, N. Regional winners and losers in future UK energy system transitions. Energy Strat. Rev. 2016, 11–31. [Google Scholar] [CrossRef]

- Green, F.; Gambhir, A. Transitional assistance policies for just, equitable and smooth low-carbon transitions: Who, what and how? Clim. Policy 2019, 20, 902–921. [Google Scholar] [CrossRef]

- Janoška, J.; Beer, G. Hnedouholná rovnica má veľa neznámych. 2014. Available online: https://www.trend.sk/biznis/hnedouholna-rovnica-ma-vela-neznamych (accessed on 14 December 2020). (In Slovak).

- European Commission. State Aid: Commission Approves Provisional Measure Ensuring Security of Local Electricity Supply in Slovakia. 10 May 2019. Available online: https://ec.europa.eu/commission/presscorner/detail/en/IP_19_2469 (accessed on 14 December 2020).

- Hornonitrianske bane Prievidza. Výročná správa za rok. 2017. Available online: http://www.registeruz.sk/cruz-public/domain/financialreport/attachment/6505953 (accessed on 10 April 2020). (In Slovak).

- Slovak Ministry of Economy. Integrated National Energy and Climate Plan for 2021 to 2030. 2019. Available online: https://ec.europa.eu/energy/topics/energy-strategy/national-energy-climate-plans_en (accessed on 14 December 2020).

- Gómez-Calvet, R.; Martínez-Duart, J.M. On the Assessment of the 2030 Power Sector Transition in Spain. Energies 2019, 12, 1369. [Google Scholar] [CrossRef] [Green Version]

- Fermeglia, M.; Bevilacqua, P.; Cafaro, C.; Ceci, P.; Fardelli, A. Legal Pathways to Coal Phase-Out in Italy in 2025. Energies 2020, 13, 5605. [Google Scholar] [CrossRef]

- Oei, P.-Y.; Brauers, H.; Herpich, P. Lessons from Germany’s hard coal mining phase-out: Policies and transition from 1950 to 2018. Clim. Policy 2019, 20, 963–979. [Google Scholar] [CrossRef] [Green Version]

- Cherp, A.; Jewell, J. The concept of energy security: Beyond the four As. Energy Policy 2014, 75, 415–421. [Google Scholar] [CrossRef] [Green Version]

- Jakstas, T. What does energy security mean? Energy Transform. Towards Sustain. 2020, 99–112. [Google Scholar] [CrossRef]

- Sovacool, B.K.; A Brown, M. Competing Dimensions of Energy Security: An International Perspective. Annu. Rev. Environ. Resour. 2010, 35, 77–108. [Google Scholar] [CrossRef] [Green Version]

- Fulli, G.; Masera, M.; Covrig, C.-F.; Profumo, F.; Bompard, E.; Huang, T. The EU Electricity Security Decision-Analytic Framework: Status and Perspective Developments. Energies 2017, 10, 425. [Google Scholar] [CrossRef] [Green Version]

- Council Directive (EU) No 2008/114 of 8 December 2008 on the Identification and Designation of European Critical Infrastructures and the Assessment of the Need to Improve Their Protection OJ L 345. 2008; pp. 75–82. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv%3AOJ.L_.2008.345.01.0075.01.ENG (accessed on 14 December 2020).

- Gerbelová, H.; Spisto, A.; Giaccaria, S. Regional energy transition: An analytical approach applied to the Slovakian coal region. In Proceedings of the 15th SDEWES Conference, Cologne, Germany, 1–5 September 2020. [Google Scholar]

- Jenniches, S. Assessing the regional economic impacts of renewable energy sources—A literature review. Renew. Sustain. Energy Rev. 2018, 93, 35–51. [Google Scholar] [CrossRef]

- White, D.J.; Hubacek, K.; Feng, K.; Sun, L.; Meng, B. The Water-Energy-Food Nexus in East Asia: A tele-connected value chain analysis using inter-regional input-output analysis. Appl. Energy 2018, 210, 550–567. [Google Scholar] [CrossRef] [Green Version]

- Llera, E.; Scarpellini, S.; Aranda, A.; Zabalza, I. Forecasting job creation from renewable energy deployment through a value-chain approach. Renew. Sustain. Energy Rev. 2013, 21, 262–271. [Google Scholar] [CrossRef]

- Lund, P. Effects of energy policies on industry expansion in renewable energy. Renew. Energy 2009, 34, 53–64. [Google Scholar] [CrossRef]

- Energy Technology Systems Analysis Program. Available online: https://iea-etsap.org/ (accessed on 10 April 2020).

- Simoes, S.; Nijs, W.; Ruiz, P.; Sgobbi, A.; Radu, D.; Bolat, P.; Thiel, C.; Peteves, E. The JRC-EU-TIMES Model—Assessing the Long-Term Role of the SET Plan Energy Technologies; Publications Office of the European Union: Luxembourg, 2013. [Google Scholar] [CrossRef]

- Decarolis, J.F.; Daly, H.; Dodds, P.; Keppo, I.; Li, F.; McDowall, W.; Pye, S.; Strachan, N.; Trutnevyte, E.; Usher, W.; et al. Formalizing best practice for energy system optimization modelling. Appl. Energy 2017, 194, 184–198. [Google Scholar] [CrossRef] [Green Version]

- Simoes, S.G.; Dias, L.P.; Gouveia, J.; Seixas, J.; De Miglio, R.; Chiodi, A.; Gargiulo, M.; Long, G.; Giannakidis, G. INSMART—Insights on integrated modelling of EU cities energy system transition. Energy Strat. Rev. 2018, 20, 150–155. [Google Scholar] [CrossRef]

- Nijs, W.; Ruiz, P.; Hidalgo, I.; Stiff, G. Baseline Scenario of the Total Energy System up to 2050: Insights from JRC-EU-TIMES for Lead-Users. 2017. Available online: https://roadmap.eu/wp-content/uploads/2018/11/HRE4_D5.4.pdf (accessed on 10 April 2020).

- Purvins, A.; Sereno, L.; Ardelean, M.; Covrig, C.-F.; Efthimiadis, T.; Minnebo, P. Submarine power cable between Europe and North America: A techno-economic analysis. J. Clean. Prod. 2018, 186, 131–145. [Google Scholar] [CrossRef]

- PLEXOS. Available online: https://energyexemplar.com/ (accessed on 10 April 2020).

- Deane, J.; Drayton, G.R.; Gallachóir, B.Ó. The impact of sub-hourly modelling in power systems with significant levels of renewable generation. Appl. Energy 2014, 113, 152–158. [Google Scholar] [CrossRef]

- Purvins, A.; Gerbelova, H.; Sereno, L.; Minnebo, P. Social welfare impact from enhanced Trans-Asian electricity trade. Energy 2021, 215, 119106. [Google Scholar] [CrossRef]

- ENTSO-E. Maps & Data. Available online: https://tyndp.entsoe.eu/maps-data (accessed on 10 April 2020).

- Office of Self-Governing Trencin Region. Analýza sociálno-ekonomickej situácie Trenčianskeho samosprávneho kraja a návrhy na zlepšenie v sociálnej a hospodárnej oblasti, UV-12667/2015. In Proceedings of the Rokovanie vlády Slovenkej Republiky, Bratislava, Slovakia, 25 March 2015. (In Slovak). [Google Scholar]

- General Employment Service of the Slovak Republic. Rokovanie expertného tímu Európskej komisie so zástupcami verejnej správy a súkromného sektora na Úrade vlády SR v súvislosti s poskytnutím technickej pomoci vo veci problematiky "prechodu uhlia" v Hornonitrianskych baniach. In Proceedings of the Internal Communication, Bratislava, Slovakia, 6 July 2017. (In Slovak). [Google Scholar]

- Office of Employment, Social Affairs and Family Prievidza. Analýza a prognóza o vývoji trhu práce v územnom obvode ÚPSVR Prievidza. 2016. Available online: https://www.upsvr.gov.sk/pd/urad-psvr/aktivity-uradu/regionalne-analyzy-a-spravy.html?page_id=532994 (accessed on 14 December 2020). (In Slovak)

- ORBIS. Available online: https://www.bvdinfo.com/nl-nl/ (accessed on 7 June 2018).

- European Parliament and Council. Regulation (EC) No 1893/2006 of the European Parliament and of the Council of 20 December 2006. Establishing the Statistical Classification of Economic Activities NACE Revision 2 and amending Council Regulation (EEC) No 3037/90 as Well as Certain EC Regulations on Specific Statistical Domains. Available online: https://eur-lex.europa.eu/legal-content/en/ALL/?uri=CELEX%3A32006R1893 (accessed on 14 December 2020).

- European Environmental Agency. Costs of air Pollution from European Industrial Facilities 2008–2012—An Updated Assessment. EEA Technical Report No 20/2014. 2014. Available online: https://www.eea.europa.eu/publications/costs-of-air-pollution-2008-2012 (accessed on 14 December 2020).

- European Parliament and Council. Directive 2010/75/EU of the European Parliament and of the Council of 24 November 2010 on Industrial Emissions (Integrated Pollution Prevention and Control). Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32010L0075 (accessed on 14 December 2020).

- Ministry of Economy of the Slovak Republic. Energy Policy Outlook of the Slovak Republic. Available online: https://www.mhsr.sk/energetika/energeticka-politika/energeticka-politika-a-strategia-energetickej-bezpecnosti (accessed on 10 April 2020).

- Slovenske elektrarne. Annual Report 2016. Available online: https://www.seas.sk/data/publishing/361/file/se2016-annual-report.pdf (accessed on 10 April 2020).

- Vattenfall Press Release. Available online: https://corporate.vattenfall.com/press-and-media/press-releases/2016/vattenfall-phases-out-coal-in-berlin-power-plant/ (accessed on 10 April 2020).

- Ontario Power Generation. From Coal to Biomass: Generating a Sustainable Future. Available online: https://www.opg.com/about/environment/Documents/OPGBiomassConversion.pdf (accessed on 10 April 2020).

- Joint Research Center. Energy Technology Reference Indicator: Projections for 2010–2050. 2014. Available online: http://publications.jrc.ec.europa.eu/repository/bitstream/JRC92496/ldna26950enn.pdf (accessed on 10 April 2020).

- Ministry of Economy of the Slovak Republic. Návrh programov vytvárania nových pracovných miest v regióne Horná Nitra v spolupráci s a. s. Hornonitrianske bane Prievidza, UV-16674/2013. In Proceedings of the Rokovanie vlády Slovenskej Republiky, Bratislava, Slovakia, 27 June 2013. (In Slovak). [Google Scholar]

- Office of Self-Governing Trencin Region. Presentation of the Upper Nitra Region. In Proceedings of the Internal Communication, Trenčín, Slovakia, 24 October 2017. [Google Scholar]

- European Commission. EU Energy Statistical Pocketbook and Country Datasheets. 2019. Available online: https://ec.europa.eu/energy/data-analysis/energy-statistical-pocketbook_en (accessed on 10 April 2020).

- Bartko, L.; Badida, M.; Horbaj, P.; Konkoly, J. Využitie geotermálnej energie v podmienkach Slovenska. Transf. Inovácií 2014, 29, 304–311. [Google Scholar]

- Dumas, P.; Antics, M.; Ungemach, P. Report on Geothermal Drilling. Available online: http://www.geoelec.eu/wp-content/uploads/2011/09/D-3.3-GEOELEC-report-on-drilling.pdf (accessed on 10 April 2020).

- GA Drilling. Available online: https://www.gadrilling.com/ (accessed on 10 April 2020).

- European Geothermal Energy Council. Geothermal Energy: A Pillar for Coal Regions in Transition. Available online: https://www.egec.org/media-publications/geothermal-pillar-coal-regions-transition/ (accessed on 10 April 2020).

- General Employer Service of the Slovak Republic. Podrobné zmapovanie situácie na pracovnom trhu v daných regiónoch a okolitých okresoch zo susedných regiónov, kde sa nachádzajú inštitúcie verejných služieb zamestnanosti. In Proceedings of the Internal Communication, Bratislava, Slovakia, 6 July 2017. (In Slovak). [Google Scholar]

- PwC. Akčný plán transformácie uhoľného regiónu Horná Nitra. Available online: http://www.prievidza.sk/akcnyplan/ (accessed on 10 April 2020).

- Geothermal Energy Association. Green Jobs through Geothermal Energy. Available online: https://archive.geothermal.org/Policy_Committee/Documents/Green_Jobs_Through_Geothermal_Energy.pdf (accessed on 10 November 2020).

- European Union. Income Taxes Broad—Slovakia. Available online: https://europa.eu/youreurope/citizens/work/taxes/income-taxes-abroad/slovakia/index_en.htm (accessed on 10 April 2020).

- Osorio-Aravena, J.C.; Frolova, M.; Terrados-Cepeda, J.; Muñoz-Cerón, E. Spatial Energy Planning: A Review. Energies 2020, 13, 5379. [Google Scholar] [CrossRef]

| Territory | Year | |||||||

|---|---|---|---|---|---|---|---|---|

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

| % | ||||||||

| Slovak Republic | 12.46 | 13.59 | 14.44 | 13.5 | 12.29 | 10.63 | 8.76 | 7.35 |

| Trenčín region | 9.51 | 9.95 | 10.89 | 10.74 | 9.56 | 7.71 | 5.85 | 4.28 |

| Prievidza district | 12.05 | 12.88 | 12.97 | 13.9 | 12.47 | 10.37 | 8.13 | 6.11 |

| Partizánske district | 12.27 | 12.85 | 14.09 | 13.34 | 11.39 | 9.40 | 6.54 | 4.49 |

| Reference | Conversion to Natural Gas | Conversion to Biomass | New Geothermal Plant | |

|---|---|---|---|---|

| Power demand (GWh) | 32,292 | 32,301 | 32,300 | 32,298 |

| Power imports (GWh) | 2432 | 2326 | 2326 | 2236 |

| Power exports (GWh) | 13,266 | 13,365 | 13,346 | 13,938 |

| Power generation (GWh) | 43,126 | 43,341 | 43,320 | 44,000 |

| Wind | 578 | 578 | 578 | 578 |

| Solar | 801 | 801 | 801 | 801 |

| Hydro | 7711 | 7723 | 7723 | 7707 |

| Hydro pump | 251 | 250 | 250 | 244 |

| Natural gas | 2994 | 4127 | 3036 | 2961 |

| Hard coal | 696 | 695 | 695 | 696 |

| Brown coal | 928 | 0 | 0 | 0 |

| Oil | 4 | 4 | 4 | 5 |

| Geothermal | 0 | 0 | 0 | 1847 |

| Biomass | 0 | 0 | 1070 | 0 |

| Uranium | 29,162 | 29,162 | 29,162 | 29,162 |

| Reduction in CO2 emissions (thousand tonnes) | n.a. | 332.7 | 649.6 | 670.9 |

| Electricity price (euros per MWh) | 70.14 | 70.09 | 70.09 | 70.06 |

| Conversion to Natural Gas | Conversion to Biomass | New Geothermal |

|---|---|---|

|

|

|

|

|

|

| Plans | Job Creation |

|---|---|

| Within the HBP group: | |

| Innovative welding of machines | +800 |

| Service for railway wagons | +160 |

| Gas storage | +50 |

| Greenhouse gas and fish breeding | +100 |

| French fries and vegetable processing | +200 |

| Logistic biomass center | +250 |

| Manufacturing of plastics | +50 |

| Total | 1610 |

| Others (existing companies and new investors): | |

| Chemical industry | +90 |

| Manufacturing of car compounds | +2000 |

| Retrofit of the power plant | +280 |

| R&D deep geothermal | +40 |

| R&D battery storage and electro mobility | +250 |

| Manufacturing compounds for RES | +200 |

| Industrial zone | +1700 |

| Tourism and spa | +1600 |

| Bottle filling station | +20 |

| Total | 6180 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gerbelová, H.; Spisto, A.; Giaccaria, S. Regional Energy Transition: An Analytical Approach Applied to the Slovakian Coal Region. Energies 2021, 14, 110. https://doi.org/10.3390/en14010110

Gerbelová H, Spisto A, Giaccaria S. Regional Energy Transition: An Analytical Approach Applied to the Slovakian Coal Region. Energies. 2021; 14(1):110. https://doi.org/10.3390/en14010110

Chicago/Turabian StyleGerbelová, Hana, Amanda Spisto, and Sergio Giaccaria. 2021. "Regional Energy Transition: An Analytical Approach Applied to the Slovakian Coal Region" Energies 14, no. 1: 110. https://doi.org/10.3390/en14010110