Journal Description

FinTech

FinTech

is an international, peer-reviewed, open access journal on a variety of themes connected with financial technology, such as cryptocurrencies, risk management, robo-advising, crowdfunding, blockchain, new payment solutions, machine learning and AI for financial services, digital currencies, etc., published quarterly online by MDPI.

- Open Access— free for readers, with article processing charges (APC) paid by authors or their institutions.

- High Visibility: indexed within RePEc, and other databases.

- Rapid Publication: manuscripts are peer-reviewed and a first decision is provided to authors approximately 22.2 days after submission; acceptance to publication is undertaken in 3.7 days (median values for papers published in this journal in the second half of 2023).

- Recognition of Reviewers: APC discount vouchers, optional signed peer review, and reviewer names published annually in the journal.

Latest Articles

Analyses of Scientific Collaboration Networks among Authors, Institutions, and Countries in FinTech Studies: A Bibliometric Review

FinTech 2024, 3(2), 249-273; https://doi.org/10.3390/fintech3020015 - 17 Apr 2024

Abstract

►

Show Figures

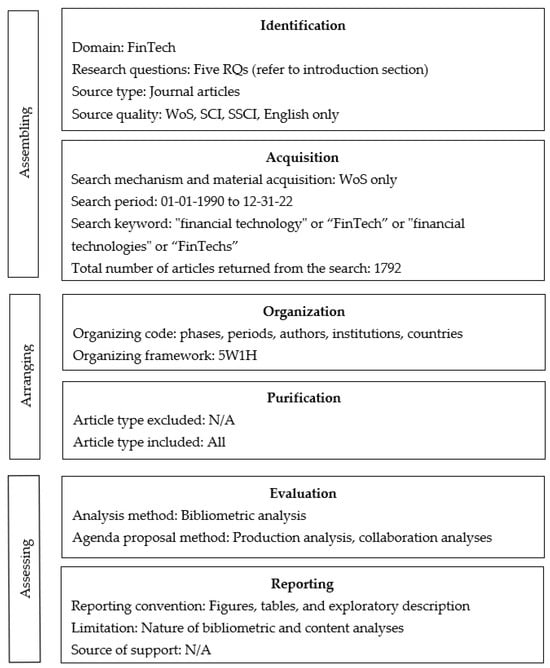

Purpose: FinTech research has grown rapidly, but few studies have measured the levels of scientific collaboration among authors, institutions, and nations. This study aimed to reveal the status and levels of scientific collaboration in this field. The results will help scholars to

[...] Read more.

Purpose: FinTech research has grown rapidly, but few studies have measured the levels of scientific collaboration among authors, institutions, and nations. This study aimed to reveal the status and levels of scientific collaboration in this field. The results will help scholars to combine their knowledge and resources to generate new ideas that may not have been possible if they worked alone and enable them to work more efficiently, resulting in higher-quality results for all parties. Design/methodology/approach: Research papers in the FinTech field indexed in the Web of Science databases from 1999 to 2022 were included in the research dataset. Using R-bibliometrix and VOS viewer (Visualisation of Similarities viewer), co-authorship networks were drawn. Additionally, some measures of the co-authorship network were assessed, such as the links, total link strength, total number of articles, total citations, normalized total citations, average year of publication, average citations, and average normalized normal citations. Beyond bibliometric analyses, this research gathers other statistics for analysis to gain further insights. Result: A total of 1792 publications were identified, and a number of these revealed an increase in the forms of collaboration, including collaboration among authors and institutions. Three lists of the most collaborative authors, institutions, and countries were compiled. The top authors, affiliations, and countries were ranked according to their total links, citations, average citations, and annual normalized citations. There were six distinct clusters of collaboration among authors, thirteen among affiliations, and eleven among countries. In terms of author collaborations, the links and total link strength had three nodes and four nodes, respectively. John Goodell, Chi-Chuan Le, and Shaen Corbet were the top three collaborative authors. In terms of affiliations, the two strength attributes were 8 and 12 nodes, with Sydney University, Hong Kong University, and the Shanghai University of Finance and Economics topping the list. In terms of collaboration among countries, these two attributes had 14 and 34 nodes. Three of the most collaborative countries were England, the People’s Republic of China, and the United States. Originality/value: In contrast with previous systematic literature reviews, this study quantitatively examines the collaboration status in the FinTech field on three levels: authors, affiliations, and countries.

Full article

Open AccessArticle

Argumentation Schemes for Blockchain Deanonymisation

by

Dominic Deuber, Jan Gruber, Merlin Humml, Viktoria Ronge and Nicole Scheler

FinTech 2024, 3(2), 236-248; https://doi.org/10.3390/fintech3020014 - 27 Mar 2024

Abstract

►▼

Show Figures

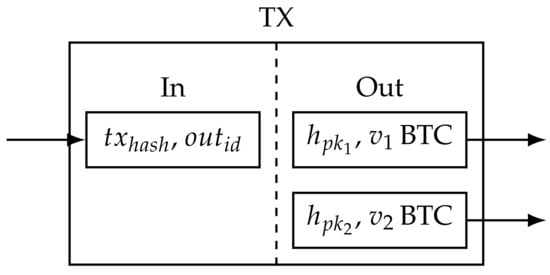

Cryptocurrency forensics have become standard tools for law enforcement. Their basic idea is to deanonymise cryptocurrency transactions to identify the people behind them. Cryptocurrency deanonymisation techniques are often based on premises that largely remain implicit, especially in legal practice. On the one hand,

[...] Read more.

Cryptocurrency forensics have become standard tools for law enforcement. Their basic idea is to deanonymise cryptocurrency transactions to identify the people behind them. Cryptocurrency deanonymisation techniques are often based on premises that largely remain implicit, especially in legal practice. On the one hand, this implicitness complicates investigations. On the other hand, it can have far-reaching consequences for the rights of those affected. Argumentation schemes could remedy this untenable situation by rendering the underlying premises more transparent. Additionally, they can aid in critically evaluating the probative value of any results obtained by cryptocurrency deanonymisation techniques. In the argumentation theory and AI community, argumentation schemes are influential as they state the implicit premises for different types of arguments. Through their critical questions, they aid the argumentation participants in critically evaluating arguments. We specialise the notion of argumentation schemes to legal reasoning about cryptocurrency deanonymisation. Furthermore, we demonstrate the applicability of the resulting schemes through an exemplary real-world case. Ultimately, we envision that using our schemes in legal practice can solidify the evidential value of blockchain investigations, as well as uncover and help to address uncertainty in the underlying premises—thus contributing to protecting the rights of those affected by cryptocurrency forensics.

Full article

Figure 1

Open AccessArticle

Comparative Analysis of Linear Models and Artificial Neural Networks for Sugar Price Prediction

by

Tathiana M. Barchi, João Lucas Ferreira dos Santos, Priscilla Bassetto, Henrique Nazário Rocha, Sergio L. Stevan, Jr., Fernanda Cristina Correa, Yslene Rocha Kachba and Hugo Valadares Siqueira

FinTech 2024, 3(1), 216-235; https://doi.org/10.3390/fintech3010013 - 12 Mar 2024

Abstract

►▼

Show Figures

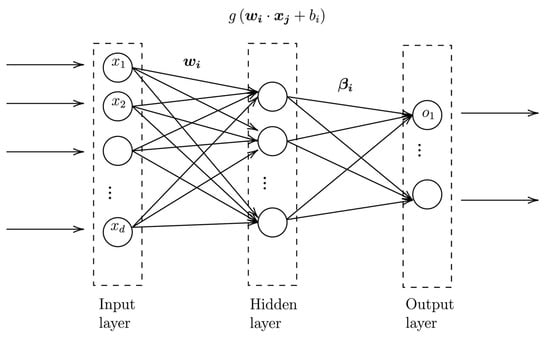

Sugar is an important commodity that is used beyond the food industry. It can be produced from sugarcane and sugar beet, depending on the region. Prices worldwide differ due to high volatility, making it difficult to estimate their forecast. Thus, the present work

[...] Read more.

Sugar is an important commodity that is used beyond the food industry. It can be produced from sugarcane and sugar beet, depending on the region. Prices worldwide differ due to high volatility, making it difficult to estimate their forecast. Thus, the present work aims to predict the prices of kilograms of sugar from four databases: the European Union, the United States, Brazil, and the world. To achieve this, linear methods from the Box and Jenkins family were employed, together with classic and new approaches of artificial neural networks: the feedforward Multilayer Perceptron and extreme learning machines, and the recurrent proposals Elman Network, Jordan Network, and Echo State Networks considering two reservoir designs. As performance metrics, the MAE and MSE were addressed. The results indicated that the neural models were more accurate than linear ones. In addition, the MLP and the Elman networks stood out as the winners.

Full article

Figure 1

Open AccessArticle

Reimagining Peer-to-Peer Lending Sustainability: Unveiling Predictive Insights with Innovative Machine Learning Approaches for Loan Default Anticipation

by

Ly Nguyen, Mominul Ahsan and Julfikar Haider

FinTech 2024, 3(1), 184-215; https://doi.org/10.3390/fintech3010012 - 05 Mar 2024

Abstract

►▼

Show Figures

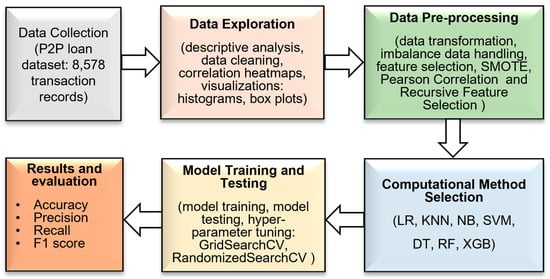

Peer-to-peer lending, a novel element of Internet finance that links lenders and borrowers via online platforms, has generated large profits for investors. However, borrowers’ missed payments have negatively impacted the industry’s sustainable growth. It is imperative to create a system that can correctly

[...] Read more.

Peer-to-peer lending, a novel element of Internet finance that links lenders and borrowers via online platforms, has generated large profits for investors. However, borrowers’ missed payments have negatively impacted the industry’s sustainable growth. It is imperative to create a system that can correctly predict loan defaults to lessen the damage brought on by defaulters. The goal of this study is to fill the gap in the literature by exploring the feasibility of developing prediction models for P2P loan defaults without relying heavily on personal data while also focusing on identifying key variables influencing borrowers’ repayment capacity through systematic feature selection and exploratory data analysis. Given this, this study aims to create a computational model that aids lenders in determining the approval or rejection of a loan application, relying on the financial data provided by applicants. The selected dataset, sourced from an open database, contains 8578 transaction records and includes 14 attributes related to financial information, with no personal data included. A loan dataset is first subjected to an in-depth exploratory data analysis to find behaviors connected to loan defaults. Subsequently, diverse and noteworthy machine learning classification algorithms, including Random Forest, Support Vector Machine, Decision Tree, Logistic Regression, Naïve Bayes, and XGBoost, were employed to build models capable of discerning borrowers who repay their loans from those who do not. Our findings indicate that borrowers who fail to comply with their lenders’ credit policies, pay elevated interest rates, and possess low FICO ratings are at a higher likelihood of defaulting. Furthermore, elevated risk is observed among clients who obtain loans for small businesses. All classification models, including XGBoost and Random Forest, successfully developed and performed satisfactorily and achieved an accuracy of over 80%. When the decision threshold is set to 0.4, the best performance for predicting loan defaulters is achieved using logistic regression, which accurately identifies 83% of the defaulted loans, with a recall of 83%, precision of 21% and f1 score of 33%.

Full article

Figure 1

Open AccessArticle

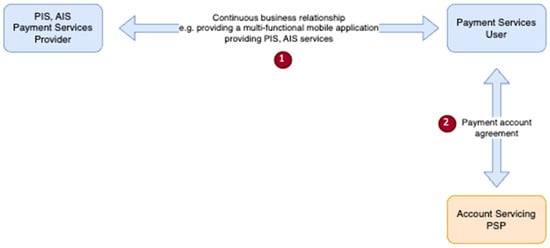

Account Information and Payment Initiation Services and the Related AML Obligations in the Law of the European Union

by

Michał Grabowski

FinTech 2024, 3(1), 173-183; https://doi.org/10.3390/fintech3010011 - 04 Mar 2024

Abstract

The Second Payment Services Directive introduced new services into the European Union legal system—Payment Initiation and Account Information Services. These services are based on payment accounts already opened and maintained for customers by the Account Servicing Payment Service Provider (bank, payment institution, electronic

[...] Read more.

The Second Payment Services Directive introduced new services into the European Union legal system—Payment Initiation and Account Information Services. These services are based on payment accounts already opened and maintained for customers by the Account Servicing Payment Service Provider (bank, payment institution, electronic money institution). The Account Services Payment Service provider performs AML/CFT verification of the account holder and applies customer due diligence measures to the account holder, such as identifying beneficial owners, obtaining information on the purpose and intended nature of the business relationship, and ongoing monitoring of the business relationship. Payment Initiation and Account Information services are therefore provided to a previously verified client and based on the payment account currently maintained for him. European Union law does not clearly specify whether a Third-Party Service Provider offering Payment Initiation or Account Information Services is obliged to re-apply financial security measures to customers. The aim of this article was to perform a legal analysis of the regulations and soft law acts in force in the European Union and to answer the question. The purposive (teleological) and linguistic–logical (grammatical) methods of interpretation of regulations were used for the analysis. The structure of the legal system of the European Union as a civil law (code law) system was taken into account. This article shows that in the current legal situation, there is no doubt that Third-Party Service Providers are obliged entities in terms of AML/CFT law and are obliged to apply the AML/CFT to customers using Payment Initiation and Account Information services. However, the degree to which customer due diligence measures have to be applied varies depending on the adopted model of providing Payment Initiation and Account Information services. Third-Party Service Providers will be obliged to apply financial security measures in cases where the relationship between the customer and the service providers will have a continuing character. In the case of occasional provision of services, when the transaction value does not exceed a certain threshold, the supplier may only perform simplified customer verification. In particular, this applies to Payment Initiation service models, where the Payment Initiation Service Provider works for merchants, enabling them to accept payments for goods and services sold. In such a model, the Service Provider has a continuous relationship with the merchant but only performs an occasional transaction for the user. The analysis also allowed for the conclusion that European Union law, including that in the draft phase, does not regulate in a sufficiently precise manner when a given model of Account Services and Payment Initiation Services may be treated as based on an occasional transaction. This made it possible to formulate a de lege ferenda request to include this issue in the proposal for an EU Regulation on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing.

Full article

(This article belongs to the Special Issue The Impact of Digitalisation on Financial Services and Financial Literacy)

►▼

Show Figures

Figure 1

Open AccessArticle

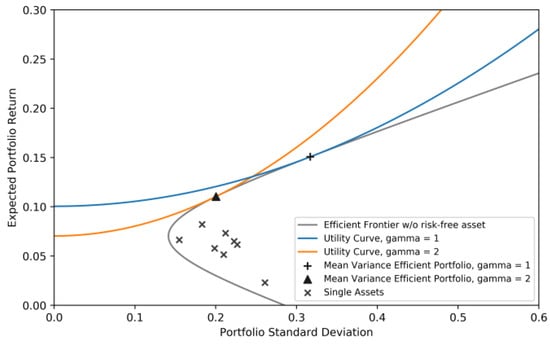

Navigating Uncertainty: Enhancing Markowitz Asset Allocation Strategies through Out-of-Sample Analysis

by

Vijaya Krishna Kanaparthi

FinTech 2024, 3(1), 151-172; https://doi.org/10.3390/fintech3010010 - 17 Feb 2024

Abstract

►▼

Show Figures

This research paper explores the complicated connection between uncertainty and the Markowitz asset allocation framework, specifically investigating how mistakes in estimating parameters significantly impact the performance of strategies during out-of-sample evaluations. Drawing on relevant literature, we highlight the importance of our findings. In

[...] Read more.

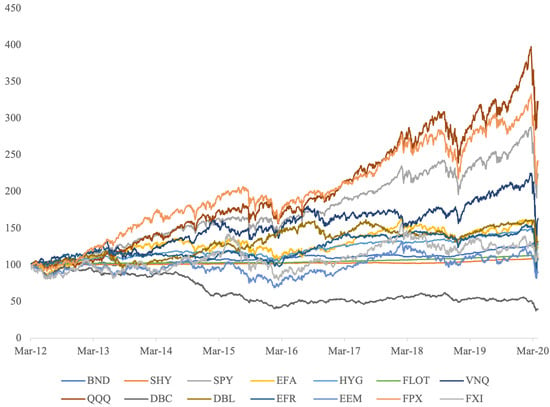

This research paper explores the complicated connection between uncertainty and the Markowitz asset allocation framework, specifically investigating how mistakes in estimating parameters significantly impact the performance of strategies during out-of-sample evaluations. Drawing on relevant literature, we highlight the importance of our findings. In contrast to common assumptions, our study systematically compares these approaches with alternative allocation strategies, providing insights into their performance in both anticipated and real-world out-of-sample events. The research demonstrates that incorporating methods to address uncertainty enhances the Markowitz framework, challenging the idea that longer sample periods always lead to better outcomes. Notably, imposing a short-sale constraint proves to be a valuable strategy for improving the effectiveness of the initial portfolio. While revealing the complexities of uncertainty, our study also highlights the surprising resilience of basic asset allocation approaches, such as equally weighted allocation, which exhibit commendable performance. Methodologically, we employ a rigorous out-of-sample evaluation, emphasizing the practical implications of parameter uncertainty on asset allocation outcomes. Investors, portfolio managers, and financial practitioners can use these insights to refine their strategies, considering the dynamic nature of markets and the limitations internal to the traditional models. In conclusion, this paper goes beyond the theoretical scope to provide substantial value in enhancing real-world investment decisions.

Full article

Figure 1

Open AccessArticle

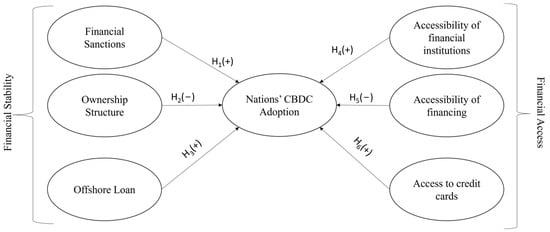

The Role of Financial Sanctions and Financial Development Factors on Central Bank Digital Currency Implementation

by

Medina Ayta Mohammed, Carmen De-Pablos-Heredero and José Luis Montes Botella

FinTech 2024, 3(1), 135-150; https://doi.org/10.3390/fintech3010009 - 15 Feb 2024

Cited by 1

Abstract

This study investigates the influence of a country’s financial access and stability and the adoption of retail central bank digital currencies (CBDCs) across 71 countries. Using an ordinal logit model, we examine how individual financial access, the ownership of credit cards, financing accessibility

[...] Read more.

This study investigates the influence of a country’s financial access and stability and the adoption of retail central bank digital currencies (CBDCs) across 71 countries. Using an ordinal logit model, we examine how individual financial access, the ownership of credit cards, financing accessibility by firms, offshore loans, financial sanctions, and the ownership structure of financial institutions influence the probability of CBDC adoption in nations. These findings reveal that nations facing financial sanctions and those with substantial offshore bank loans are more inclined to adopt CBDCs. Furthermore, a significant relationship is observed in countries where many people have restricted financial access, indicating heightened interest in CBDC adoption. Interestingly, no statistically significant relationship was found between the adoption of CBDCs and the percentage of foreign-owned banks in each country. The results show that countries with low financial stability and financial access adopt CBDCs faster. This study expands our knowledge of how a nation’s financial situation influences its adoption of CBDCs. The results provide important and relevant insights into the current discussion of the direction of global finance.

Full article

(This article belongs to the Special Issue Financial Technology and Innovation Sustainable Development)

►▼

Show Figures

Figure 1

Open AccessArticle

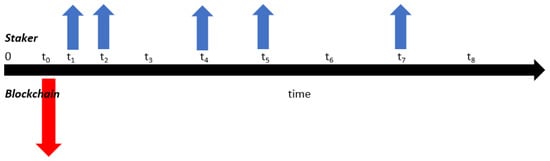

A Crypto Yield Model for Staking Return

by

Julien Riposo and Maneesh Gupta

FinTech 2024, 3(1), 116-134; https://doi.org/10.3390/fintech3010008 - 15 Feb 2024

Cited by 1

Abstract

We introduce a model that derives a metric to answer the question: what is the expected gain of a staker? We calculate the rewards as the staking return in a Proof-of-Stake (PoS) consensus context. For each period of block validation and by a

[...] Read more.

We introduce a model that derives a metric to answer the question: what is the expected gain of a staker? We calculate the rewards as the staking return in a Proof-of-Stake (PoS) consensus context. For each period of block validation and by a forward approach, we prove that the interest is given by the ratio of the average staking gain to the total staked coins. Some additional PoS features are considered in the model, such as slash rate and Maximal Extractable Value (MEV), which marks the originality of this approach. In particular, we prove that slashing diminishes the rewards, reflecting the fact that the blockchain can consider stakers to potentially validate incorrectly. Regarding MEV, the approach we have sheds light on the relation between transaction fees and the average staking gain. We illustrate the developed model with Ethereum 2.0 and apply a similar process in a Proof-of-Work consensus context.

Full article

(This article belongs to the Special Issue Advances in Analytics and Intelligent System)

►▼

Show Figures

Figure 1

Open AccessArticle

Robo Advising and Investor Profiling

by

Raquel M. Gaspar and Madalena Oliveira

FinTech 2024, 3(1), 102-115; https://doi.org/10.3390/fintech3010007 - 03 Feb 2024

Abstract

►▼

Show Figures

The rise of digital technology and artificial intelligence has led to a significant change in the way financial services are delivered. One such development is the emergence of robo advising, which is an automated investment advisory service that utilizes algorithms to provide investment

[...] Read more.

The rise of digital technology and artificial intelligence has led to a significant change in the way financial services are delivered. One such development is the emergence of robo advising, which is an automated investment advisory service that utilizes algorithms to provide investment advice and portfolio management to investors. Robo advisors gather information about clients’ preferences, financial situations, and future goals through questionnaires. Subsequently, they recommend ETF-based portfolios tailored to match the investor’s risk profile. However, these questionnaires often appear vague, and robo advisors seldom disclose the methodologies employed for investor profiling or asset allocation. This study aims to contribute by introducing an investor profiling method relying solely on investors’ relative risk aversion (RRA), which, in addition, allows for the determination of optimal allocations. We also show that, for the period under analysis and using the same ETF universe, our RRA portfolios consistently outperform those recommended by the Riskalyze platform, which may suffer from ultraconservadorism in terms of the proposed volatility.

Full article

Figure 1

Open AccessArticle

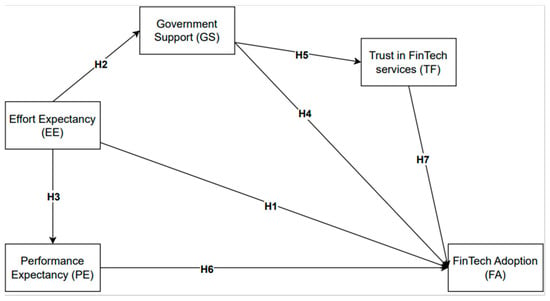

FinTech Services Adoption in Greece: The Roles of Trust, Government Support, and Technology Acceptance Factors

by

Stefanos Balaskas, Maria Koutroumani, Kiriakos Komis and Maria Rigou

FinTech 2024, 3(1), 83-101; https://doi.org/10.3390/fintech3010006 - 22 Jan 2024

Cited by 1

Abstract

►▼

Show Figures

Financial technology or FinTech is a term that has arisen in recent years; it refers to innovative technologies designed to enhance and automate the provision and utilization of financial services. Its solutions aim to simplify conventional financial procedures, boost automation, lower expenses, and

[...] Read more.

Financial technology or FinTech is a term that has arisen in recent years; it refers to innovative technologies designed to enhance and automate the provision and utilization of financial services. Its solutions aim to simplify conventional financial procedures, boost automation, lower expenses, and deliver personalized and user-friendly experiences for both businesses and consumers. But this question remains: what drives users to adopt such services and how are they perceived by the general public? In our study, a quantitative non-experimental correlational methodology in the form of an online survey was utilized to study the Greek citizens’ behavioral intentions regarding the utilization of FinTech services. Based on the answers of 348 respondents, structural equation modeling was performed to evaluate the theoretical model, which included technology acceptance factors. Unlike conventional models that primarily relate user acceptance to adoption, our research goes beyond these models by expanding on the TAM model via an exploration of the role of trust and the influence of government support on user trust and perceived effort and an examination of how these, in turn, impact the FinTech services adoption. In our context, government support refers to the regulatory frameworks, policies, and endorsements provided by governmental bodies. The results indicated that all the aspects of this study related to trust and user acceptance (effort expectancy and performance expectancy) revealed a significant and positive relationship with FinTech services adoption and can be predictive factors of citizens’ future intentions to use FinTech services. This study also verified that trust in FinTech services mediates the relationship between government support and FinTech services adoption. We place emphasis on the intricate yet complex decision-making process in technology adoption, particularly in the field of FinTech, by exploring the intertwined relationships of trust, government support, and technology acceptance factors; the findings offer valuable insights for policymakers and industry practitioners.

Full article

Figure 1

Open AccessArticle

Information Effect of Fintech and Digital Finance on Financial Inclusion during the COVID-19 Pandemic: Global Evidence

by

Peterson K. Ozili, David Mhlanga, Rym Ammar and Marwa Fersi

FinTech 2024, 3(1), 66-82; https://doi.org/10.3390/fintech3010005 - 22 Jan 2024

Abstract

►▼

Show Figures

The lockdown restrictions during the COVID-19 pandemic led to increased interest in Fintech and digital finance solutions, and it gave people an incentive to join the formal financial sector by owning a formal account. People became interested in information about Fintech and digital

[...] Read more.

The lockdown restrictions during the COVID-19 pandemic led to increased interest in Fintech and digital finance solutions, and it gave people an incentive to join the formal financial sector by owning a formal account. People became interested in information about Fintech and digital finance solutions, and it led them to search the Internet to obtain information about Fintech, digital finance, and financial inclusion. In this study, we investigate whether interest in Internet information about Fintech and digital finance led to interest in Internet information about financial inclusion during the COVID-19 pandemic. Using global data that capture interest over time, we found that interest in information about Fintech was greater in developed countries while interest in information about financial inclusion was greater in developing countries during the pandemic. Interest in Fintech information was strongly correlated with interest in financial inclusion information during the pandemic. Interest in Fintech information had a significant positive effect on interest in financial inclusion information during the pandemic. There is a unidirectional causality between interest in Fintech information and interest in financial inclusion information during the pandemic. The implication of these findings is that interest in Fintech information is an important determinant of interest in financial inclusion information.

Full article

Figure 1

Open AccessArticle

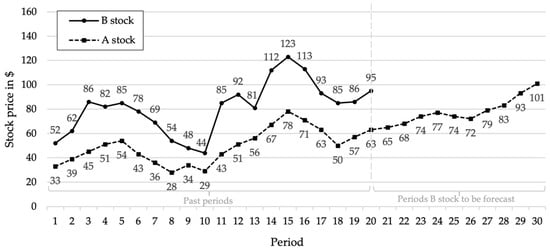

Willingness to Use Algorithms Varies with Social Information on Weak vs. Strong Adoption: An Experimental Study on Algorithm Aversion

by

Jan René Judek

FinTech 2024, 3(1), 55-65; https://doi.org/10.3390/fintech3010004 - 21 Jan 2024

Abstract

►▼

Show Figures

The process of decision-making is increasingly supported by algorithms in a wide variety of contexts. However, the phenomenon of algorithm aversion conflicts with the development of the technological potential that algorithms bring with them. Economic agents tend to base their decisions on those

[...] Read more.

The process of decision-making is increasingly supported by algorithms in a wide variety of contexts. However, the phenomenon of algorithm aversion conflicts with the development of the technological potential that algorithms bring with them. Economic agents tend to base their decisions on those of other economic agents. Therefore, this experimental approach examines the willingness to use an algorithm when making stock price forecasts when information about the prior adoption of an algorithm is provided. It is found that decision makers are more likely to use an algorithm if the majority of preceding economic agents have also used it. Willingness to use an algorithm varies with social information about prior weak or strong adoption. In addition, the affinity for technological interaction of the economic agents shows an effect on decision behavior.

Full article

Figure 1

Open AccessArticle

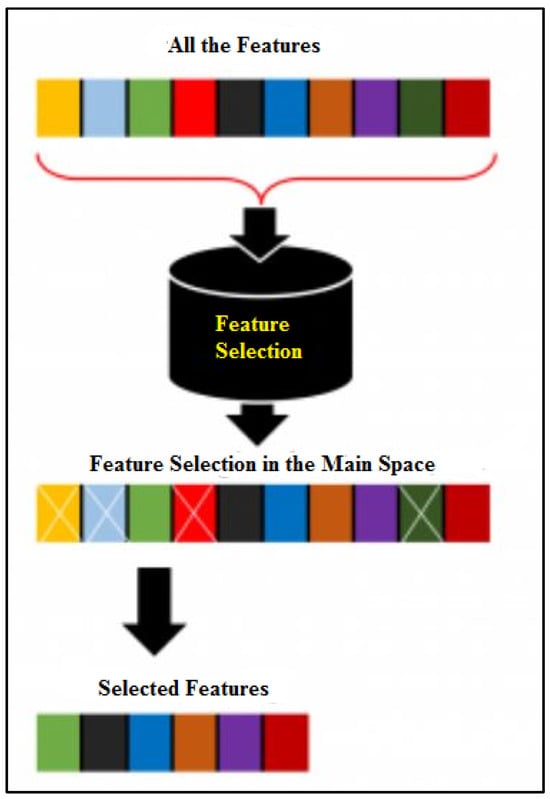

An Efficient Optimization Approach for Designing Machine Models Based on Combined Algorithm

by

Ata Larijani and Farbod Dehghani

FinTech 2024, 3(1), 40-54; https://doi.org/10.3390/fintech3010003 - 29 Dec 2023

Cited by 3

Abstract

►▼

Show Figures

Many intrusion detection algorithms that use optimization have been developed and are commonly used to detect intrusions. The process of selecting features and the parameters of the classifier are essential parts of how well an intrusion detection system works. This paper provides a

[...] Read more.

Many intrusion detection algorithms that use optimization have been developed and are commonly used to detect intrusions. The process of selecting features and the parameters of the classifier are essential parts of how well an intrusion detection system works. This paper provides a detailed explanation and discussion of an improved intrusion detection method for multiclass classification. The proposed solution uses a combination of the modified teaching–learning-based optimization (MTLBO) algorithm, the modified JAYA (MJAYA) algorithm, and a support vector machine (SVM). MTLBO is used with supervised machine learning (ML) to select subsets of features. Selection of the fewest features possible without impairing the accuracy of the results in feature subset selection (FSS) is a multiobjective optimization issue. This paper presents MTLBO as a mechanism and investigates its algorithm-specific, parameter-free idea. This study used the modified JAYA (MJAYA) algorithm to optimize the C and gamma parameters of the support vector machine (SVM) classifier. When the proposed MTLBO-MJAYA-SVM algorithm was compared with the original TLBO and JAYA algorithms on a well-known intrusion detection dataset, it was found to outperform them significantly.

Full article

Figure 1

Open AccessArticle

ICO vs. Equity Financing under Imperfect, Complex and Asymmetric Information

by

Anton Miglo

FinTech 2024, 3(1), 17-39; https://doi.org/10.3390/fintech3010002 - 27 Dec 2023

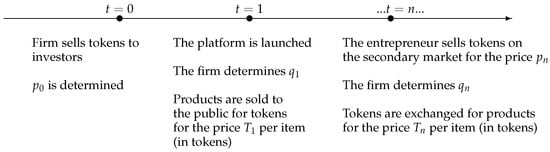

Abstract

►▼

Show Figures

This paper offers a game-theoretic model of a firm that raises funds for financing an innovative business project and chooses between ICO (initial coin offering) and equity financing. The model is based on information problems associated with both ICO and equity financing well-documented

[...] Read more.

This paper offers a game-theoretic model of a firm that raises funds for financing an innovative business project and chooses between ICO (initial coin offering) and equity financing. The model is based on information problems associated with both ICO and equity financing well-documented in the literature. Several new features are introduced, for example, information complexity, which is analyzed along with a more traditional imperfect information and an asymmetric information approach. The model provides several implications that have not yet been tested. For example, we find that the message complexity can be beneficial for firms conducting ICOs. Also, high-quality projects can use ICO as a signal of quality. Thirdly, the average size of projects undertaking equity financing is larger than that of firms conducting ICO.

Full article

Figure 1

Open AccessArticle

Impact of COVID-19 Movement Restrictions on Mobile Financing Services (MFSs) in Bangladesh

by

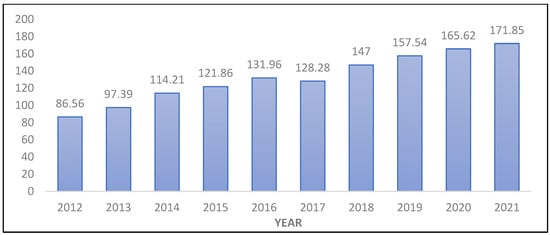

Sungida Rashid

FinTech 2024, 3(1), 1-16; https://doi.org/10.3390/fintech3010001 - 21 Dec 2023

Abstract

►▼

Show Figures

According to the National Financial Inclusion Strategy (NFIS), Bangladesh aims to achieve a 100% financial inclusion target by 2026 through mobile financing services (MFSs). However, despite several efforts, the financial inclusion score remained only 53% at the end of 2021, compared to 50%

[...] Read more.

According to the National Financial Inclusion Strategy (NFIS), Bangladesh aims to achieve a 100% financial inclusion target by 2026 through mobile financing services (MFSs). However, despite several efforts, the financial inclusion score remained only 53% at the end of 2021, compared to 50% in 2017. A substantial proportion of this growth came through MFSs during the COVID-19 pandemic. This article investigates the short-run and long-run influence of COVID-19 movement restriction orders on MFSs. An autoregressive distributed lag model (ARDL) is applied to the monthly transaction data over the period of December 2016 to May 2022 of the three most popular MFSs. Movement restriction orders are associated with a significant increase in person-to-person transactions (P2P) and person-to-business transactions (P2B) in the long run, but the effect is positive and statistically insignificant for remittance transfer. Furthermore, using the volume of ATM transactions as a measure of financial inclusion, this study confirms the crucial role of movement restriction orders in intensifying the financial inclusion of Bangladesh through MFSs. The coefficients of error correction models (ECM) indicate that policymakers must act promptly to develop actionable strategies to maintain the short run momentum of the demand for MFSs to achieve the national target.

Full article

Figure 1

Open AccessArticle

Usage of AI in Sustainable Knowledge Management and Innovation Processes; Data Analytics in the Electricity Sector

by

Lea Kocjancic and Sergej Gricar

FinTech 2023, 2(4), 718-736; https://doi.org/10.3390/fintech2040040 - 17 Nov 2023

Abstract

Successful organisations prioritise product quality and customer satisfaction. Non-financial indicators are crucial for measuring performance, requiring specific financial and technology management knowledge. Effective knowledge management and entrepreneurial activity significantly impact performance, vital to the country’s economic factors. Electricity is crucial to society’s development.

[...] Read more.

Successful organisations prioritise product quality and customer satisfaction. Non-financial indicators are crucial for measuring performance, requiring specific financial and technology management knowledge. Effective knowledge management and entrepreneurial activity significantly impact performance, vital to the country’s economic factors. Electricity is crucial to society’s development. Renewable energy sources such as solar, wind, hydropower, and biomass can generate sustainable electricity. Managing environmental, social, and economic aspects is essential for sustainable societal and virtual development. In this study, the central element of novelty is associated with the dependent variable Nominal Labour Productivity per Employee. This research shows that effective knowledge management impacts a company’s business performance. Based on secondary data from various sources, we have used factor analysis to assess the interrelationship between the factors and econometric dimensionalities. Accompanied by this econometric approach, the research methodology aims to present hybrid models based on econometric techniques and artificial intelligence (AI) networks. Based on the principal component method analysis results, we show the interdependence of 30 variables in the micro and macro environment. The new components of the correlated variables show how knowledge and innovation are related to the economic performance of society, and nominal employee productivity is a valuable indicator for measuring economic efficiency. Nevertheless, AI, a knowledge management product, provides helpful comments on the econometric results.

Full article

Open AccessArticle

The Effect of Leadership Styles on the Growth of Fintech Start-Ups in Zambia

by

Progress Choongo, Mungu Chileshe, Christine Nakamba Lesa, Bruce Mwiya and Thomas Kweku Taylor

FinTech 2023, 2(4), 698-717; https://doi.org/10.3390/fintech2040039 - 06 Nov 2023

Abstract

The purpose of this study is to determine the relationship between the leadership styles of leaders of financial technology (Fintech) start-ups and firm growth. A quantitative design employing a cross-sectional survey with the use of a Likert questionnaire was conducted on the leaders

[...] Read more.

The purpose of this study is to determine the relationship between the leadership styles of leaders of financial technology (Fintech) start-ups and firm growth. A quantitative design employing a cross-sectional survey with the use of a Likert questionnaire was conducted on the leaders of top-performing Fintech firms in Zambia, as recognized by Tracxn in its May 2020 report. This study focuses on three leadership styles: transformational leadership, transactional leadership, and laissez-faire leadership. The most significant result is that transformational leadership is strongly associated with the growth of Fintech start-ups in Zambia, while transactional leadership plays a limited role. The association between laissez-faire leadership and firm growth is positive but weak. The research makes two main contributions to the literature in the field of Fintech. First, the findings can help researchers explain leadership styles that predict the growth of Fintech start-ups. Second, founders of Fintech firms will understand the most important leadership styles that can lead to the growth of start-ups. The limitations of this study relate to the sample size, the need to consider other readership styles, and the use of qualitative and longitudinal designs that would provide more insights and validation.

Full article

(This article belongs to the Special Issue Research on Corporate Finance and Financial Economics)

Open AccessArticle

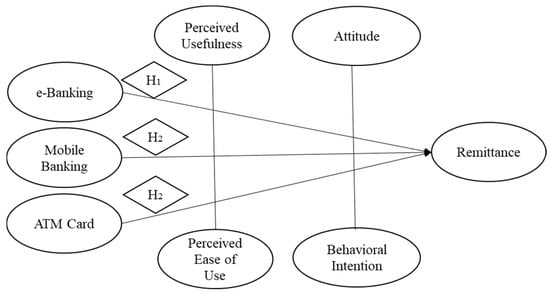

Digital Financial Inclusion and Remittances: An Empirical Study on Bangladeshi Migrant Households

by

Kazi Abdul Mannan and Khandaker Mursheda Farhana

FinTech 2023, 2(4), 680-697; https://doi.org/10.3390/fintech2040038 - 18 Oct 2023

Cited by 1

Abstract

Globally, large numbers of adults remain unbanked, and most of them live in rural areas of the Third World. The recent outbreak of the COVID-19 pandemic has shown us how inequalities in accessing financial services continue to affect us. However, digital financial inclusion

[...] Read more.

Globally, large numbers of adults remain unbanked, and most of them live in rural areas of the Third World. The recent outbreak of the COVID-19 pandemic has shown us how inequalities in accessing financial services continue to affect us. However, digital financial inclusion has emerged as an effective tool used to tackle socioeconomic ills and drive economic development. In fact, due to these modern technological developments, the number of studies in this area is very limited, especially in the context of developing economies. This study examines the impacts of migrant remittances on digital financial inclusion within households in Bangladesh by using the Migration and Remittance Household Survey. To meet the research objectives of this study, a household survey was conducted and 2165 households interviewed in 2022–2023 in Bangladesh. The survey data collected was tested using univariate and multivariate estimations. This study finds that the coefficient of remittance has positive relationships with the probability of e-bank accounts and the use of mobile banking for a household’s financial transactions. However, the use of ATM cards by households for financial transactions has not been significantly affected. The article concludes that remittance flows may enhance access to and use of means of digital financial inclusion by reducing some of the barriers and costs in Bangladesh, which could greatly contribute to the country’s economic growth by creating and increasing a strong fund for investment. The findings of this study can help in taking various steps to facilitate the most powerful financial sector of Bangladesh, namely, remittance management.

Full article

(This article belongs to the Special Issue The Impact of Digitalisation on Financial Services and Financial Literacy)

►▼

Show Figures

Figure 1

Open AccessArticle

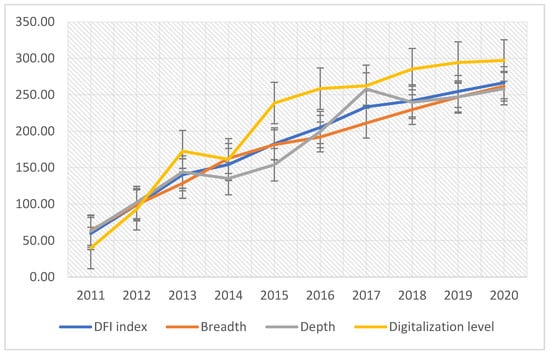

Use of Theil for a Specific Duality Economy: Assessing the Impact of Digital Inclusive Finance on Urban-Rural Income Gap in Chongqing

by

Nai Chiek Aik and Qiurui Zhang

FinTech 2023, 2(4), 668-679; https://doi.org/10.3390/fintech2040037 - 27 Sep 2023

Cited by 1

Abstract

►▼

Show Figures

This study uses panel data from 2016 to 2020 to examine the impact of digital financial inclusion on income inequality in the urban-rural divide of Chongqing, China. The results suggest that increasing access to digital financial services could help narrow the income gap

[...] Read more.

This study uses panel data from 2016 to 2020 to examine the impact of digital financial inclusion on income inequality in the urban-rural divide of Chongqing, China. The results suggest that increasing access to digital financial services could help narrow the income gap between urban and rural areas. However, the impact becomes significantly positive when controlling for other variables with the Random Effects regression model. Among the control variables, the urbanization rate and government expenditure are found to be significant determinants of income inequality in Chongqing. These findings offer insights for policymakers on the potential benefits of targeted interventions to promote financial inclusion and sustainable urbanization, while ensuring effective allocation of government spending to reduce income inequality.

Full article

Figure 1

Open AccessArticle

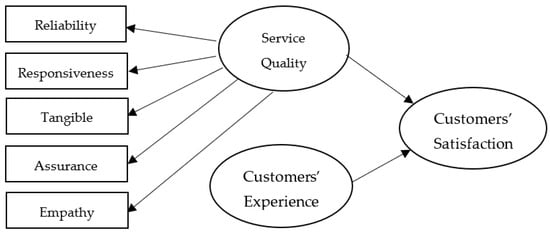

Customers’ Satisfaction of E-Banking in Bangladesh: Do Service Quality and Customers’ Experiences Matter?

by

Md. Abdul Bashir, Md. Alaul Haque, Aidin Salamzadeh and Md. Mizanur Rahman

FinTech 2023, 2(3), 657-667; https://doi.org/10.3390/fintech2030036 - 13 Sep 2023

Abstract

The banking sectors are optimistic that electronic banking (E-banking) will help them provide better customer service and strengthen customer relationships. Despite this, a relatively low priority has been given to the level of satisfaction that E-banking users in Bangladesh have regarding the quality

[...] Read more.

The banking sectors are optimistic that electronic banking (E-banking) will help them provide better customer service and strengthen customer relationships. Despite this, a relatively low priority has been given to the level of satisfaction that E-banking users in Bangladesh have regarding the quality of the services they receive and their overall experiences. Consequently, this study aims to determine the effect of service quality and customer experiences on the level of satisfaction perceived by E-banking customers in Bangladesh. Using a convenience sampling technique and a self-administered questionnaire, we gathered data from 315 E-banking customers. The independent variable (service quality and customer experience) and dependent variable (customer satisfaction) on a five-point “Likert-Type Scale” explain the degree to which participants agree or disagree with the questionnaire’s statements. Covariance-based structural equation modeling (CB-SEM) was utilised to analyse the gathered data. The findings of this study indicate that service quality and customer experience significantly positively affect E-banking customer satisfaction in Bangladesh. The outcomes of this study will urge the banking authorities to prioritize service quality to boost customer satisfaction by suggesting several steps to improve the efficiency, effectiveness, and security of the E-banking system.

Full article

(This article belongs to the Special Issue Corporate Governance, Digital and Money Economy)

►▼

Show Figures

Figure 1

Highly Accessed Articles

Latest Books

E-Mail Alert

News

Topics

Topic in

Commodities, Economies, Energies, JRFM, FinTech

Energy Market and Energy Finance

Topic Editors: Junhua Zhao, Julien ChevallierDeadline: 31 December 2024

Conferences

Special Issues

Special Issue in

FinTech

Advances in Investment for Sustainable Development

Guest Editors: Indrė Lapinskaitė, Kristina KovaitėDeadline: 13 May 2024

Special Issue in

FinTech

Corporate Governance, Digital and Money Economy

Guest Editors: Grzegorz Zimon, Nina Stępnicka, Beata SadowskaDeadline: 31 May 2024

Special Issue in

FinTech

Financial Technology and Innovation Sustainable Development

Guest Editors: Eglantina Hysa, Ovidiu Folcuţ, Anuradha Iddagoda, Otilia Manta, Mohammed K. A. KaabarDeadline: 31 August 2024

Special Issue in

FinTech

Trends and New Developments in FinTech

Guest Editors: Nikiforos T. Laopodis, Eleftheria KostikaDeadline: 31 December 2024