4.3. Analysis of Keywords

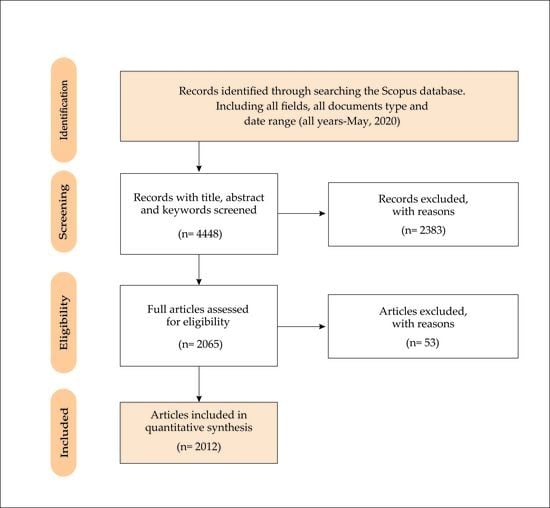

Table 4 lists, according to the Scopus database, the 20 most frequently used keywords in the 2012 articles of the analysed sample, during the period examined (1975–2019). The most prominent terms are ‘Finance’ (in 866 articles, 43.04%), and ‘Technology’ (227, 11.28%). These two terms, together with ‘Management’ (129, 6.41%), in tenth position, were considered in the search query for the Scopus database. In addition to these keywords, ‘Information Technology’ (210, 10.44%) and ‘Economics’ (198, 9.84%) follow in importance, in third and fourth position, respectively.

The link attribute denotes the connection or relation between two keyworks, while the total link strength attribute indicates the number of publications in which two keywords appear together. Hence, the keyword ‘Finance’ is the one with the most links (732) and the highest total link strength (6095). It is followed by the term ‘Technology’ (547, 1923). Without considering the terms that have been used in the search for Scopus, the most prominent keywords are ‘Information Technology’ (371, 1443), ‘Economics’ (539, 1870), ‘Organization and Management’ (324, 1297), ‘Project Management’ (285, 1004), ‘Financial Management’ (393, 1304), ‘Decision Making’ (438, 1254), and ‘Investments’ (403, 1290).

Research in financial technologies has dedicated efforts to clarify how this industry should be managed so that the results are optimal at the global level [

118,

119], and to the transfer of technology and knowledge generated in universities and research centres to the society to provide them with practical application [

120,

121].

Despite the fact that bibliometrics and data mining are concerned with statistical analysis of data with the purpose of discovering patterns and trends in data, in the case of bibliometrics, its object of study is communication between academics in a quantitative way, through bibliometric indicators, a relevant aspect for this research. In this context, it is a matter of past use of information, productivity of the authors in different disciplinary fields through citation studies, etc. In this way, the focus is placed on the authors and on the dating networks that are elaborated in a certain field. Although it is true that it is an external study of scientific production, bibliometric data have the advantage of flexibility and availability, which is why its application in scientific and technological research allows monitoring of technological development at various levels (university, institute or country) [

122].

Figure 4 represents the network map for the keywords of the articles on Fintech, based on the co-occurrence analysis. In this Figure, the colour of the connections is used to differentiate the clusters based on the number of co-occurrences, while the size varies according to the number of repetitions. Hence, the VOSviewer software tool has detected seven main research lines developed by the different keyword communities. According to the term associated with a greater number of articles within each component, the cluster and the associated line of research are grouped under the terms ‘Finance’, ‘Economics’, ‘Technology Transfer’, ‘Investments’, ‘Innovation’, ‘Societies and Institutions’ and ‘Commerce’. These terms describe the content of this field of research. For each term, the occurrences attribute is indicated, which denotes the number of documents in which a term appears, as well as the total link strength, which indicates to the number of articles in which two terms occur together.

Cluster 1 (pink), the largest and most central, groups 30.49% keywords. It is led by ‘Finance’ (occurrences: 866, total link strength: 6095).

Table 5 includes the 50 main keywords associated with this cluster. This first thematic axis studies the financial aspects from different approaches, such as (i) technological, including AI and the Internet; (ii) management, in relation to risk management and systems management; (iii) customer satisfaction, in terms of problem solving and data security; and, (iv) the processing of financial data, which includes both accounting and financial performance [

123,

124,

125].

Cluster 2 (green) brings together 26.41% of the keywords. It is headed by “Economics” (occurrences: 198, total link strength: 1870).

Table 6 contains the 50 main keywords associated with this cluster. This second component is associated with the economy, that is, it is dedicated to examining the economic aspects and the statistical and management processes that allow an organisation to obtain economic and operational improvements. It includes terms such as cost-benefit analysis, capital financing and capital expenditures [

126,

127].

Cluster 3 is made up of 16.56% of the keywords and is headed by “Technology Transfer” (occurrences: 124, total link strength: 885).

Table 7 incorporates the 50 main keywords associated with this cluster. This research line, linked to cluster 3, is dedicated to analysing the impact of technology transfer, and its relationship with a more sustainable society. In this sense, the scientific production of this thematic axis deals with the responsible and sustainable use of technology, considering the direct impact it has on the social, economic and environmental spheres of the community. It includes terms such as economic and social effects, environmental management, environmental impact, climate change, environmental planning and environmental technology [

128,

129].

Cluster 4 (yellow) is led by ‘Investments’ (occurrences: 138, total link strength: 1290), and groups 10.78% of the keywords.

Table 8 includes the 50 main key terms associated with this cluster. This fourth research line studies investments and the actors involved. This component develops the scientific production on profitability, economic analysis and optimization of investments. It also includes terms such as public-private partnership, planning and sustainability to support financial actions [

130].

Cluster 5 (violet) is made up of 5.78% of the key terms and is headed by ‘Innovation’ (occurrences: 77, total link strength: 560).

Table 9 contains the top 40 key terms associated with this cluster. This fifth component is associated with the research of financial technology innovation, that is, it is dedicated to recognising the possibilities offered by knowledge, research and development to the financial system. It includes terms such as globalisation, entrepreneurship, human capital and interdisciplinary approach as cross-cutting issues for its success and development [

131,

132].

Cluster 6 (blue) groups 4.99% of the keywords and is led by “Societies and Institutions” (occurrences: 108, total link strength: 830).

Table 10 incorporates the top 30 key terms associated with this cluster. The research line linked to cluster 6 is dedicated to societies and institutions, and deals with an analysis of the impact of policies and their processes on society and institutions. Financial markets, energy resources and environmental risks are interrelated and act directly on environmental issues, such as global warming and risk perception. In this sense, the scientific production of this thematic axis deals with both the direct impact of policies on nature and the use of natural resources and the generation of waste [

133,

134].

Finally, cluster 7 (orange), the least numerous along with cluster 6, is made up of 4.99% of the key terms and is headed by ‘Commerce’ (occurrences: 56, total link strength: 476).

Table 11 lists the top 30 key terms associated with this cluster. This seventh research line studies commerce attending to aspects such as modernisation, productivity, industrial development and standardisation. The scientific production of this thematic axis deals with, from the legal frameworks, to legal obligations, legal regulations and environmental regulations [

135,

136].

In short, these seven thematic axes bring together all the concepts related to the investigation of financial technology during the analysis period (1975–2019), since it includes the different approaches that have been analysed by the actors that make up this field of study, that is, researchers, research institutions, countries and financing institutions.

4.4. Authors, Research Institutions and Countries

Table 12 shows the main characteristics of the ten most prolific authors in this research topic. The sample of articles has been written by 4496 authors.

Thereby, the ten most productive authors and the research institutions to which they are affiliated were Kauffman (R.J. Singapore Management University); Lindelöf, P. (Södertörn University); Löfsten, H. (Chalmers University of Technology); Maebashi, I.; Maeda, M.; and Mitsuda, Y. (University of Tokyo); Negishi, M. and Nishizawa, M. (Research Organization of Information and Systems National Institute of Informatics); Nomura, H. (Nagoya University, Department of Molecular Design and Engineering); and Peffers, K. (Lee Business School). By region, 7 authors of this ranking are Asian origin (6 Japanese and 1 Singaporean), 2 Swedish and 1 American.

Computer Science is the main subject area where the articles of the ten most productive authors are classified; followed by Business, Management and Accounting; Decision Sciences; and Engineering.

Furthermore, the most used keyword in the articles written by authors of this ranking is ‘Finance’, which is used by everyone, 8 in the first position, those of Asian and American origin, and 2 in second place, those of Swedish origin. It is followed, in order of importance, by ‘Research and Development Management’ and ‘Education’, used by the 6 Japanese authors in second and third position, respectively. It also highlights ‘New Technology-based Firms’ used by the 2 Swedish authors in the first position; and others related to the financial aspect of the subject, such as ‘Financing’ and ‘Financial Services Industry’. The publications of the main authors are linked to the thematic axes that analyse the financial, economic, innovation and commercial aspects of the research.

Figure 5 displays the cooperation map between the authors, based on co-authorship analysis, who have published worldwide on Fintech. The colour of each component is linked with the group of authors in the publication of articles, while the diameter of the circle indicates the number of articles by the author. In consequence, the authors are associated to six clusters. The network shows a great dispersion in the association of authors by co-authorship, during the period analysed (1975–2019).

Cluster 1 (pink) groups 25.22%, and presents the collaboration between Bracey, P.; Chen, J.; Gunatilake, H.; Guo, Z.; Hasan, R.; Huang, B.; Huang, W.; Jia, A.; Jiang, Y.; Khan, M.E.; Khor, N.; Lagman-Martin, A.S.; Niimi, Y.; Sun, L.; Wang, W.; Wang, X.; and Wei, Y., among others.

Cluster 2 (green) brings together 23.48% of authors, and contains the cooperation by, among others, Chen, H.; Fu, S.; Gao, J.; Huo, D.; Jiang, S.; Li, D.; Li, J.W.; Roy, R.; Shen, X.J.; Sun, G.; Wan, S.; Wen, T.; Xie, R.; Yang, S.L.; and Zhou, H.

Cluster 3 (red) groups 20.00% and is composed by authors like Bi, Y.; Cui, Y.; Gao, C.; Guo, J.; Liu, C.; Meng, H.; Niyato, D.; Sun, N.; Wang, H.; Wang, X.L.; Xie, F., and Yu, J., among others.

Cluster 4 (yellow) links 19.13% and presents the collaboration of, among others, Chan, F.T.S.; Fei, S.; He, H.; Hsu, C.-F.; Hu, X.; Huang, S.Y.; Jin, M.; Lin, F.; Liu, Y.; Ruan, J.; Schoenherr, T.; Shi, B.; Shi, Y.; Tsai, S.-B.; Wang, N.; Wu, C.; Xu, X.; Zhao, M.; and Zhu, F.

Cluster 5 (violet) links 6.96% of the authors and presents the cooperation of, among others, Baset, S.; Dillenberger, D.N.; Ford, D.L.; Hull, R.; Laredo, J.; Novotny, P.; Vaculin, R.; and Zhang, Q.

Finally, Cluster 6 (blue) links 5.22% and describes the collaboration of, among others, Chu, C.; Gao, S.; Tang, Z.; Todo, Y.; Wang, J.; and Zhou, T.

On the other hand, it is noteworthy that in component 4, 40.91% of the authors joined in 2019; followed by cluster 3 (30.43%), cluster 1 (20.69%) and cluster 2 (14.81%). Both the United States and Japan stand out for innovation and research in technologies that involve processes of disruption and transformation in the financial sector. These two world powers address studies, publications related to innovation and financial technology [

31,

137,

138].

The 2012, articles on financial technology research have been written in 3338 international affiliations.

Table 13 displays the 10 most prolific research institutions in this topic. This ranking highlights that 7 are of American origin (The World Bank; Massachusetts Institute of Technology; Harvard University; Columbia University in the City of New York; Harvard Medical School, Purdue University; and Harvard Business School) and 3 British (London School of Economics and Political Science; Cranfield University; and University College London).

Business, Management and Accounting is the subject area where articles from the 10 most productive research institutions are most classified, in the same way that it happens for all the articles in the sample. In order of importance, Engineering follows, and the group of thematic areas: Environmental Science, Computer Science, Social Sciences. They are also grouped, although less important, in Medicine; Agricultural and Biological Sciences; Economics, Econometrics and Finance; Health Professions; and Decision Sciences.

Moreover,

Table 6 also shows the main keywords of the most productive research institutions in this topic. The most used keyword in the research developed by the 10 most productive financial technology institutions is ‘Finance’, where 7 institutions use it in first position, 1 in second, and 2 in third, thus highlighting the financial aspect of this topic. They are followed by risk assessment, decision-making and investments. Less important is a group of keywords that are related to different aspects of the research: technological (Technology, Information Technology, Biotechnology and Industry), economic-financial (Build Operate Transfers, Economics, Costs, Economic Aspect and Capital), administrative (Organization and Management, and Industrial Management), social (Developing Country, and Societies and Institutions) and commercial (Marketing).

The publications of the main institutions are linked to the thematic axes that analyse the financial and economic aspects of the research.

Figure 6 shows the network of institutions based on the co-authorship analysis. The VOSviewer software tool associates them into three groups.

Cluster 1 (pink) groups 38.46% of the institutions, among which stand out the Business and Management Research Institute, University Of Bedfordshire (United Kingdom); Capgemini UK Ltd. (United Kingdom); Ceo, Commissioner of E-Governance, Government of Tamil Nadu (India); Department of Digitalization, Copenhagen Business School (Denmark); Department of Management Studies, Indian Institute of Technology, Delhi (India); Department of Marketing, Events and Tourism, University of Greenwich (United Kingdom); Department of Mathematics, Computational Foundry, Swansea University (United Kingdom); Department of Physics, College Of Science, Swansea University (United Kingdom); Economics Department, University of West of England (United Kingdom); and Emerging Markets Research Centre (EMaRC), School of Management, Swansea University (United Kingdom).

Cluster 2 (green) joins 38.46%, among others, to Information and Communication Technology Section, Faculty of Technology, Policy and Management, Delft University of Technology (Netherlands); Information Systems Area, Indian Institute of Management Tiruchirappalli (India); Institute For Analytics and Data Science, University of Essex (United Kingdom); International Business, Marketing And Branding Research Centre, School of Management, University of Bradford, Bradford (United Kingdom); Manipal Global Education Services, Bangalore (India); Morgan Academy, School of Management, Swansea University (United Kingdom); Norwich Business School, University of East Anglia, Norwich, Norfolk (United Kingdom); Operations & Information Management Department, Aston Business School (United Kingdom); Prin. L.N. Welingkar Institute of Management Development & Research, Mumbai (India); and School of Business and Economics, Loughborough University (United Kingdom).

Finally, cluster 3 (violet) associates 23.08%, among others, School of Education, Swansea University, Swansea, (United Kingdom); School of Management, Swansea University, (United Kingdom); School of Social and Political Sciences, University of Edinburgh, (United Kingdom); Swansea I-Lab (Innovation Lab), School of Management, Swansea University, (United Kingdom); Symbiosis Institute of Business Management, Pune & Symbiosis International (Deemed) University, Pune (India); or Urban Scale Interventions, (United Kingdom).

In this order, the United Kingdom has bet on the study of financial innovation, and transferring debate and research on the future of the international financial services sector from research centres and universities to society [

139].

In this research topic, the 2012 articles were written in 108 different countries.

Table 7 shows the top 10 countries in this field. The country with the most articles is the United States (560, 27.83%), followed by the United Kingdom (216, 10.74%). Then followed by the China (175, 8.70%), India (79, 3.93%), Germany (71, 3.53%) and Canada (67, 3.33%). Each of the remaining countries did not exceed 3% of the total articles.

Business, Management and Accounting is the thematic area that mostly associates articles associated with the most prolific countries (8 of 10) in financial technology research, during the period 1975–2019. China mainly classifies them in Engineering, and Russia in Economics, Econometrics and Finance.

Furthermore,

Table 14 also presents the three main keywords to the most productive countries in this research topic. The most used keyword in the articles is ‘Finance’, used in the 10 countries first. The main keywords used by these 10 countries are associated in three different groups. In this way, they are associated with the technological aspects of the research topic (Information Technology, Technology and Technology Transfer); with management aspects (Financial Management, Information Management, Management, Organization and Management, Project Management, Risk Management and Decision Making); and with the financial aspects (Financial Management, Investments and Risk Management).

The publications of the main countries are linked to the thematic axes that analyse the financial, economic, innovation and investment aspects of research. In the same way that happens with the main research institutions, the United States and the United Kingdom are the countries that contribute the most to the development of financial technology research [

140].

Figure 7 shows a collaboration map between the main countries based on the co-authorship analysis. Likewise, the different colours correspond to the different clusters of countries, while the diameter of the circle varies depending on the number of articles published by each country. The VOSviewer tool has grouped them into six components.

Cluster 1 (pink), the most numerous, includes 39.08% of the countries, and is headed by the United Kingdom. This is associated, among others, with Canada, France, Germany, Netherlands, Ireland, Finland, Sweden, South Korea, Spain, Belgium, Japan, Switzerland, Ghana, Turkey, Indonesia, Nigeria, Iran, Tanzania, Congo, Ethiopia, Tunisia, Pakistan, Sri Lanka, Zimbabwe, Oman, Cameroon, Gabon, Luxembourg, Jordan, Bangladesh, Barbados, British Isles or Brunei Darussalam.

Cluster 2 (green), includes 31.03% of the countries, is led by the United States and shares work with China, Australia, Taiwan, India, Hong Kong, Austria, Denmark, New Zealand, Kuwait, Singapore, Malaysia, Norway, Russia, Thailand, Ukraine, Saudi Arabia, Israel, Czech Republic, Fiji, Macau, Iceland, United Arab Emirates, Philippines, Bahrain, Iraq and Bulgaria.

Cluster 3 (network), includes 10.34% of the countries, is led by South Africa, and includes countries such as Kenya, Uganda, Poland, Lithuania, Slovenia, Croatia, Serbia and Montenegro.

Cluster 4 (yellow), includes 10.34% of the countries, is headed by Brazil, and includes Argentina, Costa Rica, Mexico, Chile, Colombia, Uruguay, Bolivia and Paraguay.

Cluster 5 (violet), includes 5.75% of the countries, is led by Italy, includes Mozambique, Hungary, Albania and Mongolia.

Finally, Cluster 6 (blue), includes 3.45% of the countries, is headed by Greece, and cooperates with Portugal and Cyprus.

At a global level, led by the United States, the United Kingdom and China, research is focusing on different areas, such as technological risk, cyber risk and the management of the change of financial technologies in the individual and in society [

141,

142]. Furthermore, the potential of AI for financial services will be analysed, along with the ethical challenges, the skills gap between people and the risks associated with the changing dynamics of the market and the technology and financial industry [

143].

4.5. Evolution of Keywords

Figure 8 shows the evolution and maturity of each keyword community, since it differentiates the period in which they have been studied and associated with the documents examined. In this way, it is verified that there has been an evolution in terminology in the research of financial technologies, which can, in turn, be divided into four sub-periods: 1975–2004, 2005–2009, 2010–2014 and 2015–2018.

In the first period (1975–2004) the keywords that were shaping the study theme were incorporated. These have been the pioneers and have allowed the establishment of a field of research. Among the main terms, the following are highlighted by total link strength: planning, research, cost control, information processing, technological forecasting, risks, public sector, geographic distribution, program evaluation, evaluation studies, demography, purchasing, process control, socioeconomic factors, environmental planning, organisations, technology, high-cost, developed country, statistical analysis, government agencies, information theory, operating costs, management tool, monitoring, data communication systems, organisational culture, teamwork, knowledge engineering, fee, personal computers, metropolitan area networks, resource development, economic performance, finance control, finance management, financial analyses, financial assistance, financial bottom line indexes, financial deregulation, financial flows, financial holding, financial investors, financial optimisation, financial organisation, financial performance, financial planning, financial plan, financial ratio, financial report and financial resource.

This first period defined emerging financial services that use information technology applicable to the final phase of consumption of a financial service [

144].

In a second period (2005–09) new terms were incorporated into the research theme, among which the following stand out: agent-based model (ABM), agent-based systems, agglomeration economies, alternative approaches, alternative trading systems, business angel, business communication, business environment, business functions, business goals, business intelligence (BI), business knowledge, business leaders, business planning, business plans, business process management system, business process reengineering, business process reengineering (BPR), business processing, business productivity, business skills, business strategy, business system domains, business transformations, business value of it, capital and operating costs, capital costs, capital funds, capital market-asset, capitalist organisations, commercial banks, computer supported cooperative work (CSCW), co-payments, cost controls, cost functions, cost increase, cost information, cost minimization analysis, cost optimal control, cost-analysis, credit cards, credit evaluation management, credit supply, data flow analysis, data flow diagram, data flow diagrams, data flow graphs, data gathering, data import, data limitations, economic competitiveness, economic developments, economic efficiency, economic growth rates, economic history, economic instrument, economic level, finance managements, finance structuring, financial analyses, financial digitisation, financial engineerings, financial holding, financial holding companies, financial index, financial indices, financial investors, financial organizations, financial performances, financial plans, financial ratio, financial reports, industrial innovations, industrial installations, industrial logging, industrial property, industrial sectors, information technology outsourcing, information technology procurement methods, information technology restructuring, international finance, international financial management, international investments, international organization, international relations, inventory systems, investment allocation, investment capital, investment decision and investment planning.

In the second period, the new disruptions in the financial sector and the business models that Fintech’s bring about are shaped [

31,

40].

Likewise, it is observed that there has been an evolution in the key terms related to the research topic during a third period 2010–2014, among which the following stand out: manager, artificial intelligence, public-private partnership, environmental regulations, earnings, life cycle assessment, computer security, demand-side management, financial risks, surgery, supply chain, society, business development, microfinance, wellbeing, satisfaction, e-learning, enterprise resource management, corporate strategy, financial viability, accountability, commercial activity, empirical research, teaching and learning, teaching approaches, teaching experience, financial and nonfinancial indicators, financial appraisal, financial constraints, financial decisions, financial feasibility, financial information service system, financial instruments, financial loss, financial management system, financial modelling, financial objectives, financial reporting, financial risk analysis, financial risks, financial service innovation, financial supply chain management, financial viability, financialisation, financing constraints, financing services, bivariate ar(p) model, bivariate time series, black swan, business continuity, business continuity planning, business curriculum, business decisions, business development, business flow, business formation and business marketing.

This third period includes the magnitude of the change that the financial sector is undergoing and the generational change in financial services [

145].

Finally, in fourth the period (2015–18), which coincides with the largest exponential increase in the publication of articles on financial technologies, a set of terms have been linked to this research topic, among which stand out for total link strength: Fintech, blockchain, electronic money, bitcoin, cryptocurrency, innovation, big data, artificial intelligence, financial services, financial inclusion, banking, crowdfunding, sales, electronic commerce, regtech, privacy, mobile payment, machine learning, china, data privacy, authentication, cryptography, security, global system for mobile communications, peer-to-peer lending, smart contract, financial regulation, P2P lending, digital economy, financial market, digitisation, cyber security, technology acceptance model, peer to peer networks, learning systems, technology adoption, financial transactions, economic development, business modelling, risk assessment, mobile banking, mobile phone, sustainability, information asymmetry, sustainable development, platforms, Ethereum, mobile telecommunication systems, network security, crowdsourcing, regulatory technology, mobile banking, economic analysis, technological innovation, financial innovation, United States, Internet of Things, e-commerce, peer to peer, purchasing, data analytics, business model, least squares method and currency.

In this fourth period, the fintech phenomenon formally implies a paradigm shift that has revolutionised the financial sector, and the challenges it poses are analysed [

32,

146].

The different periods and the large number of keywords associated with international research in financial technologies allow us to understand the variety of study axes in research activity. Therefore, this

Figure 8 allows us to understand the importance of the key terms based on the time in which they have appeared, that is, the pioneers have had a greater influence and have been a reference for those that have emerged later.