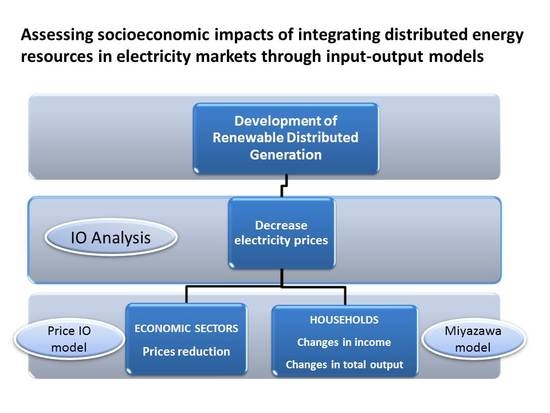

Assessing Socioeconomic Impacts of Integrating Distributed Energy Resources in Electricity Markets through Input-Output Models

Abstract

:1. Introduction

2. Methodology

2.1. Price Input-Output Model

x1 = (I − A)−1y1

2.2. Input-Output Model with Endogenous Consumption

3. Disaggregation of the Spanish Electricity Sector

3.1. Disaggregation of Intermediate Demand

3.2. Disaggregation of Final Demand

3.3. Disaggregation of Primary Inputs and Total Production

4. Results

4.1. Scenarios

4.2. Exogenizing Electrical Energy from a Wind Source and Photovoltaic Source

4.3. The Impact of Electricity Price Reduction on Households

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Zhou, K.; Yang, S. Understanding household energy consumption behavior: The contribution of energy big data analytics. Renew. Sustain. Energy Rev. 2016, 56, 810–819. [Google Scholar] [CrossRef]

- Trujillo-Baute, E.; del Río, P.; Mir-Artigues, P. Analysing the impact of renewable energy regulation on retail electricity prices. Energy Policy 2018, 114, 153–164. [Google Scholar] [CrossRef]

- REE. Las energías renovables en el sistema eléctrico español 2018; Red Eléctrica de España: Madrid, Spain, 2019. [Google Scholar]

- Akadiri, S.S.; Alola, A.A.; Akadiri, A.C.; Alola, U.V. Renewable energy consumption in EU-28 countries: Policy toward pollution mitigation and economic sustainability. Energy Policy 2019, 132, 803–810. [Google Scholar] [CrossRef]

- Soares, N.; Martins, A.G.; Carvalho, A.L.; Caldeira, C.; Du, C.; Castanheira, É.; Rodrigues, E.; Oliveira, G.; Pereira, G.I.; Bastos, J.; et al. The challenging paradigm of interrelated energy systems towards a more sustainable future. Renew. Sustain. Energy Rev. 2018, 95, 171–193. [Google Scholar] [CrossRef]

- Choi, J.-K.; Bakshi, B.; Haab, T. Effects of a carbon price in the U.S. on economic sectors, resource use, and emissions: An input–output approach. Energy Policy 2010, 38, 3527–3536. [Google Scholar] [CrossRef]

- Valadkhani, A.; Babacan, A.D.A. The impacts of rising energy prices on non-energy sectors in Australia. Econ. Anal. Policy 2014, 44, 386–395. [Google Scholar] [CrossRef]

- Gemechu, E.; Butnar, I.; Llop, M.F.; Castells, F. Environmental tax on products and services based on their carbon footprint: A case study of the pulp and paper sector. Energy Policy 2012, 50, 336–344. [Google Scholar] [CrossRef]

- Finn, M. Perfect competition and the effects of energy price increases on economic activity. J. Money Credit Bank. 2000, 32, 400–416. [Google Scholar] [CrossRef]

- Wu, K.-Y.; Huang, Y.-S.; Wu, J.-H. Impact of electricity shortages during energy transitions in Taiwan. Energy 2018, 151, 622–632. [Google Scholar] [CrossRef]

- Jiang, Z.; Tan, J. How the removal of energy subsidy affects general price in China: A study based on input–output model. Energy Policy 2013, 63, 599–606. [Google Scholar] [CrossRef]

- Ogarenko, I.; Hubacek, K. Eliminating Indirect Energy Subsidies in Ukraine: Estimation of Environmental and Socioeconomic Effects Using Input–Output Modeling. J. Econ. Struct. 2013, 2, 1–27. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, N.; Wu, M. The impacts of energy price fluctuations on China’s agriculture and rural economic development. Adv. Mater. Res. 2012, 524–527, 3216–3219. [Google Scholar] [CrossRef]

- Knetsch, T.A.; Molzahn, A. Supply side effects of strong energy price hikes in German industry and transportation. Empir. Econ. 2012, 43, 1215–1238. [Google Scholar] [CrossRef]

- Logar, I.; Van Den Bergh, J.C.J.M. The impact of peak oil on tourism in Spain: an input–output analysis of price, demand and economy-wide effects. Energy 2013, 54, 155–166. [Google Scholar] [CrossRef]

- Llop, M. Economic impact of alternative water policy scenarios in the Spanish production system: An input-output analysis. Ecol. Econ. 2008, 68, 288–294. [Google Scholar] [CrossRef]

- Cámara, A.; Martínez, M.I. Hacia una economía baja en carbono: Objetivos para 2030 en energías renovables. Regional Sectoral Econ. Stud. 2017, 17, 103–124. [Google Scholar]

- Langarita, R.; Duarte, R.; Hewings, G.; Sánchez-Chóliz, J. Testing European goals for the Spanish electricity system using a disaggregated CGE model. Energy 2019, 179, 1288–1301. [Google Scholar] [CrossRef]

- Ramos, C.; García-Muñiz, A.; Moreno, B.; Díaz, G. Small-scale renewable power technologies are an alternative to reach a sustainable economic growth: Evidence from Spain. Energy 2019, 167, 13–25. [Google Scholar] [CrossRef]

- Miyazawa, K. Input-output analysis and interrelational multiplier as a matrix. Hitotsub. J. Econ. 1968, 9, 39–58. [Google Scholar]

- Dietzenbacher, E. In Vindication of the Ghosh Model: A Reinterpretation as a Price Model. J. Reg. Sci. 1997, 37, 629–651. [Google Scholar] [CrossRef]

- De Mesnard, L. Is the Ghosh Model Interesting. J. Reg. Sci. 2009, 49, 361–372. [Google Scholar] [CrossRef]

- Miller, R.E.; Blair, P.D. Input-Output Analysis: Foundations and Extensions; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Okuyama, Y.; Hewings, G.J.D.; Sonis, M. Economic impacts of an unscheduled event: Based on Miyazawa’s framework. J. Appl. Reg. Sci. 1996, 2, 79–93. [Google Scholar]

- Eurostat. NACE Rev.2. Statistical Classification of Economic Activities in the European Communit; Eurostat Methodologies and Working Papers; European Commission: Luxembourg, 2008. [Google Scholar]

- Spanish Statistical Institute. Structural Business Statistics: Industrial Sector; INE: Madrid, Spain, 2015; Available online: https://www.ine.es/dyngs/INEbase/en/operacion.htm?c=Estadistica_C&cid=1254736143952&idp=1254735576550&menu=resultados&secc=1254736143612&padre=&capsel=4601 (accessed on 22 November 2019).

- Spanish Statistical Institute. Structural Business Statistics: Industrial Sector, Trade Sector, Services Sector. Methodology; INE: Madrid, Spain, 2019; pp. 1–57. [Google Scholar]

- IRENA. Global Energy Transformation A roadmap to 2050; IRENA-International Renewable Energy Agency: Abu Dhabi, UAE, 2019. [Google Scholar]

- IRENA. Renewable Power Generation Costs in 2017; IRENA-International Renewable Energy Agency: Abu Dhabi, UAE, 2018. [Google Scholar]

- GWEC. Global Wind Report 2018; GWEC—Global Wind Energy Council: Brussels, Belgium, 2019. [Google Scholar]

- Eurostat. Supply, Transformation and Consumption of Electricity Statistics. 2018. Available online: https://ec.europa.eu/eurostat/web/products-datasets/-/NRG_105A (accessed on 22 November 2019).

- Eurostat. Electricity Prices for Non-Household Consumers Statistic; Eurostat: Brussels, Belgium, 2015. [Google Scholar]

- Spanish Statistical Institute. Household Budget Survey—HBS; INE: Madrid, Spain, 2015. [Google Scholar]

- Würzburg, K.; Labandeira, X.; Linares, P. Renewable generation and electricity prices: Taking stock and new evidence for Germany and Austria. Energy Econ. 2013, 40, S159–S171. [Google Scholar] [CrossRef]

- Dillig, M.; Jung, M.; Karl, J. The impact of renewables on electricity prices in Germany–An estimation based on historic spot prices in the years 2011–2013. Renew. Sustain. Energy Rev. 2016, 57, 7–15. [Google Scholar] [CrossRef]

- Linares, P.; Santos, F.J.; Ventosa, M. Coordination of carbon reduction and renewable energy support policies. Clim. Policy 2008, 8, 377–394. [Google Scholar] [CrossRef]

- Gil, H.A.; Gomez-Quiles, C.; Riquelme, J. Large-scale wind power integration and wholesale electricity trading benefits: Estimation via an ex post approach. Energy Policy 2012, 41, 849–859. [Google Scholar] [CrossRef]

- Gelabert, L.; Labandeira, X.; Linares, P. An ex-post analysis of the effect of renewables and cogeneration on Spanish electricity prices. Energy Econ. 2011, 33, S59–S65. [Google Scholar] [CrossRef]

- Azofra, D.; Martínez, E.; Jiménez, E.; Blanco, J.; Azofra, F.; Saenz-Díez, J.C. Comparison of the influence of photovoltaic and wind power on the Spanish electricity prices by means of artificial intelligence techniques. Renew. Sustain. Energy Rev. 2015, 42, 532–542. [Google Scholar] [CrossRef]

- Ballester, C.; Furió, D. Effects of renewables on the stylized facts of electricity prices. Renew. Sustain. Energy Rev. 2015, 52, 1596–1609. [Google Scholar] [CrossRef]

- Vaca, J.; Núñez, G.; Kido, A. Análisis multisectorial del incremento de precios de la electricidad en la economía de México. Problemas del Desarrollo. 2019, 50, 167–189. [Google Scholar] [CrossRef]

- Arlinghaus, J. Impacts of Carbon Prices on Indicators of Competitiveness: A Review of Empirical Findings; OECD Environment Working Papers, 87; OECD: Paris, France, 2015. [Google Scholar] [CrossRef]

- Arocena, P.; Díaz, A.C. La evolución de los costes energéticos y su efecto en la competitividad de la industria española. Econ. Ind. 2015, 396, 151–162. [Google Scholar]

- Álvarez, E.; Larrea, M.; Díaz, A.C.; Kamp, B. ¿Afectan los costes de energía a la competitividad de la industria? Econ. Ind. 2016, 401, 155–170. [Google Scholar]

- Spanish Statistical Institute. Energy Consumption Survey; INE: Madrid, Spain, 2015; Available online: https://www.ine.es/dyngs/INEbase/en/operacion.htm?c=Estadistica_C&cid=1254736146240&menu=ultiDatos&idp=1254735576715 (accessed on 22 November 2019).

- Labandeira, X.; Labeaga, J.M.; López-Otero, X. Estimation of elasticity price of electricity with incomplete information. Energy Econ. 2012, 34, 627–633. [Google Scholar] [CrossRef]

- Blázquez, L.; Boogen, N.; Filippini, M. Residential electricity demand in Spain: New empirical evidence using aggregate data. Energy Econ. 2013, 36, 648–657. [Google Scholar] [CrossRef]

- Romero-Jordán, D.; Del Río, P.; Peñasco, C. An analysis of the welfare and distributive implications of factors influencing household electricity consumption. Energy Policy 2016, 88, 361–370. [Google Scholar] [CrossRef]

- Romero-Jordán, D.; Peñasco, C.; del Río, P. Analysing the determinants of household electricity demand in Spain. An econometric study. Int. J. Electr. Power Energy Syst. 2014, 63, 950–961. [Google Scholar] [CrossRef]

- Hewitt, R.; Winder, N.; Hernandez-Jimenez, V.; Alonso, P.; Bermejo, L. Innovation, pathways and barriers in Spain and beyond: An integrative research approach to the clean energy transition in Europe. Energy Res. Soc. Sci. 2017, 34, 260–271. [Google Scholar] [CrossRef]

- Day, R.; Walker, G.; Simcock, N. Conceptualising energy use and energy poverty using a capabilities framework. Energy Policy 2016, 93, 255–266. [Google Scholar] [CrossRef]

- Aristondo, O.; Onaindia, E. Counting energy poverty in Spain between 2004 and 2015. Energy Policy 2018, 113, 420–429. [Google Scholar] [CrossRef]

- Hirth, L.; Ziegenhagen, I. Balancing Power and Variable Renewables: Three Links. Renew. Sustain. Energy Rev. 2015, 50, 1035–1051. [Google Scholar] [CrossRef]

- European Commission. A Clean Planet for All A European Strategic Long-Term Vision for a Prosperous, Modern, Competitive and Climate Neutral Economy; COM(2018) 773 Final; European Commission: Brussels, Belgium, 28 November 2018. [Google Scholar]

- Bódis, K.; Monforti, F.; Szabó, S. Could Europe have more mini hydro sites? A suitability analysis based on continentally harmonized geographical and hydrological data. Renew. Sustain. Energy Rev. 2014, 37, 794–808. [Google Scholar] [CrossRef]

| 35 Electricity, Gas, Steam and Air Conditioning Supply |

|---|

| 35.1 Electric power generation, transmission and distribution |

| 35.11 Production of electricity |

| 35.12 Transmission of electricity |

| 35.13 Distribution of electricity |

| 35.14 Trade of electricity |

| 35.2 Manufacture of gas; distribution of gaseous fuels through mains |

| 35.21 Manufacture of gas |

| 35.22 Distribution of gaseous fuels through mains |

| 35.23 Trade of gas through mains |

| 35.3 Steam and air conditioning supply |

| 35.30 Steam and air conditioning supply |

| 35 Electric Energy, Gas, Steam and Air Conditioning Supply |

|---|

| 35.1 Production, transport and distribution of electrical energy |

| 35.12 Transmission of electricity |

| 35.13 Distribution of electricity |

| 35.14 Trade of electricity |

| 35.15 Production of hydroelectric energy |

| 35.16 Production of electric power from a conventional thermal origin |

| 35.17 Production of electrical energy from a nuclear source |

| 35.18 Production of electrical energy from a wind source |

| 35.19 Production of electrical energy of another type |

| 35.2 Production of gas; Pipeline distribution of gaseous fuels |

| 35.21 Gas production |

| 35.22 Distribution of gaseous fuels through mains |

| 35.23 Trade of gas through mains |

| 35.3 Supply of steam and air conditioning |

| 35.30 Supply of steam and air conditioning |

| Activities | Row | Column |

|---|---|---|

| Production, transport and distribution of electrical energy | 0.870 | 0.780 |

| Transmission of electricity | 0.035 | 0.006 |

| Distribution of electricity | 0.117 | 0.021 |

| Trade of electricity | 0.429 | 0.746 |

| Production of electrical energy | 0.419 | 0.228 |

| Production of gas; Pipeline distribution of gaseous fuels, Supply of steam and air conditioning | 0.130 | 0.220 |

| Activities | RES-E Activities | Weighting Factors |

|---|---|---|

| Electric power from a conventional origin | Nuclear | 0.63 |

| Coal | ||

| Fuel oil/natural gas | ||

| Combined Cycle | ||

| Cogeneration | ||

| Electrical energy from a wind source | Wind | 0.18 |

| Photovoltaic | Photovoltaic | 0.03 |

| Other renewables | Thermoelectric solar | 0.15 |

| Hydraulic | ||

| Hydro-wind | ||

| Other renewables |

| Level of Functional Breakdown | Weighting Factors |

|---|---|

| 04.5.1.0 Electricity | 0.725 |

| 04.5.2.1 City gas and natural gas | 0.220 |

| 04.5.2.2 Liquefied gas (butane, propane, …) | 0.055 |

| Electricity Activities | Weighting Factors |

|---|---|

| Transmission of electricity | 0.218 |

| Distribution of electricity | 0.011 |

| Trade of electricity | 0.001 |

| Electrical energy from a wind source | 0.137 |

| Photovoltaic | 0.024 |

| Other renewables | 0.123 |

| Electric power from a conventional origin | 0.486 |

| Activities | Weighting Factors |

|---|---|

| Transmission of electricity | 0.1580 |

| Distribution of electricity | 0.0083 |

| Trade of electricity | 0.0004 |

| Electrical energy from a wind source | 0.0997 |

| Photovoltaic | 0.0171 |

| Other renewables | 0.0892 |

| Electric power from a conventional origin | 0.3523 |

| Production of gas; Pipeline distribution of gaseous fuels, Supply of steam and air conditioning | 0.2750 |

| Activities | Weighting Factors |

|---|---|

| Production, transport and distribution of electrical energy | 0.8735 |

| Transmission of electricity | 0.0440 |

| Distribution of electricity | 0.3581 |

| Trade of electricity | 0.0801 |

| Production of electrical energy | 0.3913 |

| Production of gas; Pipeline distribution of gaseous fuels, Supply of steam and air conditioning | 0.1265 |

| Year | Electricity Generated by Renewable Resources RES-E (%) * | Spot Electricity Price (€/MWh) * |

|---|---|---|

| 2005 | 19.12 | 56.62 |

| 2006 | 19.99 | 52.63 |

| 2007 | 21.68 | 40.35 |

| 2008 | 23.75 | 65.15 |

| 2009 | 27.84 | 37.35 |

| 2010 | 29.78 | 37.87 |

| 2011 | 31.56 | 50.73 |

| 2012 | 33.47 | 48.63 |

| 2013 | 36.73 | 45.98 |

| 2014 | 37.77 | 44.64 |

| 2015 | 36.95 | 52.75 |

| 2016 | 36.61 | 41.90 |

| Scenarios | Estimated Electricity Price Reduction (%) | |

|---|---|---|

| Increase of % RES-E | Household | Industry |

| 5 | −2.2 | −2.6 |

| 25 | −11.4 | −13.0 |

| 50 | −22.8 | −26.1 |

| 75 | −34.2 | −39.1 |

| 85 | −38.7 | −44.4 |

| 100 | −45.6 | −52.2 |

| Scenarios | Price Reduction (%) | |

|---|---|---|

| Increase of % RES-E | Industry Electricity | Global |

| 5 | −2.6 | −0.14 |

| 25 | −13.0 | −0.72 |

| 50 | −26.1 | −1.45 |

| 75 | −39.1 | −2.18 |

| 85 | −44.4 | −2.47 |

| 100 | −52.2 | −2.90 |

| Activities\Scenarios | 2.6 | 13 | 26.1 | 39.1 | 44.4 | 52.2 |

|---|---|---|---|---|---|---|

| Food, beverages and tobacco products | 0.001 | 0.004 | 0.009 | 0.012 | 0.013 | 0.018 |

| Wood and products of wood and cork, except furniture; articles of straw and plaiting materials | 0.001 | 0.004 | 0.009 | 0.012 | 0.013 | 0.018 |

| Paper and paper products | 0.001 | 0.008 | 0.015 | 0.020 | 0.023 | 0.031 |

| Printing and recording services | 0.001 | 0.005 | 0.011 | 0.014 | 0.016 | 0.022 |

| Chemicals and chemical products | 0.001 | 0.007 | 0.013 | 0.017 | 0.020 | 0.027 |

| Rubber and plastic products | 0.001 | 0.005 | 0.011 | 0.015 | 0.016 | 0.022 |

| Other non-metallic mineral products | 0.003 | 0.017 | 0.035 | 0.046 | 0.052 | 0.070 |

| Basic metals | 0.002 | 0.011 | 0.022 | 0.028 | 0.032 | 0.043 |

| Fabricated metal products, except machinery and equipment | 0.001 | 0.007 | 0.014 | 0.019 | 0.022 | 0.029 |

| Transmission of electricity | 0.017 | 0.085 | 0.170 | 0.223 | 0.253 | 0.341 |

| Distribution of electricity | 0.019 | 0.098 | 0.196 | 0.257 | 0.291 | 0.394 |

| Trade of electricity | 0.028 | 0.140 | 0.281 | 0.369 | 0.417 | 0.564 |

| Other renewables | 0.014 | 0.072 | 0.144 | 0.189 | 0.214 | 0.289 |

| Electric power from a conventional origin | 0.015 | 0.075 | 0.151 | 0.197 | 0.223 | 0.302 |

| Production of gas; Pipeline distribution of gaseous fuels, Supply of steam and air conditioning | 0.009 | 0.044 | 0.089 | 0.117 | 0.132 | 0.178 |

| Constructions and construction Works | 0.001 | 0.005 | 0.011 | 0.014 | 0.016 | 0.021 |

| Motion picture, video and television program production services, sound recording and music publishing; programming and broadcasting services | 0.001 | 0.005 | 0.009 | 0.013 | 0.014 | 0.019 |

| Author | Period | Elasticity |

|---|---|---|

| [46] | 2005–2007 | −0.2536 |

| [47] | 2000–2008 | −0.07 |

| [48] | 1998–2009 | −0.2673 |

| [49] * | 2006–2008 | Min: −0.1138, Max: −0.163 |

| 2010–2012 | Min: −0.2084, Max: −0.3307 |

| Variations (pmp) | ||||||

|---|---|---|---|---|---|---|

| Price Scenarios | −2.2 | −11.4 | −22.8 | −34.2 | −38.7 | −45.6 |

| Total income | 0.23 | 1.2 | 2.4 | 3.6 | 4.7 | 4.9 |

| Total output | 2.2 | 2.6 | 3.0 | 3.3 | 3.5 | 3.8 |

| Activities |

|---|

| Products of agriculture, hunting and related services |

| Fish and other fishing products; aquaculture products; support services to fishing |

| Food products; beverages; tobacco products |

| Textiles; wearing apparel; leather and related products |

| Electrical energy from a wind source |

| Photovoltaics |

| Other renewables |

| Retail trade services, except for motor vehicles and motorcycles |

| Accommodation and food services |

| Financial services, except insurance and pension funding |

| Services auxiliary to financial services and insurance services |

| Real estate services |

| Travel agents, tour operators and other reservation services and related services |

| Human health services |

| Residential care services; social work services without accommodation |

| Creative, arts and entertainment services; library, archive, museum and other cultural services; gambling and betting services |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ramos Carvajal, C.; García-Muñiz, A.S.; Moreno Cuartas, B. Assessing Socioeconomic Impacts of Integrating Distributed Energy Resources in Electricity Markets through Input-Output Models. Energies 2019, 12, 4486. https://doi.org/10.3390/en12234486

Ramos Carvajal C, García-Muñiz AS, Moreno Cuartas B. Assessing Socioeconomic Impacts of Integrating Distributed Energy Resources in Electricity Markets through Input-Output Models. Energies. 2019; 12(23):4486. https://doi.org/10.3390/en12234486

Chicago/Turabian StyleRamos Carvajal, Carmen, Ana Salomé García-Muñiz, and Blanca Moreno Cuartas. 2019. "Assessing Socioeconomic Impacts of Integrating Distributed Energy Resources in Electricity Markets through Input-Output Models" Energies 12, no. 23: 4486. https://doi.org/10.3390/en12234486