Coproduction of Acrylic Acid with a Biodiesel Plant Using CO2 as Reaction Medium: Process Modeling and Production Cost Estimation

Abstract

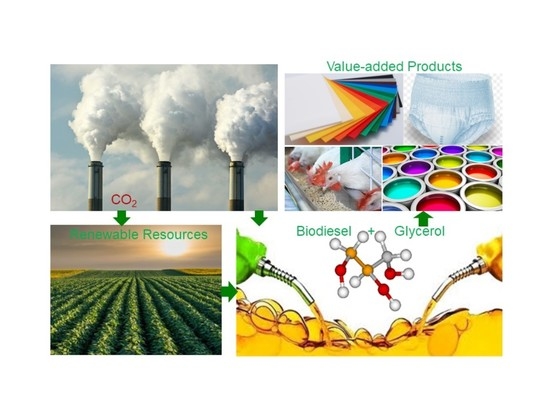

:1. Introduction

2. Materials and Methods

2.1. Main Steps of Converting Glycerol to Acrylic Acid

2.2. Process Modeling

2.3. Estimation of Production Costs

- Material-related information. This includes the different unit costs (e.g., purchase price, selling price, waste treatment/disposal cost) of pure components, and stock mixtures.

- Stream-related information. This includes the classification of input and output streams into different categories (e.g., raw materials, revenues, wastes, etc.).

- Operation-related information. This includes the costs of labor and utilities (heat transfer agents and power) for each operation.

- Equipment-related information. This includes the capital and operating costs for each equipment (e.g., purchase cost, installation, maintenance, consumables, etc.).

3. Results and Discussion

3.1. Overview of Base Model

3.2. Factor Effects on Base Model

3.3. Effect of CO2 Input on Base Model

3.4. Effect of No CO2/Energy Recycling

3.5. Effect of Threefold Scale-Up

4. Conclusions and Future Perspective

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Carus, M.; Dammer, L. The Circular Bioeconomy—Concepts, Opportunities, and Limitations. Ind. Biotechnol. 2018, 14, 83–91. [Google Scholar] [CrossRef]

- Ye, X.P.; Ren, S. 3–Value-Added Chemicals from Glycerol. In Soy-Based Chemicals and Materials; Brentin, R., Ed.; American Chemical Society: Washington, DC, USA, 2014; pp. 43–80. [Google Scholar]

- Johnson, D.T.; Taconi, K.A. The glycerin glut: Options for the value-added conversion of crude glycerol resulting from biodiesel production. Environ. Prog. 2007, 26, 338–348. [Google Scholar] [CrossRef]

- Katryniok, B.; Paul, S.; Dumeignil, F. Recent Developments in the Field of Catalytic Dehydration of Glycerol to Acrolein. ACS Catal. 2013, 3, 1819–1834. [Google Scholar] [CrossRef]

- Liu, L.; Ye, X.P.; Bozell, J.J. A Comparative Review of Petroleum-Based and Bio-Based Acrolein Production. ChemSusChem 2012, 5, 1162–1180. [Google Scholar] [CrossRef] [PubMed]

- Cheng, L.; Liu, L.; Ye, X.P. Acrolein Production from Crude Glycerol in Sub- and Super-Critical Water. J. Am. Oil Chem. Soc. 2013, 90, 601–610. [Google Scholar] [CrossRef]

- Ott, L.; Bicker, M.; Vogel, H. Catalytic dehydration of glycerol in sub- and supercritical water: A new chemical process for acrolein production. Green Chem. 2006, 8, 214–220. [Google Scholar] [CrossRef]

- Akizuki, M.; Oshima, Y. Kinetics of Glycerol Dehydration with WO3/TiO2 in Supercritical Water. Ind. Eng. Chem. Res. 2012, 51, 12253–12257. [Google Scholar] [CrossRef]

- Cheng, L.; Ye, X.P. A DRIFTS Study of Catalyzed Dehydration of Alcohols by Alumina-supported Heteropoly Acid. Catal. Lett. 2009, 130, 100–107. [Google Scholar] [CrossRef]

- Liu, L.; Ye, X.P.; Katryniok, B.; Capron, M.; Paul, S.; Dumeignil, F. Extending Catalyst Life in Glycerol-to-Acrolein Conversion Using Non-thermal Plasma. Front. Chem. 2019, 7, 108. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Katryniok, B.; Paul, S.; Belliere-Baca, V.; Rey, P.; Dumeignil, F. Glycerol dehydration to acrolein in the context of new uses of glycerol. Green Chem. 2010, 12, 2079–2098. [Google Scholar] [CrossRef]

- Tsukuda, E.; Sato, S.; Takahashi, R.; Sodesawa, T. Production of acrolein from glycerol over silica-supported heteropoly acids. Catal. Commun. 2007, 8, 1349–1353. [Google Scholar] [CrossRef]

- Chai, S.-H.; Wang, H.-P.; Liang, Y.; Xu, B.-Q. Sustainable production of acrolein: Gas-phase dehydration of glycerol over 12-tungstophosphoric acid supported on ZrO2 and SiO2. Green Chem. 2008, 10, 1087–1093. [Google Scholar] [CrossRef]

- Katryniok, B.; Paul, S.; Capron, M.; Dumeignil, F. Towards the sustainable production of acrolein by glycerol Dehydration. ChemSusChem 2009, 2, 719–730. [Google Scholar] [CrossRef] [PubMed]

- Zou, B.; Ren, S.; Ye, X.P. Glycerol Dehydration to Acrolein Catalyzed by ZSM-5 Zeolite in Supercritical Carbon Dioxide Medium. ChemSusChem 2016, 9, 3268–3271. [Google Scholar] [CrossRef] [PubMed]

- Ye, X.P. Glycerol Dehydration Methods and Products Thereof. US Patent US9796648B2, 24 October 2017. [Google Scholar]

- Haas, M.J.; McAloon, A.; Yee, W.; Foglia, T. A process model to estimate biodiesel production costs. Bioresour. Technol. 2006, 97, 671–678. [Google Scholar] [CrossRef] [PubMed]

- Ikushima, Y.; Saito, N.; Arai, M. Supercritical carbon dioxide as reaction medium: Examination of its solvent effects in the near-critical region. J. Phys. Chem. 1992, 96, 2293–2297. [Google Scholar] [CrossRef]

- Fujita, S.; Tanaka, T.; Akiyama, Y.; Asai, K.; Hao, J.; Zhao, F.; Arai, M. Impact of Carbon Dioxide Pressurization on Liquid Phase Organic Reactions: A Case Study on Heck and Diels–Alder Reactions. Adv. Synth. Catal. 2008, 350, 1615–1625. [Google Scholar] [CrossRef]

- Grand View Research Inc. Report, Acrylic Acid Market Analysis. 2016. Available online: https://www.grandviewresearch.com/industry-analysis/acrylic-acid-market (accessed on 18 August 2020).

- Yadav, D.G.; Sharma, R.V.; Katole, S.O. Selective Dehydration of Glycerol to Acrolein: Development of Efficient and Robust Solid Acid Catalyst MUICaT-5. Ind. Eng. Chem. Res. 2013, 52, 10133–10144. [Google Scholar] [CrossRef]

- Varone, A. The CO2 Economy–The Transformation of Carbon Dioxide from a Liability to an Asset. Institute for Advanced Sustainability Studies. 2016. Available online: https://www.iass-potsdam.de/en/blog/2016/07/co2-economy-transformation-carbon-dioxide-liability-asset (accessed on 12 July 2020).

- Attis Biofuels. Report, Carbon Dioxide. 2020. Available online: https://www.attisbiofuels.com/by-products/carbon-dioxide (accessed on 12 July 2020).

| Key scale data |

| Annual consumption of 33,635 metric tons degummed soybean oil as feedstock |

| Modeled as continuous process of vegetable oil transesterification, biodiesel refining, and ester and glycerol recovery |

| Annual revenues are from 38 million liters (10 million gallons) biodiesel plus 3810 metric tons crude glycerol (80 wt.%) |

| Key modeling analysis results (based on 2003 price) |

| Capital costs $11.3 million to build the biodiesel facility |

| Annual operating cost $21 million |

| Soybean oil feedstock accounts for 88% of total production cost, which is linearly dependent on feedstock cost |

| Unit biodiesel production cost = $0.53/L ($2.00/gal) vs. selling price of biodiesel = $0.61/L ($2.32/gal) |

| Crude glycerol revenue = $0.33/kg, which reduces production costs by ~6%. |

| $0.022/kg ($0.01/lb) reduction in glycerol value results in $0.0022/L ($0.0085/gal) increase of production cost |

| Summary | |

| Total capital investment | $7,468,000 |

| Annual operating cost | $3,987,000 |

| Main product revenue | $3,882,797 |

| Co-products revenue | $573,117 |

| Total revenue | $4,455,914 |

| Unit production cost | $2.33/kg acrylic acid |

| Unit production revenue | $2.60/kg acrylic acid |

| Gross profit margin | 10.53% |

| Capital investment itimized | |

| Equipment purchase cost | $2,782,000 |

| Direct fixed capital | $6,866,000 |

| Working capital | $258,605 |

| Startup & validation | $343,318 |

| Material throughputs | |

| Annual consumption of glycerol (80%) | 3,810,000 kg |

| Annual production of acrylic acid | 1,712,437 kg |

| Annual production of acetic acid | 351,194 kg |

| Annual production of acetol | 314,778 kg |

| Major operating costs and revenue values | |

| Glycerol (feedstock) | $0.33/kg |

| Acrylic acid (main revenue) | $2.27/kg |

| Acetic acid (revenue) | $0.74/kg |

| Acetol (revenue) | $1.00/kg |

| Total labor cost | $462,000/year |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ye, X.P.; Ren, S. Coproduction of Acrylic Acid with a Biodiesel Plant Using CO2 as Reaction Medium: Process Modeling and Production Cost Estimation. Energies 2020, 13, 6089. https://doi.org/10.3390/en13226089

Ye XP, Ren S. Coproduction of Acrylic Acid with a Biodiesel Plant Using CO2 as Reaction Medium: Process Modeling and Production Cost Estimation. Energies. 2020; 13(22):6089. https://doi.org/10.3390/en13226089

Chicago/Turabian StyleYe, X. Philip, and Shoujie Ren. 2020. "Coproduction of Acrylic Acid with a Biodiesel Plant Using CO2 as Reaction Medium: Process Modeling and Production Cost Estimation" Energies 13, no. 22: 6089. https://doi.org/10.3390/en13226089